Key Takeaways:

- Snowflake Inc. (SNOW, Financial) reported a significant increase in product revenue, reaching $997 million in Q1.

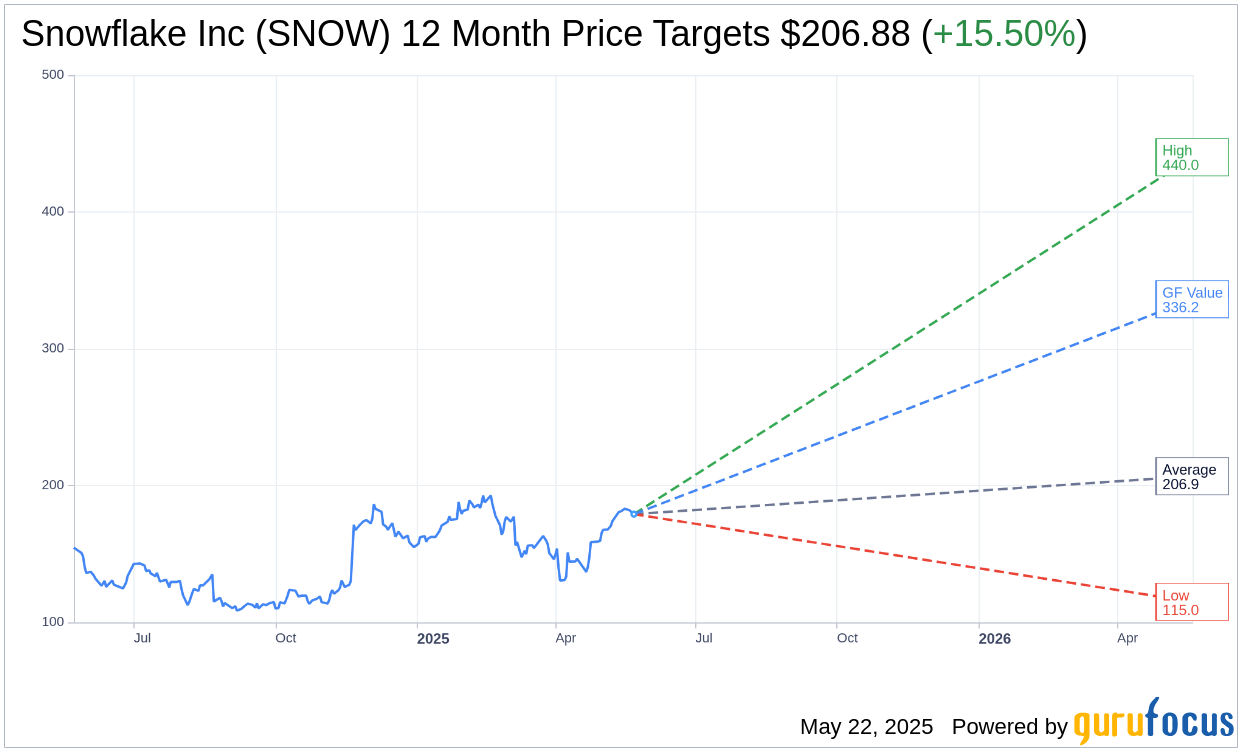

- Wall Street analysts forecast a potential 15.50% rise in SNOW's stock price, with a high target of $440.00.

- GuruFocus estimates suggest an 87.72% upside, predicting a fair value of $336.24 for the stock in one year.

Impressive Revenue Growth in Q1

Snowflake Inc. (SNOW) demonstrated robust financial performance by reporting a 26% year-over-year increase in product revenue for the first quarter, totaling an impressive $997 million. This growth reflects the company's strong market presence and continued customer traction. Additionally, Snowflake's remaining performance obligations surged by 34% to $6.7 billion, underscoring the company's future potential.

Looking ahead, Snowflake projects its Q2 product revenue to range between $1.035 billion and $1.04 billion. Furthermore, the company has raised its fiscal year 2026 revenue guidance to $4.325 billion, signaling confidence in sustained growth.

Wall Street Analysts' Projections

Wall Street analysts have set ambitious price targets for Snowflake Inc (SNOW, Financial), with an average target price of $206.88. This figure suggests a potential upside of 15.50% from the current trading price of $179.12. The high estimate goes as far as $440.00, while the low estimate stands at $115.00. Investors seeking more detailed forecast data can visit the Snowflake Inc (SNOW) Forecast page.

The consensus rating from 47 brokerage firms places Snowflake Inc's (SNOW, Financial) average brokerage recommendation at 2.0, indicating an "Outperform" status. This rating scale ranges from 1 to 5, where 1 represents a Strong Buy, and 5 indicates a Sell.

Long-Term Value Estimations

According to GuruFocus estimates, the projected GF Value for Snowflake Inc (SNOW, Financial) in the next year is set at $336.24. This estimation suggests a substantial upside of 87.72% from the current price of $179.12. The GF Value is an important metric that represents the fair value Snowflake’s stock should trade at, based on historical trading multiples, past business growth, and future performance forecasts. For more comprehensive data, visit the Snowflake Inc (SNOW) Summary page.