Citron Research recently commented on Duolingo (DUOL, Financial), expressing a strong opinion about its future prospects. Initially betting against the company before its last earnings report, Citron admits that their initial assessment was incorrect. Despite this, they believe their overall thesis has strengthened. The introduction of a new AI translation tool by Google, unveiled at I/O 2025, is seen as a potential disruptor in the language learning industry.

According to Citron, Google's innovative tool, which goes beyond mere text translation by capturing nuances like tone and expression, poses a significant challenge to Duolingo's business model. They liken this development to the advent of calculators reducing the necessity to master arithmetic, suggesting that although learning languages remains crucial, the landscape is undoubtedly shifting.

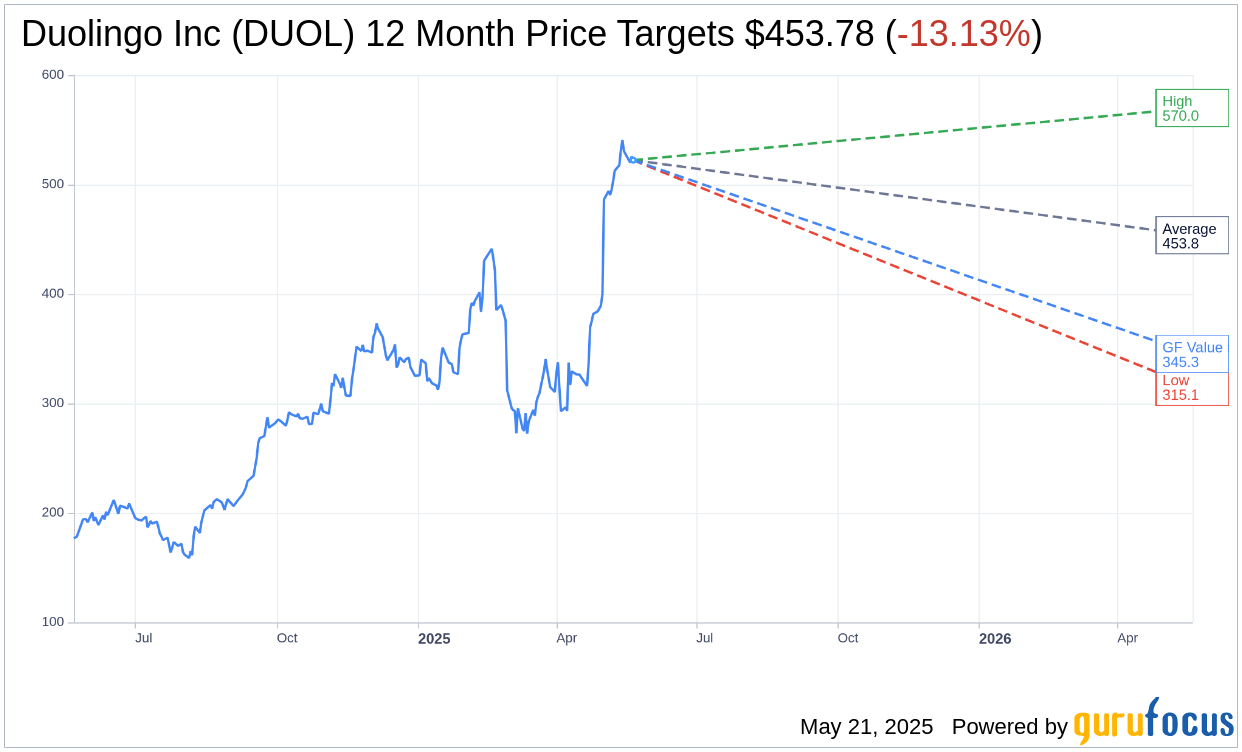

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Duolingo Inc (DUOL, Financial) is $453.78 with a high estimate of $570.00 and a low estimate of $315.12. The average target implies an downside of 12.77% from the current price of $520.19. More detailed estimate data can be found on the Duolingo Inc (DUOL) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Duolingo Inc's (DUOL, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Duolingo Inc (DUOL, Financial) in one year is $345.29, suggesting a downside of 33.62% from the current price of $520.1865. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Duolingo Inc (DUOL) Summary page.

DUOL Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Duolingo Inc (DUOL, Financial) reported strong growth in daily active users (DAUs), with a 49% year-over-year increase, indicating robust user engagement.

- The company successfully launched 148 new language courses using AI, significantly speeding up content creation compared to previous years.

- Duolingo Inc (DUOL) is expanding its offerings with new subjects like chess, math, and music, which are already being monetized similarly to language learning.

- AI is playing a transformative role in Duolingo Inc (DUOL)'s operations, enhancing content creation, feature development, and overall efficiency.

- The company is seeing positive trends in its Duolingo Max subscription, which now accounts for 7% of subscribers, contributing to strong financial performance.

Negative Points

- Despite the growth in new subjects, they remain significantly smaller in scale compared to language learning, limiting their immediate impact on revenue.

- Duolingo Inc (DUOL) faces challenges in converting users in low GDP per capita regions, affecting overall monetization potential.

- The company anticipates a 150 basis point decline in gross margin year-over-year, with some sequential declines expected in the second quarter.

- Pricing for Duolingo Max remains high in certain markets like India, potentially limiting adoption until costs can be reduced.

- The company acknowledges that it will take time, potentially years, for word of mouth to significantly boost the adoption of its intermediate and advanced English content.