Goldman Sachs has revised its rating on W. R. Berkley (WRB, Financial), moving it from Buy to Neutral. Simultaneously, the price target for the stock has been adjusted upwards to $76 from the previous $74. According to the analyst's assessment, W. R. Berkley's reserve position is weaker compared to its industry peers, making its valuation appear less appealing. This current valuation suggests a less favorable balance between risk and reward, especially given the company's low likelihood but potentially high impact concerns over its liability reserve position. This could exert additional pressure on the company's earnings in the short term.

Wall Street Analysts Forecast

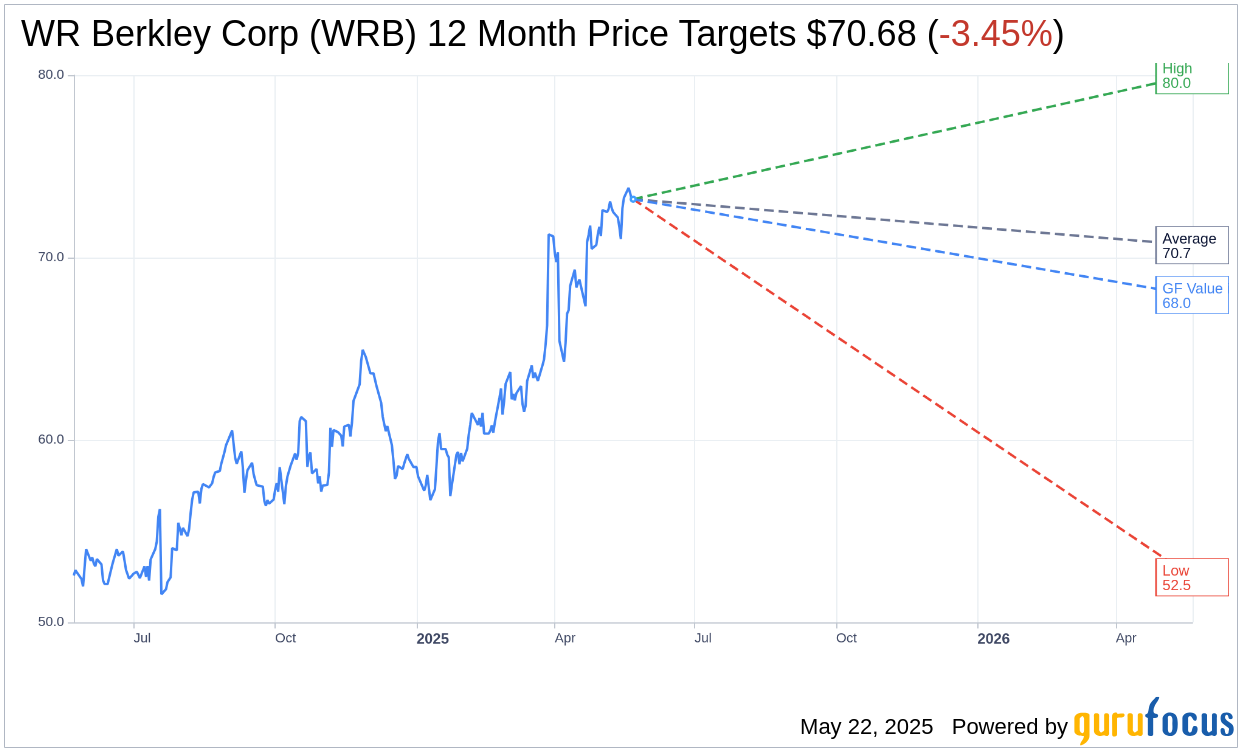

Based on the one-year price targets offered by 14 analysts, the average target price for WR Berkley Corp (WRB, Financial) is $70.68 with a high estimate of $80.00 and a low estimate of $52.47. The average target implies an downside of 3.45% from the current price of $73.20. More detailed estimate data can be found on the WR Berkley Corp (WRB) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, WR Berkley Corp's (WRB, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for WR Berkley Corp (WRB, Financial) in one year is $67.95, suggesting a downside of 7.17% from the current price of $73.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the WR Berkley Corp (WRB) Summary page.

WRB Key Business Developments

Release Date: April 21, 2025

- Net Income: $418 million or $1.04 per share.

- Annualized Return on Equity: 19.9%.

- Operating Earnings: $405 million or $1.01 per share.

- Calendar Year Combined Ratio: 90.9%.

- Current Accident Year Combined Ratio (excluding cat losses): 87.2%.

- Catastrophe Losses: 3.7 loss ratio points or $111 million.

- Net Premiums Earned: $3 billion.

- Net Premiums Written: Over $3.1 billion.

- Insurance Segment Growth: 10.2% to $2.7 billion.

- Reinsurance & Monoline Excess Segment Growth: 8.2% to $439 million.

- Net Investment Income: Increased 12.6% to $360 million.

- Net Invested Assets: $30.7 billion.

- Operating Cash Flows: $744 million.

- Foreign Currency Losses: $19 million.

- Effective Tax Rate: 22.5%.

- Stockholders' Equity: Increased by more than $500 million to $8.9 billion.

- Book Value Per Share Growth: 7.1% in the quarter.

- Cash and Cash Equivalents: More than $1.9 billion.

- Financial Leverage: 24.2%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- WR Berkley Corp (WRB, Financial) reported a strong first quarter with net income of $418 million, or $1.04 per share, and an annualized return on beginning of year equity of 19.9%.

- The company achieved record net premiums written of more than $3.1 billion, with the insurance segment growing by 10.2% and the Reinsurance & Monoline Excess segment by 8.2%.

- Net investment income increased by 12.6% to $360 million, driven by record net invested assets and higher new money rates.

- The company's balance sheet remains robust, with stockholders' equity increasing by more than $500 million to a record $8.9 billion.

- WR Berkley Corp (WRB) maintained a strong credit quality with a portfolio rated AA minus and a low financial leverage of 24.2%.

Negative Points

- The company faced significant industry-wide catastrophic activity, particularly from the California wildfires, resulting in cat losses of $111 million.

- The current accident year loss ratio, excluding cats, increased by 30 basis points over the prior year due to business mix.

- Foreign currency losses amounted to $19 million due to the weakening US dollar.

- Professional liability and cyber insurance markets have become particularly competitive, impacting growth opportunities.

- The company is closely monitoring the impact of tariffs on loss costs, which could affect future pricing and profitability.