Titan Machinery (TITN, Financial) announced first-quarter revenue of $594.3 million, significantly surpassing the projected $445.75 million. Despite facing persistent challenges within the agricultural sector, the company remains committed to its strategic goals aimed at optimizing inventory levels and managing cyclical downturns. The robust revenue outcome in the first quarter primarily resulted from the timely delivery of pre-sold equipment, rather than a surge in demand, according to CEO Bryan Knutson.

The company does not expect this to alter its full fiscal year outlook, anticipating continued subdued retail conditions due to ongoing pressures on farmer profitability. Government support programs are seen as a critical, albeit currently uncertain, factor. Titan Machinery is steadfastly focused on executing its inventory reduction plans and customer care strategies, which are crucial for navigating the prevailing market challenges and enhancing its business position during this cycle.

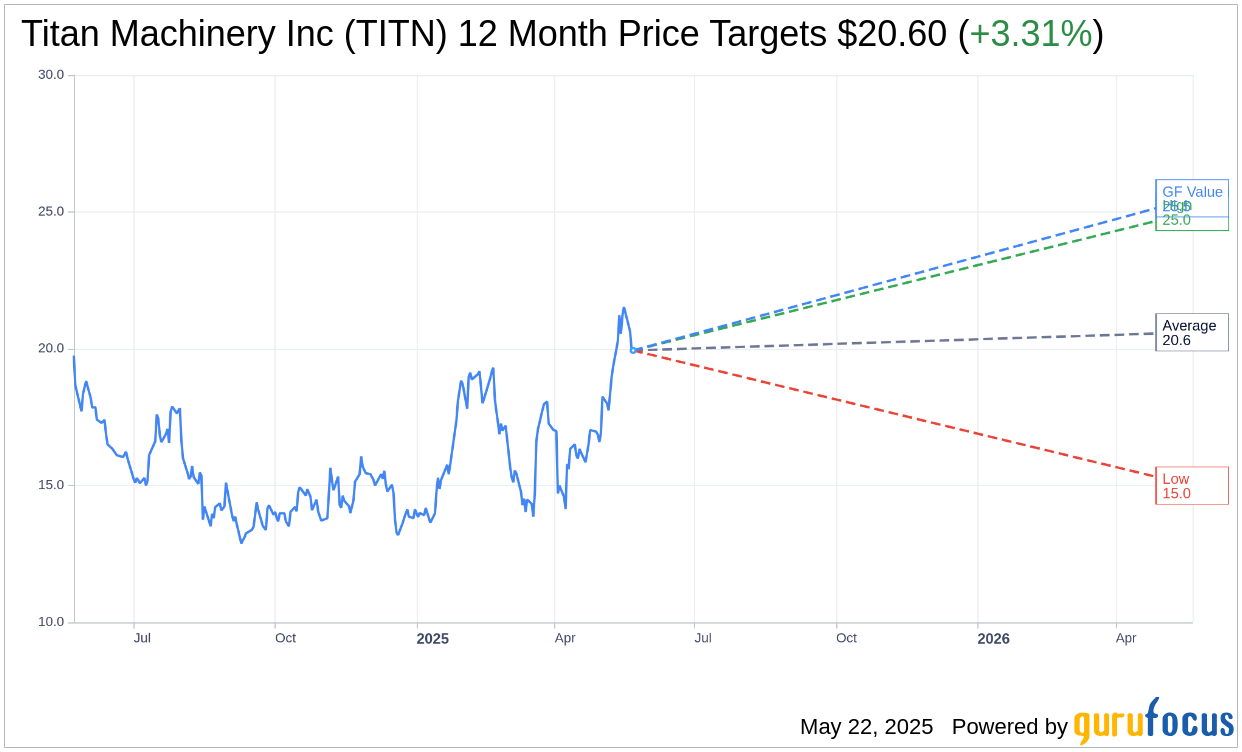

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Titan Machinery Inc (TITN, Financial) is $20.60 with a high estimate of $25.00 and a low estimate of $15.00. The average target implies an upside of 3.31% from the current price of $19.94. More detailed estimate data can be found on the Titan Machinery Inc (TITN) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Titan Machinery Inc's (TITN, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Titan Machinery Inc (TITN, Financial) in one year is $25.50, suggesting a upside of 27.88% from the current price of $19.94. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Titan Machinery Inc (TITN) Summary page.

TITN Key Business Developments

Release Date: March 20, 2025

- Total Revenue: $759.9 million for Q4 fiscal 2025, down from $852.1 million in the prior year period.

- Gross Profit: $51 million for Q4 fiscal 2025, compared to $141 million in the prior year period.

- Gross Profit Margin: 6.7% for Q4 fiscal 2025.

- Operating Expenses: $96.7 million for Q4 fiscal 2025, a decrease of 3.6% from the prior year period.

- Adjusted Net Loss: $44.9 million or $1.98 per diluted share for Q4 fiscal 2025.

- Same Store Sales: Decreased 12% for Q4 fiscal 2025.

- Agriculture Segment Sales: Decreased 13.8% to $534.7 million for Q4 fiscal 2025.

- Construction Segment Sales: Decreased 5.5% to $94.6 million for Q4 fiscal 2025.

- European Segment Sales: Increased 6.1% to $65.4 million for Q4 fiscal 2025.

- Australia Segment Sales: $65.3 million for Q4 fiscal 2025, down from $69.8 million in the prior year period.

- Inventory Reduction: $304 million sequential decrease in Q4 fiscal 2025, totaling $419 million reduction since fiscal Q2.

- Floor Plan and Other Interest Expense: $13.1 million for Q4 fiscal 2025, decreased 8.5% sequentially.

- Fiscal 2025 Total Revenue: $2.7 billion, compared to $2.8 billion for fiscal 2024.

- Fiscal 2025 Adjusted Net Loss: $29.7 million or $1.31 per diluted share.

- Cash Position: $36 million as of January 31, 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Titan Machinery Inc (TITN, Financial) achieved a significant inventory reduction of $304 million in the fourth quarter, totaling a $419 million decrease since the peak in the fiscal second quarter.

- The company reported an 8.2% increase in same-store sales for its service business, reflecting the success of its customer care strategy and increased service capacity.

- Titan Machinery Inc (TITN) maintained a cleaner inventory position in its construction segment, allowing for more responsiveness to market opportunities.

- The European segment showed resilience with a 6.1% sales increase, largely meeting expectations despite challenging conditions.

- The company is optimistic about the construction segment's multi-year outlook, supported by housing shortages and the federal infrastructure bill.

Negative Points

- Total revenue for the fourth quarter decreased by 12% compared to the prior year, primarily due to lower equipment margins in the domestic agriculture segment.

- The company reported an adjusted net loss of $44.9 million for the fourth quarter, compared to a net income of $24 million in the prior year period.

- Titan Machinery Inc (TITN) expects a significant decline in demand for large agriculture equipment in North America, with forecasts suggesting a 30% decrease in 2025.

- The Australian segment faced challenges due to below-average rainfall, impacting yields and resulting in lower profitability for customers.

- The company anticipates a softening demand for construction equipment in fiscal 2026 due to economic uncertainty.