Scotiabank has adjusted its price target for Castle Biosciences (CSTL, Financial), reducing it to $40 from a previous $44, though it maintains an Outperform rating. Despite facing challenges such as the halt in Medicare reimbursement for DecisionDx-SCC and the cessation of IDgenetix, the company has increased its full-year financial outlook. Looking ahead, Castle Biosciences is progressing with plans to introduce a therapy guidance test for atopic dermatitis, aiming for a launch by the end of 2025.

Wall Street Analysts Forecast

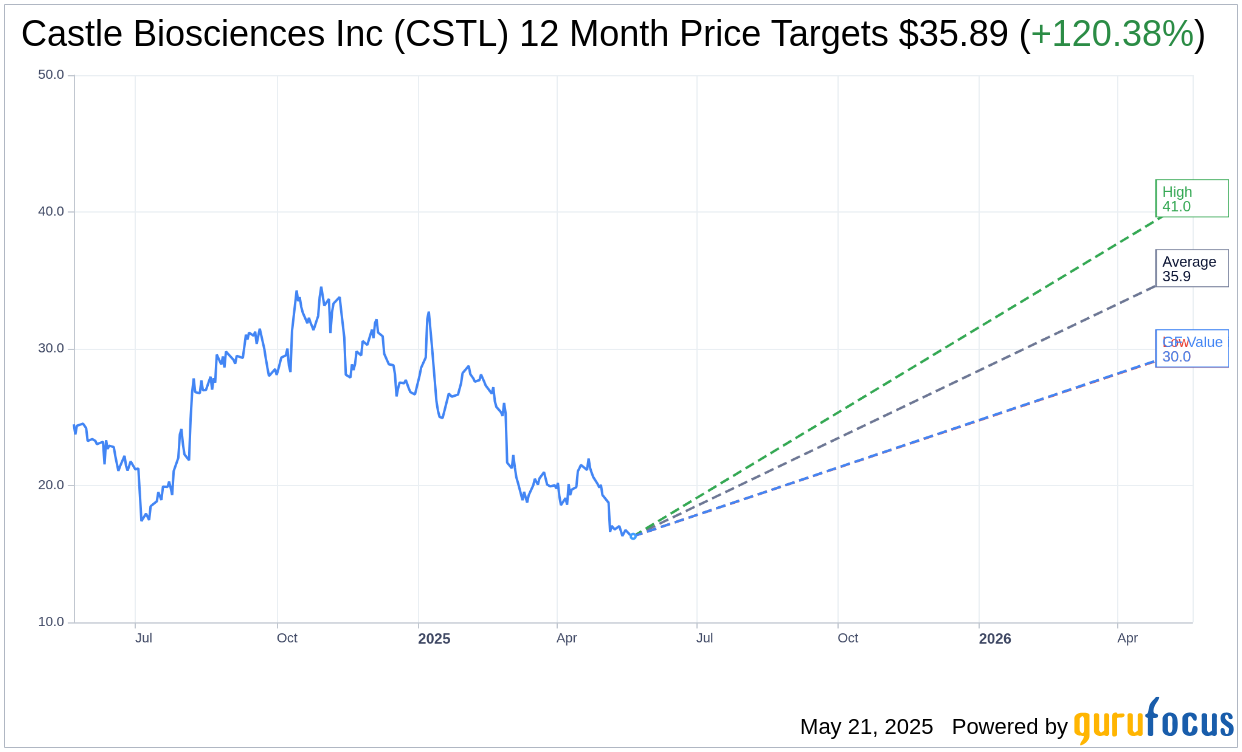

Based on the one-year price targets offered by 9 analysts, the average target price for Castle Biosciences Inc (CSTL, Financial) is $35.89 with a high estimate of $41.00 and a low estimate of $30.00. The average target implies an upside of 121.06% from the current price of $16.24. More detailed estimate data can be found on the Castle Biosciences Inc (CSTL) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Castle Biosciences Inc's (CSTL, Financial) average brokerage recommendation is currently 1.4, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Castle Biosciences Inc (CSTL, Financial) in one year is $30.03, suggesting a upside of 84.97% from the current price of $16.235. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Castle Biosciences Inc (CSTL) Summary page.

CSTL Key Business Developments

Release Date: May 05, 2025

- Revenue: $88 million, a 21% increase compared to Q1 2024.

- Adjusted Revenue: $87.2 million, a 22% increase over Q1 2024.

- Gross Margin: 49.2% for Q1 2025; adjusted gross margin was 81.2%.

- Net Loss: $25.8 million for Q1 2025.

- Net Loss Per Share: $0.90; adjusted net loss per share was $0.20.

- Adjusted EBITDA: $13 million, compared to $10.5 million in Q1 2024.

- Cash, Cash Equivalents, and Marketable Securities: $275.2 million as of March 31, 2025.

- Test Report Volume Growth: 33% increase for core revenue drivers.

- TissueCypher Test Reports: 7,432, representing 117% year-over-year growth.

- DecisionDx-Melanoma Test Reports: 8,621, a 3% increase compared to Q1 2024.

- DecisionDx-SCC Test Reports: 4,375 for Q1 2025.

- Operating Expenses: $115.9 million, compared to $78.4 million in Q1 2024.

- Sales and Marketing Expenses: $36.8 million, up from $30.5 million in Q1 2024.

- General and Administrative Expenses: $21.8 million, compared to $18 million in Q1 2024.

- R&D Expenses: $12.6 million, compared to $13.8 million in Q1 2024.

- Interest Income: $3.1 million for Q1 2025.

- Net Cash Used in Operating Activities: $6 million for Q1 2025.

- Net Cash Used in Investing Activities: $22.4 million for Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Castle Biosciences Inc (CSTL, Financial) reported a 21% increase in revenue to $88 million for the first quarter of 2025, driven by a 33% growth in test report volume.

- The company has a strong balance sheet with $275 million in cash, cash equivalents, and marketable investment securities, providing flexibility for growth initiatives.

- Castle Biosciences Inc (CSTL) announced the acquisition of Previse, which is expected to strengthen its position in the gastrointestinal space.

- The DecisionDx-Melanoma test achieved a significant milestone with over 200,000 test orders since its launch, highlighting its adoption and impact on patient care.

- TissueCypher test reports grew by 117% year-over-year, indicating strong demand and acceptance in the gastroenterology community.

Negative Points

- The gross margin for the first quarter of 2025 was significantly impacted, dropping to 49.2% from 77.9% in the first quarter of 2024, due to a one-time adjustment related to the discontinuation of IDgenetix.

- Castle Biosciences Inc (CSTL) reported a net loss of $25.8 million for the first quarter of 2025, compared to a net loss of $2.5 million in the same period of 2024.

- The DecisionDx-SCC test faced reimbursement challenges, with the Novitas Local Coverage Determination policy including noncoverage language, impacting revenue expectations.

- Operating expenses increased to $115.9 million in the first quarter of 2025 from $78.4 million in the first quarter of 2024, driven by higher personnel costs and business development activities.

- The company decided to discontinue the IDgenetix test effective May 2025, reallocating resources to other areas with unmet clinical needs.