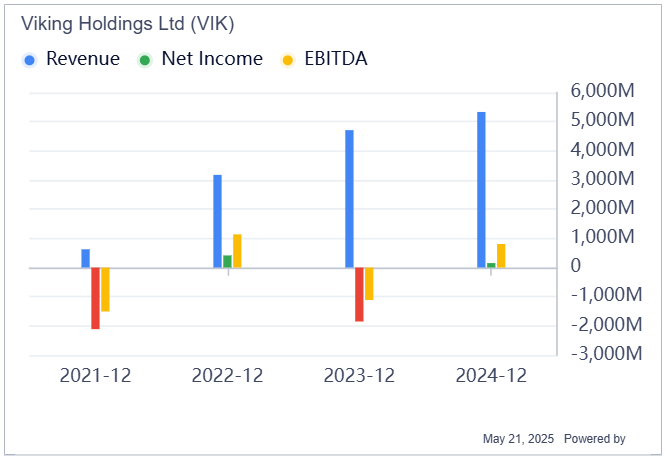

Viking Holdings (VIK, Financial) growth looks explosive—on paper. Revenue soared from $625 million in 2021 to over $5.3 billion in 2024, compounding at a jaw-dropping 104.3% CAGR. That's not just outpacing the cruise industry—it's lapping it. The company's first quarter as a public entity didn't disappoint either: a narrower-than-expected loss, top-line beat, and bullish signals on net yield and capacity. Viking Holdings is riding a travel renaissance, with its founder-CEO calling it “robust demand for enriching travel experiences.” But Wall Street wasn't cheering.

Despite the strength, Viking stock dropped over 5% after the report. Why? Investors zoomed in on bookings—and didn't love what they saw. Advance bookings for 2026 are tracking only 4% higher than 2025, a steep drop from the 12% jump a year earlier. Pricing tends to start high and slide, and analysts warn that this +4% growth may already be near peak. Add in the lack of concrete financial guidance and some vague management commentary, and you've got a recipe for investor hesitation—even in a red-hot sector.

From the chart, Viking's revenue is skyrocketing, but profitability isn't yet following suit. Net income remains in the red, though losses are narrowing, and EBITDA—after dipping in 2023—is starting to climb again in 2024. The trend? Strong top-line growth, improving margins, but still a ways to go before bottom-line strength kicks in.

If Viking can translate its surging sales into sustained profits, this could be one of the most interesting long-term plays in travel.