ReShape Lifesciences (RSLS, Financial) reported a revenue of $1.1 million for the first quarter of 2025, a decrease from $1.9 million in the same period last year. Despite the drop, the company has experienced operational and strategic growth. A key development includes a new distribution partnership with Liaison Medical to introduce the enhanced Lap-Band 2.0 FLEX to the Canadian market, following Health Canada approval in late 2024. This move aims to provide less invasive weight-loss alternatives to a broader audience.

Additionally, ReShape expanded its product range in the U.S. through a distribution agreement for Motion Informatics’ advanced neuromuscular rehabilitation devices. The company's commitment to diabetes innovation was also showcased at the Minnesota Neuromodulation Symposium with promising pre-clinical data on its Diabetes Neuromodulation device. The system has gained substantial intellectual property protection, including patents extending through 2039, reinforcing its position in treating diabetes and obesity.

In February, ReShape completed a $6.0 million public offering, bolstering its financial standing as it pursues growth strategies. The company is also progressing toward finalizing a merger with Vyome and an asset sale to Biorad Medisys, with Board support for these transformative transactions expected to enhance shareholder value and accelerate company growth.

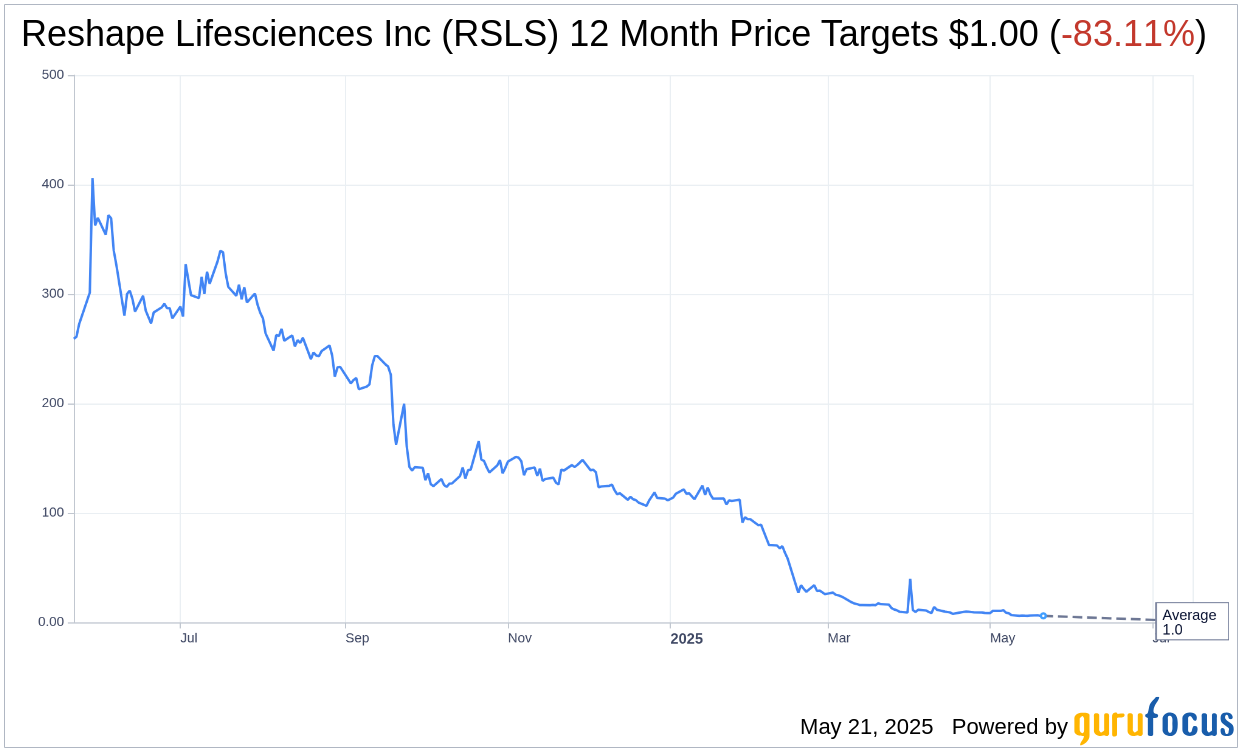

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Reshape Lifesciences Inc (RSLS, Financial) is $1.00 with a high estimate of $1.00 and a low estimate of $1.00. The average target implies an downside of 83.11% from the current price of $5.92. More detailed estimate data can be found on the Reshape Lifesciences Inc (RSLS) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Reshape Lifesciences Inc's (RSLS, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.