Key Takeaways:

- Mirion Technologies (MIR, Financial) enhances its convertible notes offering to $350 million, tapping into favorable market dynamics.

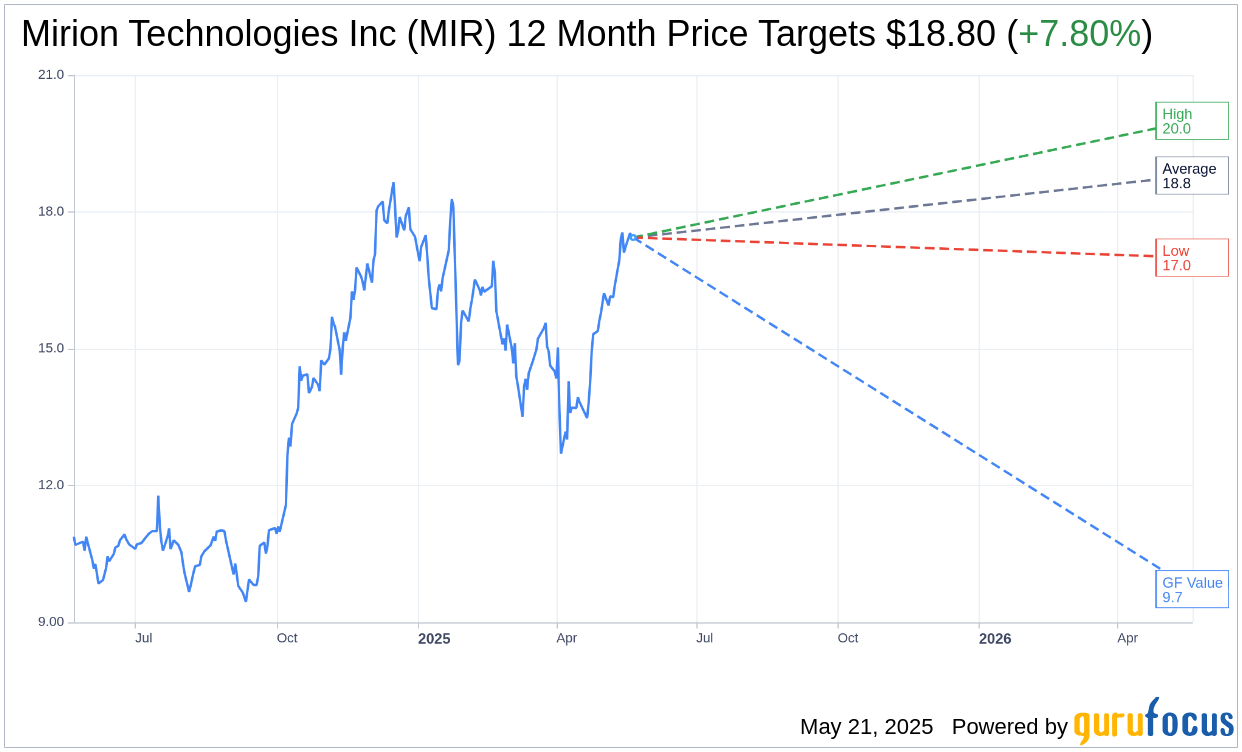

- Wall Street analysts suggest an average price target increase of 7.80% over the current stock price.

- GuruFocus estimates a significant potential downside, indicating a possible overvaluation at current levels.

Mirion Technologies (MIR) recently announced an upward revision in the size of its 0.25% Convertible Senior Notes, maturing in 2030, from an initial $300 million to $350 million. This strategic move is expected to close by May 23, 2025, as the company seeks to leverage conducive market conditions.

Wall Street Analysts Forecast

The current sentiment among analysts suggests a cautiously optimistic outlook for Mirion Technologies Inc (MIR, Financial). With input from five analysts, the average price target lands at $18.80, ranging from a high estimate of $20.00 to a low of $17.00. This average target projects a potential upside of 7.80% from the current stock price of $17.44. Investors seeking more granular data can visit the Mirion Technologies Inc (MIR) Forecast page.

Furthermore, the consensus recommendation from five brokerage firms currently assigns Mirion Technologies Inc (MIR, Financial) an average recommendation score of 1.6. This places the company in the "Outperform" category, on a scale where 1 is a Strong Buy and 5 is a Sell.

However, according to GuruFocus metrics, the estimated GF Value for Mirion Technologies Inc (MIR, Financial) in one year is $9.73. This estimation suggests a potential downside of 44.21% from the current share price of $17.44, indicating that the stock might be overvalued. The GF Value is derived from the stock's historical trading multiples, past business growth, and future business performance projections. For further insights, investors can explore the Mirion Technologies Inc (MIR) Summary page.