Summary:

- MSCI Inc partners with Intapp to integrate private asset data into the DealCloud platform.

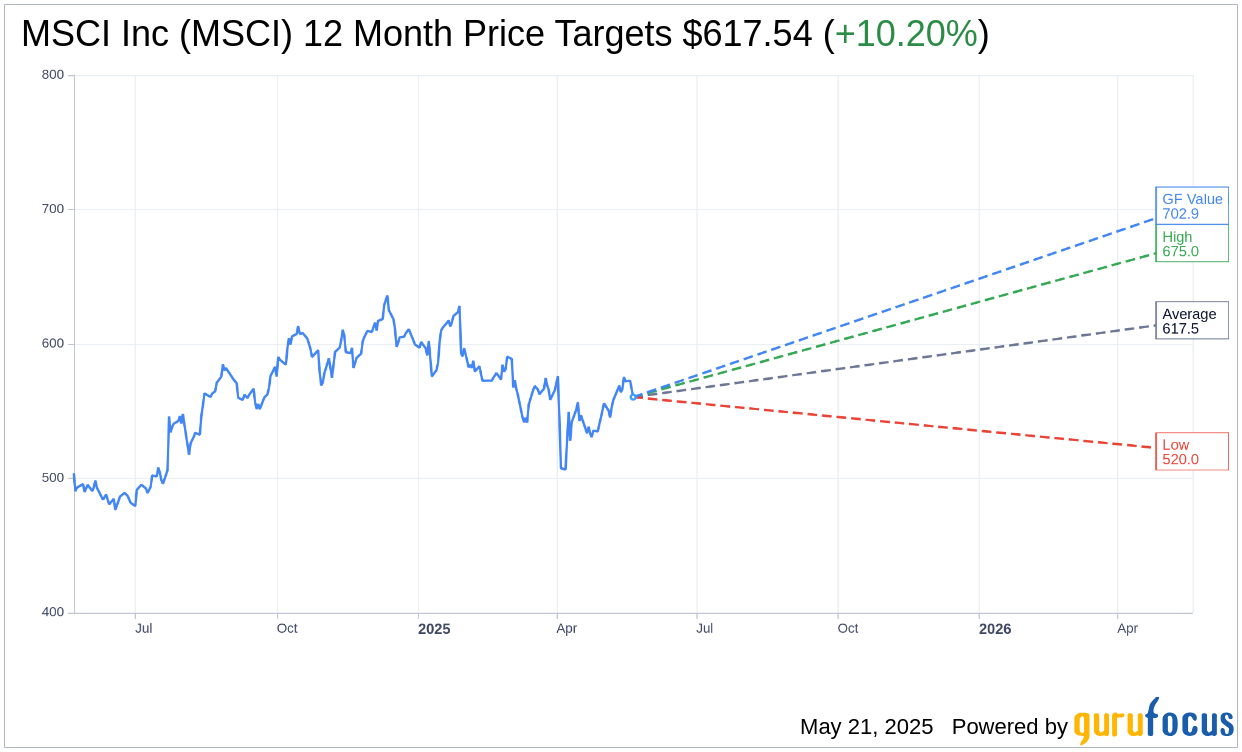

- Analysts project a potential upside for MSCI with an average price target of $617.54.

- GuruFocus estimates a significant upside based on its GF Value assessment at $702.88.

Strategic Collaboration Between MSCI and Intapp

In an effort to bolster data accessibility and enhance real asset data mining, MSCI Inc (MSCI, Financial) has entered into a preliminary partnership with Intapp. This collaboration focuses on integrating MSCI's extensive private asset data directly into Intapp's DealCloud platform. By enabling customizable dashboards and reports, this strategic move aims to provide users streamlined access to critical data, thereby optimizing their data-driven decision-making processes.

Wall Street Analysts' Insights on MSCI

According to 13 analysts' one-year price targets, MSCI Inc is anticipated to reach an average price of $617.54, with projections ranging from a high of $675.00 to a low of $520.00. This average target suggests a promising upside potential of 10.13% from its current trading price of $560.75. Further insights and data can be explored on the MSCI Inc (MSCI, Financial) Forecast page.

Brokerage Recommendations and Ratings

The consensus from 19 brokerage firms positions MSCI Inc with an average recommendation of 2.3, aligning with an "Outperform" status. The brokerage rating system ranges between 1, which indicates a Strong Buy, and 5, which signifies a Sell. This suggests a general optimism among analysts regarding MSCI's performance prospects.

GuruFocus's Valuation: Insight into MSCI's Potential

Utilizing the proprietary GF Value metric, GuruFocus estimates MSCI Inc's value at $702.88 within one year. This implies a substantial upside of 25.35% from the present price of $560.75. The GF Value is a calculated figure reflecting what the stock should ideally trade at, derived from historical trading multiples, past growth trajectories, and future performance predictions. For a deeper dive into the financials, visit the MSCI Inc (MSCI, Financial) Summary page.