Key Takeaways:

- CEL-SCI Corp (CVM, Financial) announces a public offering of 2 million shares at $2.50 each, aiming to raise $5 million.

- Pre-market trading saw a significant 44% dive in CEL-SCI's stock price, now at $2.51.

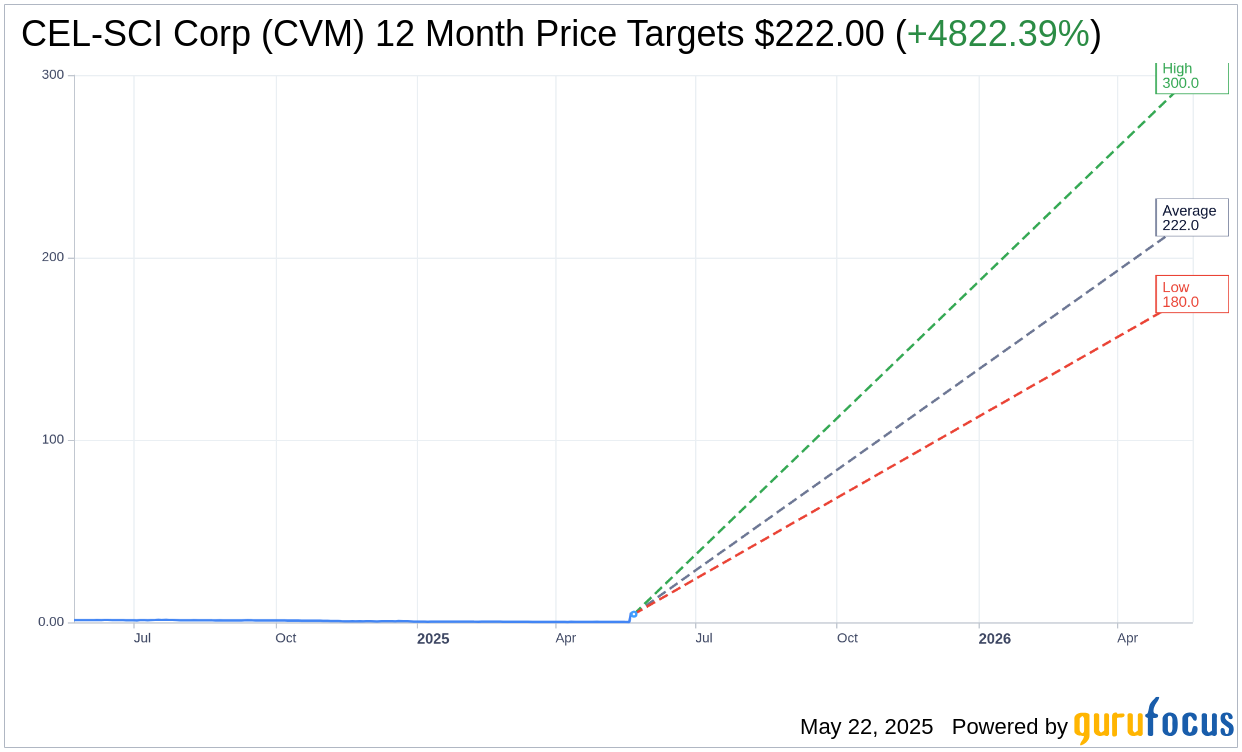

- Analysts present an optimistic one-year price target for CEL-SCI, suggesting substantial upside potential.

CEL-SCI's Ambitious Stock Offering

CEL-SCI Corp (CVM), a company at the forefront of cancer immunotherapy, has revealed plans to initiate a public offering of 2 million shares, each priced at $2.50. This strategic move, poised to generate $5 million in proceeds, is scheduled to conclude on May 23, 2025. The announcement, however, triggered a swift 44% decline in CEL-SCI's stock price during pre-market hours, bringing it down to $2.51.

Analyst Insights and Forecast

According to projections from three seasoned analysts, CEL-SCI Corp (CVM, Financial) holds a one-year average price target of $222.00, with lofty expectations ranging from a high of $300.00 to a low of $180.00. This suggests a remarkable upside potential of 4,822.39% from the current trading price of $4.51. Investors interested in deeper analysis can explore further details on the CEL-SCI Corp (CVM) Forecast page.

Brokerage Recommendations

The consensus from two prominent brokerage firms positions CEL-SCI Corp (CVM, Financial) with an average recommendation of 2.0, translating to an "Outperform" rating. This rating system uses a scale from 1 to 5, where a score of 1 denotes a "Strong Buy," and 5 indicates a "Sell." Such endorsement underscores the market's favorable perception of CEL-SCI's growth trajectory.

As CEL-SCI continues to navigate the complexities of the biotech landscape, this public offering represents a pivotal moment for both the company and investors seeking opportunities in the dynamic world of cancer immunotherapy.