Key Highlights:

- Hyperscale Data (GPUS, Financial) reports a significant revenue decline of 34.8% year-over-year.

- The company plans to restart Bitcoin mining activities despite the financial loss.

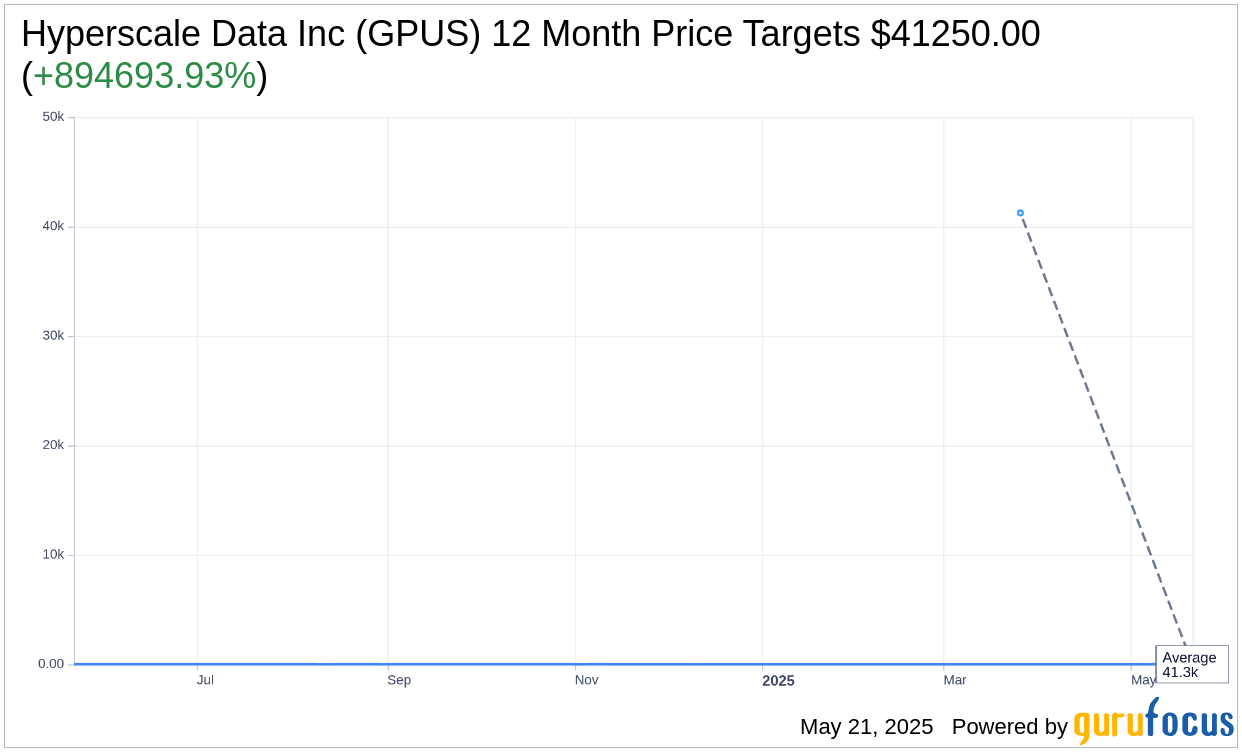

- Analyst price targets suggest a dramatic potential upside of 894,693.93%.

Hyperscale Data Inc. (GPUS) recently reported a challenging first-quarter performance, characterized by a net loss with GAAP EPS of -$0.98. The company's revenue shrank to $25.02 million, reflecting a notable 34.8% decrease from the previous year. Despite these setbacks, the company remains strategically focused on revitalizing its Bitcoin mining operations at its Montana facility, indicating a commitment to its core business areas.

Optimistic Analyst Forecasts

According to insights from one analyst, Hyperscale Data's stock price is projected to reach an ambitious average target of $41,250.00 over the next year. Notably, this price target indicates a remarkable potential upside of 894,693.93% from its current trading price of $4.61. This optimistic price target underscores strong confidence in the company's recovery and growth potential. For more detailed estimates, visit the Hyperscale Data Inc (GPUS, Financial) Forecast page.

Additionally, the consensus recommendation among brokerage firms for Hyperscale Data Inc. stands at an "Outperform" rating, with an average brokerage recommendation score of 2.0 on a scale where 1 signifies Strong Buy and 5 represents a Sell. This indicates a positive sentiment in the investment community regarding the company's future trajectory.

GF Value Assessment: A Cautious Perspective

According to GuruFocus estimates, the one-year GF Value for Hyperscale Data Inc. is pegged at $1.89, suggesting a potential downside of 59% from its current stock price of $4.61. The GF Value, a key proprietary metric, represents GuruFocus' calculated fair value of the stock based on historical trading multiples, past business growth, and future performance projections. For a comprehensive analysis, consult the Hyperscale Data Inc (GPUS, Financial) Summary page.

In summary, while Hyperscale Data faces immediate financial challenges, the company's strategic initiatives and positive analyst forecasts highlight an intriguing investment opportunity. Investors should weigh these factors alongside the GF Value assessment to make informed decisions.