- LVMH (LVMUY, Financial) faces ongoing challenges with weak luxury goods demand in major markets.

- The company projects a revenue decrease in upcoming quarters, raising concerns among investors.

- Despite challenges, analysts maintain an optimistic outlook, forecasting significant upside potential.

LVMH (LVMUY) cautions investors about continued weak demand for luxury goods in key markets like Asia and the U.S., which together account for over half of its sales. The company anticipates a further 3.7% revenue drop in Q2, following a 5% decline in Q1.

Wall Street Analysts Forecast

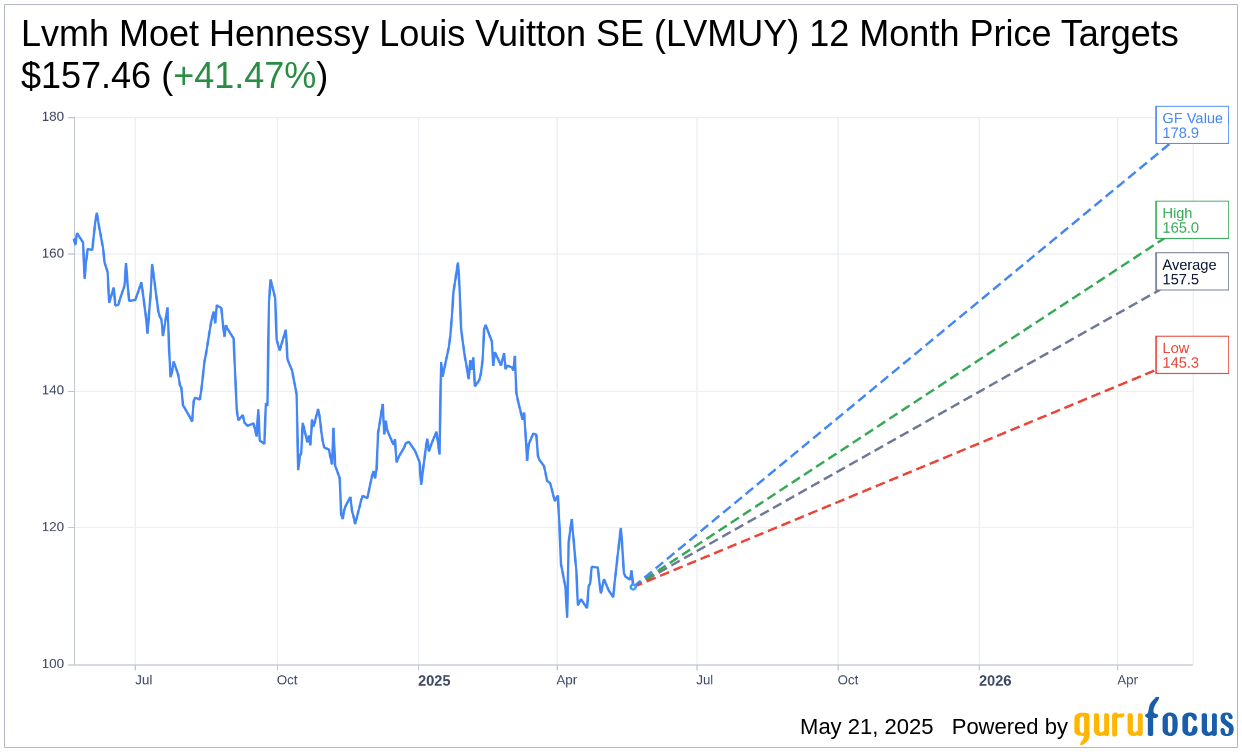

Based on the one-year price targets offered by 3 analysts, the average target price for Lvmh Moet Hennessy Louis Vuitton SE (LVMUY, Financial) is $157.46 with a high estimate of $165.00 and a low estimate of $145.26. The average target implies an upside of 41.28% from the current price of $111.46. For more detailed estimate data, visit the Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Lvmh Moet Hennessy Louis Vuitton SE's (LVMUY, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

GuruFocus Valuation Insights

According to GuruFocus estimates, the estimated GF Value for Lvmh Moet Hennessy Louis Vuitton SE (LVMUY, Financial) in one year is $178.87, suggesting an upside of 60.49% from the current price of $111.455. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on historical multiples the stock has traded at previously, as well as past business growth and future estimates of the business' performance. For more detailed data, see the Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) Summary page.