- Progressive Corp (PGR, Financial) experienced a noteworthy 19% increase in net premiums earned in April, totaling $6.64 billion.

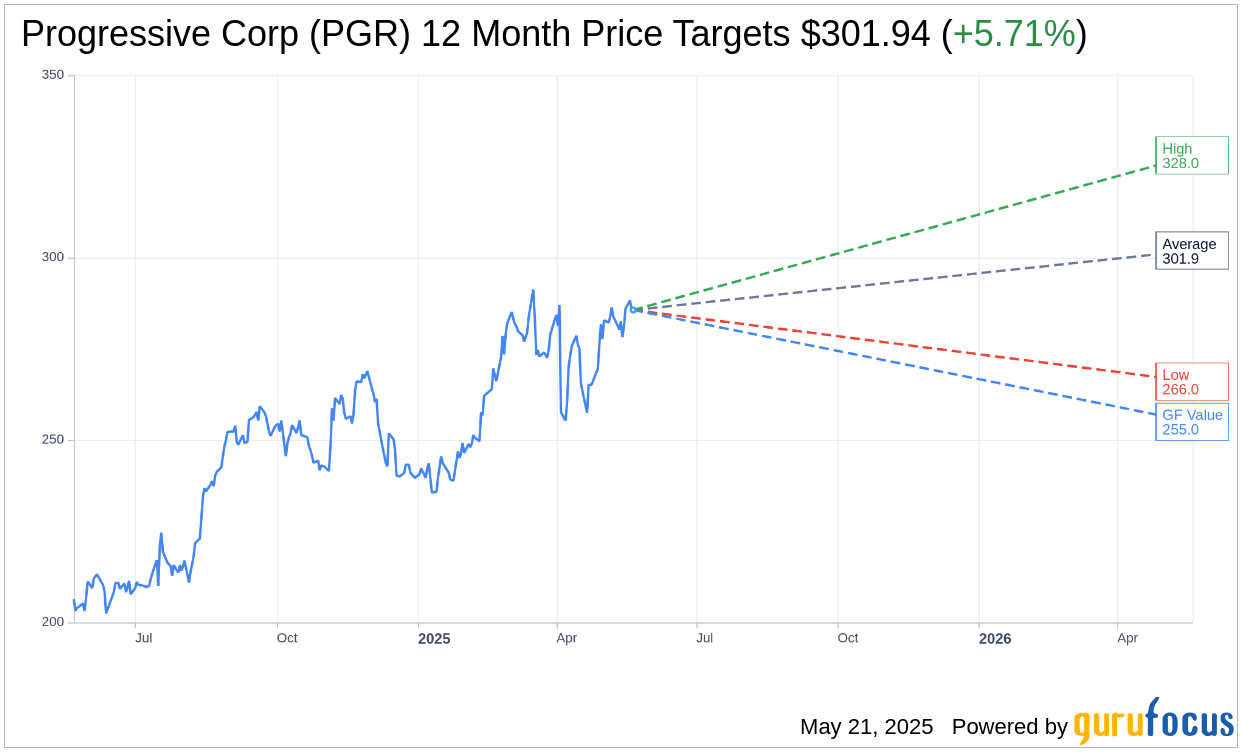

- Analysts have set a one-year average price target of $301.94, suggesting potential upside.

- Despite a solid performance, GuruFocus estimates indicate a 10.73% downside in the stock's future value.

Progressive (PGR) has reported robust growth metrics for April, underscoring its strong market position and financial health. The insurance giant recorded a 19% year-over-year jump in net premiums earned, amounting to an impressive $6.64 billion. Meanwhile, net premiums written saw an 11% increase, reaching $6.84 billion. Notably, the company's net income soared to $986 million, with a GAAP EPS pegged at $1.68, all while improving its combined ratio to 84.9%.

Wall Street Analysts Forecast

Market analysts have offered a range of price targets for Progressive Corp (PGR). The consensus from 16 financial experts has resulted in an average price target of $301.94. This figure represents a modest increase of 5.71% from the current trading price of $285.63. Estimates vary, with the most optimistic target at $328.00, while the most conservative stands at $266.00. For further insights and detailed data, visit the Progressive Corp (PGR, Financial) Forecast page.

According to consensus ratings from 22 brokerage firms, Progressive Corp is rated at an average of 2.3, categorizing it as "Outperform". This rating operates on a scale from 1 to 5, where 1 is Strong Buy, and 5 is Sell, indicating a generally positive outlook from the analyst community.

GuruFocus Valuation Outlook

Despite impressive earnings and a positive outlook from Wall Street, the GuruFocus Value (GF Value) estimation for Progressive Corp (PGR, Financial) presents a more cautious view. It forecasts the GF Value at $254.97 for one year, implying a potential downside of 10.73% from the current price level of $285.63. The GF Value is a proprietary metric that estimates the fair value of a stock, calculated using historical multiples, past business growth, and future performance projections. For a comprehensive analysis, visit the Progressive Corp (PGR) Summary page.