Key Insights:

- Palantir Technologies secures a major $795 million contract modification with the U.S. Army, projected for completion by 2029.

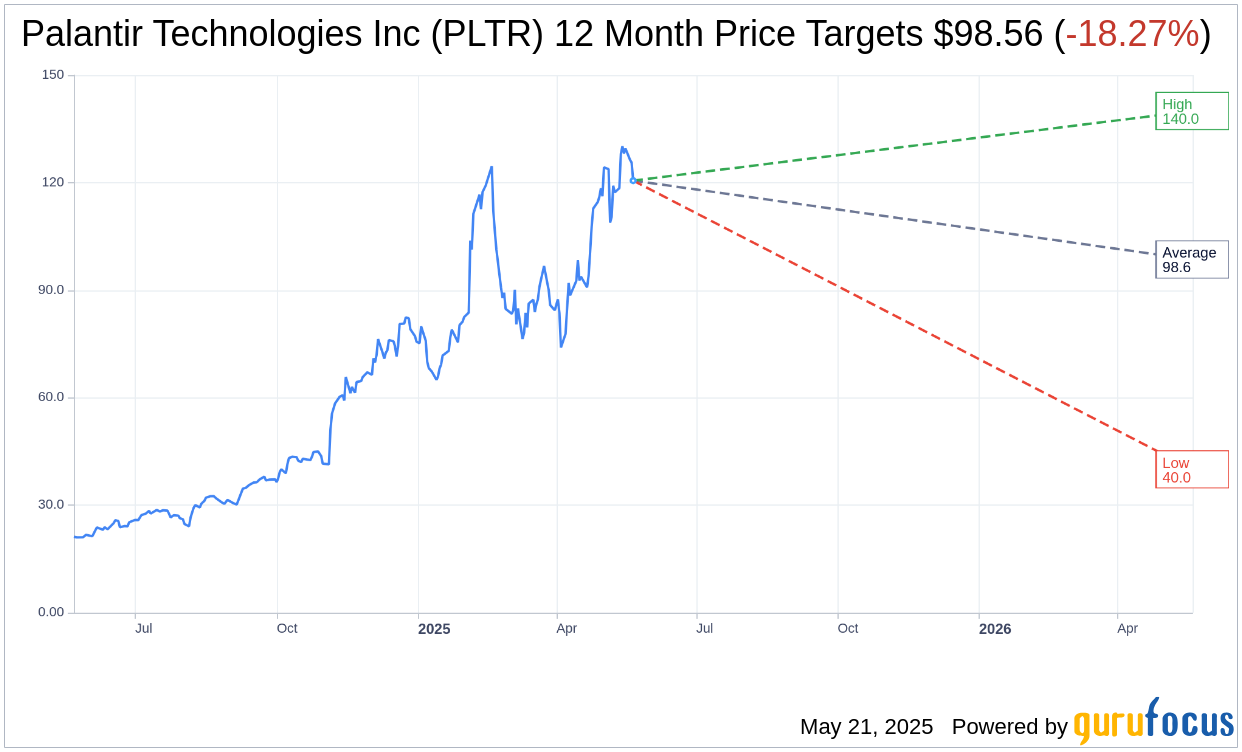

- Analysts' average price target for Palantir suggests a downside from current trading prices.

- The company's GF Value indicates potential overvaluation when compared to the current stock price.

Palantir Technologies' Strategic Contract Win

Palantir Technologies (PLTR, Financial) has successfully obtained a significant $795 million contract modification from the U.S. Army for Maven Smart System software licenses. This notable contract, managed by Army Contracting Command Aberdeen Proving Ground in Maryland, is scheduled to be completed by May 28, 2029. The specific project locations and funding allocations will be determined on a per-order basis.

Wall Street Analysts' Predictions

According to projections from 20 analysts, the average target price for Palantir Technologies Inc (PLTR, Financial) is $98.56. This includes a high estimate of $140.00 and a low of $40.00. Notably, the average target price suggests an 18.27% downside from the current price of $120.58. For more detailed analyst projections, visit the Palantir Technologies Inc (PLTR) Forecast page.

The consensus from 24 brokerage firms positions Palantir Technologies Inc (PLTR, Financial) with an average recommendation of 2.9, indicating a "Hold" status. The recommendation scale employs a range from 1 to 5, where 1 signifies a "Strong Buy" and 5 denotes a "Sell."

Valuation Insights via GF Value

According to GuruFocus, the estimated GF Value for Palantir Technologies Inc (PLTR, Financial) in one year is $30.44. This estimation suggests a 74.76% downside from the current stock price of $120.58. The GF Value is a critical metric reflecting GuruFocus' estimation of the stock's fair trade value, derived from historical trading multiples and predictions of future business performance. For further insights, explore the Palantir Technologies Inc (PLTR) Summary page.