On May 21, 2025, Canaccord Genuity's analyst Jon Young maintained a "Buy" rating for Merit Medical Systems (MMSI, Financial), while also raising the price target for the company's stock. The updated price target is now set at $112.00, up from the previous target of $108.00.

This adjustment represents a 3.70% increase in the stock’s price target, reflecting continued confidence in the company's performance and future prospects. The buy rating indicates positive sentiment and suggests that the stock is expected to outperform over the coming months.

Investors in Merit Medical Systems (MMSI, Financial) may consider this revised target and maintained rating as a positive signal from Canaccord Genuity, pointing towards potential growth and increased value in the stock.

Wall Street Analysts Forecast

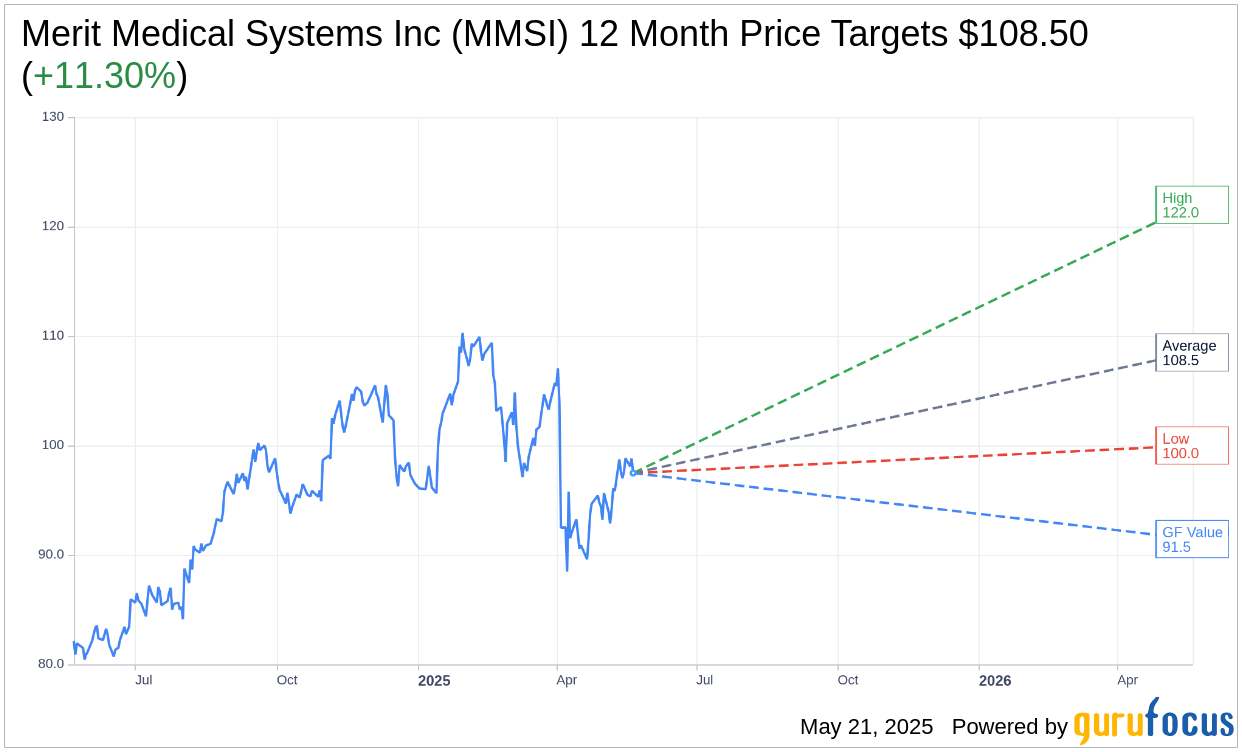

Based on the one-year price targets offered by 10 analysts, the average target price for Merit Medical Systems Inc (MMSI, Financial) is $108.50 with a high estimate of $122.00 and a low estimate of $100.00. The average target implies an upside of 11.51% from the current price of $97.31. More detailed estimate data can be found on the Merit Medical Systems Inc (MMSI) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Merit Medical Systems Inc's (MMSI, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Merit Medical Systems Inc (MMSI, Financial) in one year is $91.45, suggesting a downside of 6.02% from the current price of $97.305. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Merit Medical Systems Inc (MMSI) Summary page.