Key Highlights:

- Target (TGT, Financial) experienced a 2.8% decline in sales for the first quarter of 2025, with comparable sales dropping by 3.8%.

- Despite sales challenges, Target is implementing strategic innovations and opening new stores to bolster growth.

- GuruFocus' GF Value suggests a potential upside of 63.6% for Target shares in one year.

In the latest financial update, Target Corp (NYSE: TGT) reported a 2.8% sales decline in the first quarter of 2025. The drop in comparable sales was recorded at 3.8%, mitigated slightly by the positive developments from new store openings and an increase in non-merchandise sales. CEO Brian Cornell reassured investors by outlining robust strategies for both innovation and growth. Meanwhile, CFO Jim Lee provided updated full-year adjusted EPS guidance between $7 and $9, reflecting prevailing economic uncertainties that could impact the retail giant's performance.

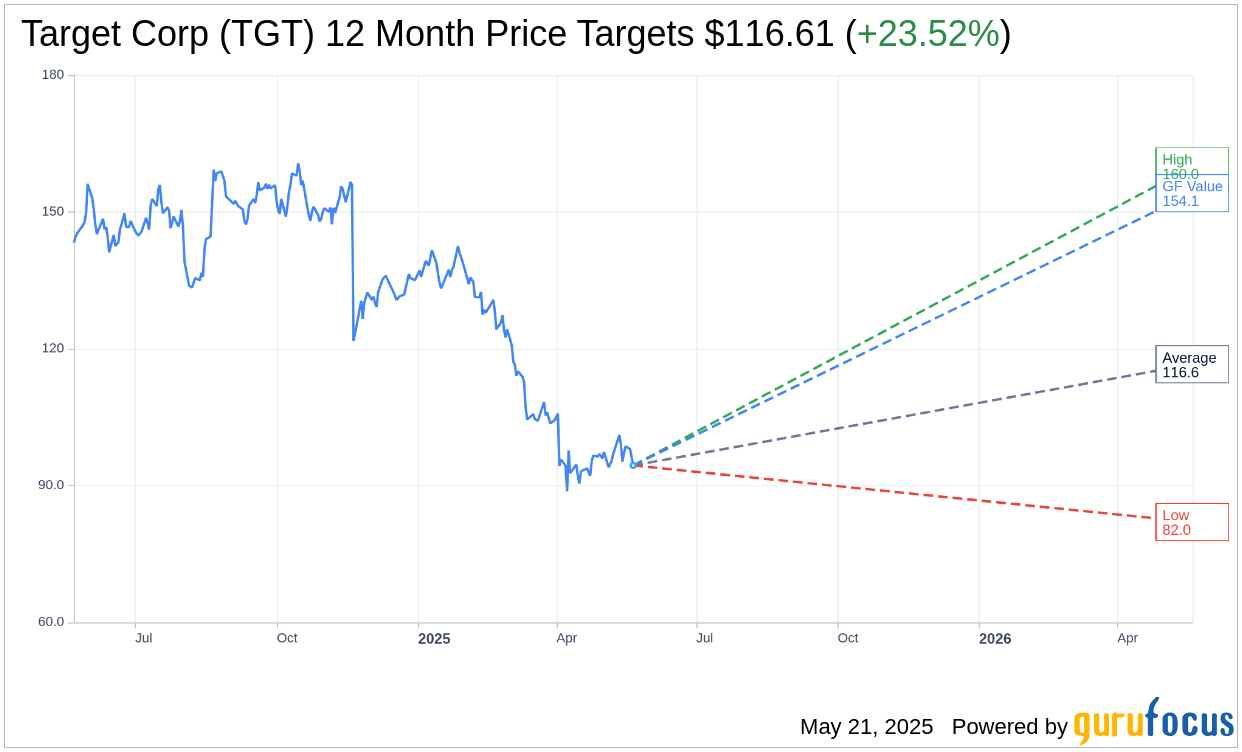

Wall Street Analysts Forecast

According to the one-year price targets provided by 31 seasoned analysts, Target Corp's (TGT, Financial) average target price stands at $116.61. This includes a high estimate of $160.00 and a low estimate of $82.00. The average target suggests a promising upside potential of 23.78% from the current trading price of $94.21. For more granular estimate data, investors can visit the Target Corp (TGT) Forecast page.

In terms of investment recommendations, the consensus from 39 brokerage firms rates Target Corp (TGT, Financial) with an average recommendation of 2.6, which corresponds to a "Hold" status. This rating is derived from a scale where 1 signifies Strong Buy and 5 denotes Sell. It's crucial for investors to consider these insights when making portfolio decisions.

Leveraging GuruFocus' proprietary metrics, the estimated GF Value for Target Corp (TGT, Financial) in the coming year is projected at $154.13, implying a significant upside of 63.6% from the current market price of $94.21. This GF Value represents GuruFocus' assessment of the stock's fair trading value, derived from historical trading multiples, snapshots of past business growth, and predictive analytics of future performance. To delve deeper into these insights, please visit the Target Corp (TGT) Summary page.