ADAR1 Capital Management, holding 13.3% of Keros Therapeutics (KROS, Financial) shares, has publicized that Institutional Shareholder Services, a reputable proxy advisory firm, has advised shareholders to withhold votes for sitting directors Mary Ann Gray and Alpna Seth. This recommendation comes ahead of Keros' Annual Meeting on June 4, due to governance issues highlighted by ISS that suggest the need for increased accountability in the company.

Additionally, ADAR1 has pointed out that Keros plans to reveal the findings of its strategic review process only five days after the Annual Meeting. This timing leaves shareholders in a position to make critical voting decisions without full insight into the strategic outcomes, potentially impacting their best interests. ADAR1 urges Keros to release these findings before the meeting, allowing shareholders to make an informed decision regarding their votes.

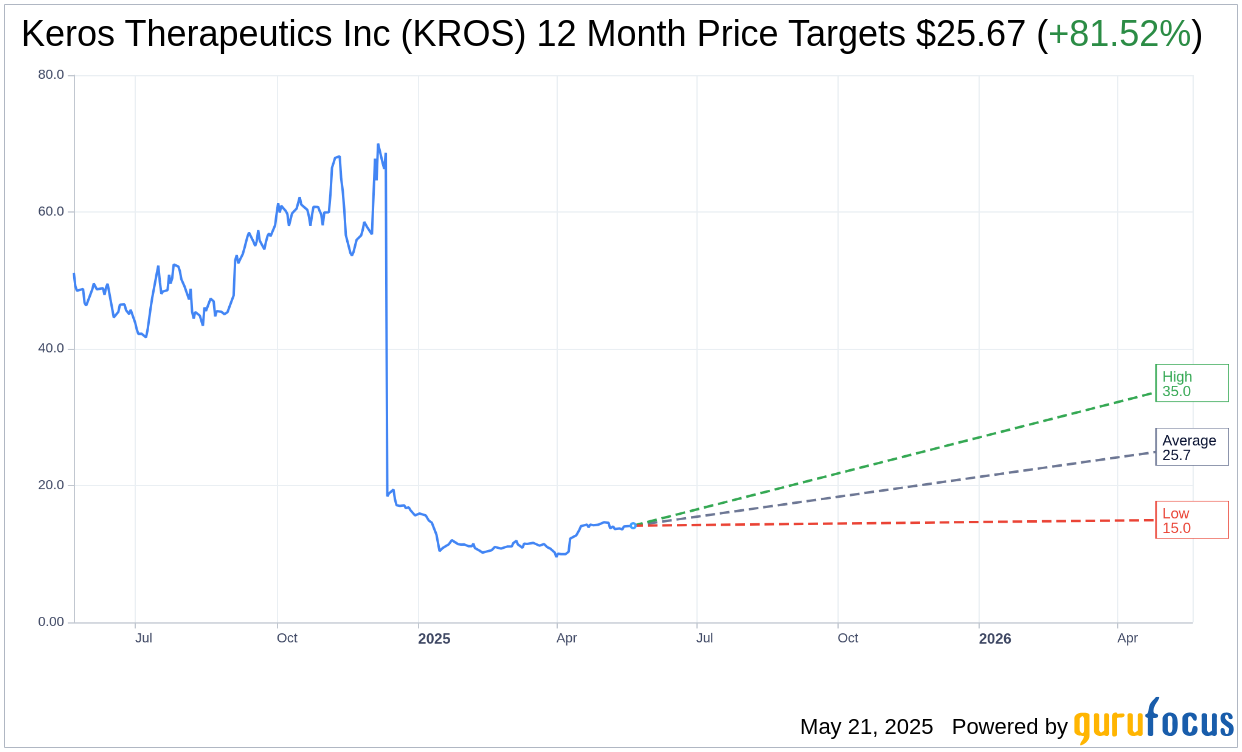

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Keros Therapeutics Inc (KROS, Financial) is $25.67 with a high estimate of $35.00 and a low estimate of $15.00. The average target implies an upside of 81.52% from the current price of $14.14. More detailed estimate data can be found on the Keros Therapeutics Inc (KROS) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Keros Therapeutics Inc's (KROS, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.