Significant bearish activity has been observed in Nuscale Power (SMR, Financial), as put options have surged to 15,555 contracts, approximately five times the usual volume. The most heavily traded contracts are the June 2025 $18 puts and the June 27 weekly $17 puts, together accounting for nearly 13,300 contracts. The Put/Call Ratio currently stands at 2.05, indicating a stronger inclination towards bearish bets. Additionally, the at-the-money implied volatility has risen by over two points within the day. Investors are keeping a close eye on Nuscale Power's upcoming earnings announcement, slated for August 7th.

Wall Street Analysts Forecast

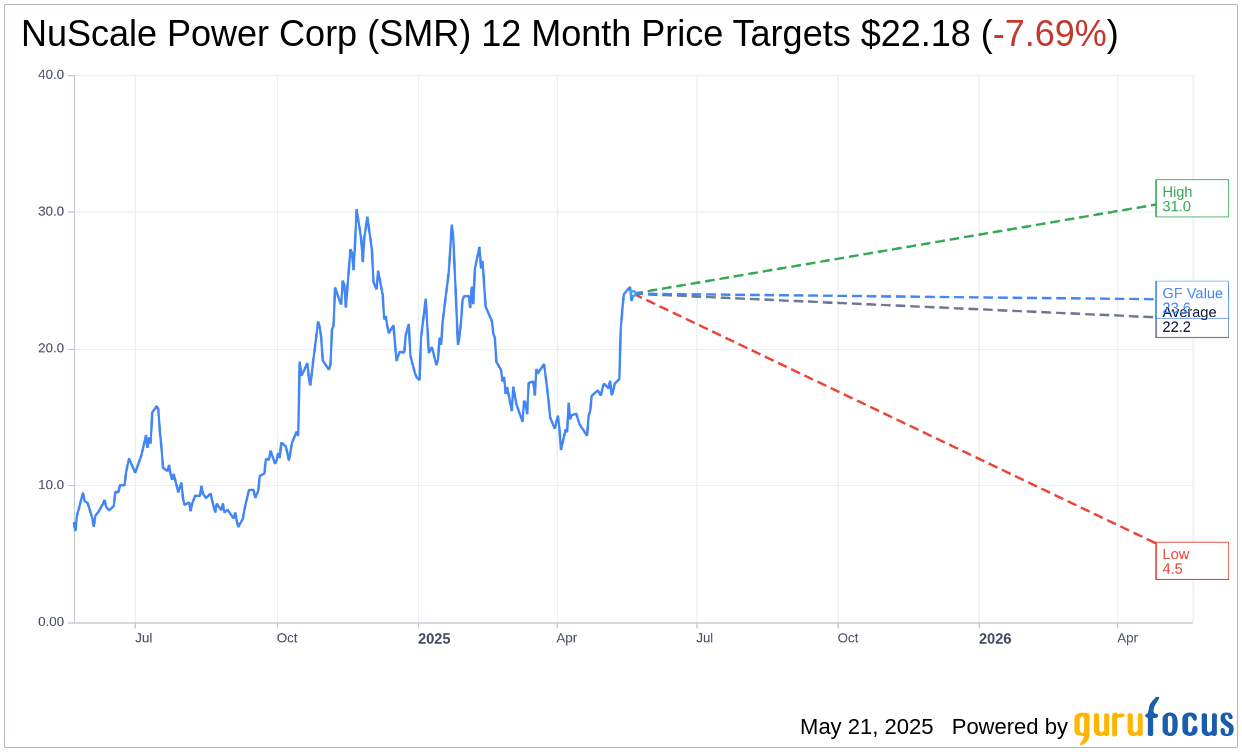

Based on the one-year price targets offered by 10 analysts, the average target price for NuScale Power Corp (SMR, Financial) is $22.18 with a high estimate of $31.00 and a low estimate of $4.50. The average target implies an downside of 7.69% from the current price of $24.03. More detailed estimate data can be found on the NuScale Power Corp (SMR) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, NuScale Power Corp's (SMR, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for NuScale Power Corp (SMR, Financial) in one year is $23.59, suggesting a downside of 1.83% from the current price of $24.03. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the NuScale Power Corp (SMR) Summary page.

SMR Key Business Developments

Release Date: May 12, 2025

- Cash and Cash Equivalents: $491.4 million at the end of Q1 2025.

- Short-term Investments: $30 million at the end of Q1 2025.

- Revenue: $13.4 million for Q1 2025, up from $1.4 million in Q1 2024.

- Operating Expenses: $42.3 million for Q1 2025, down from $44.6 million in Q1 2024.

- Share Sale Proceeds: $102.4 million generated from the sale of 4.5 million shares through the ATM program.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- NuScale Power Corp (SMR, Financial) remains the only SMR company with US Nuclear Regulatory Commission design approval, positioning it ahead of competitors.

- The company is on track to meet its 2030 delivery target, with significant progress in customer engagement and supply chain readiness.

- NuScale's RoPower project in Romania is advancing, with meaningful revenue and cash flow contributions, and discussions to extend the project into the detailed design phase.

- The company anticipates final approval from the NRC to increase power output per module from 50-megawatt electric to 77-megawatt electric by July 2025.

- NuScale has a strong balance sheet with cash and cash equivalents of $491.4 million, bolstered by a successful sale of shares generating $102.4 million in gross proceeds.

Negative Points

- Operating expenses remain high at $42.3 million for the quarter, although slightly reduced from the previous year.

- The company is still in the process of securing a firm customer order, with expectations set for the end of 2025.

- NuScale faces potential challenges from tariffs, although they do not anticipate a material impact at this time.

- The nuclear supply chain is tight, with a limited number of suppliers, which could impact the ability to fulfill multiple orders simultaneously.

- NuScale's cash flow is dependent on securing a customer contract, which remains uncertain despite ongoing discussions.