SINTX Technologies (SINT, Financial) has secured International Patent No. 7635292, which explores innovative applications of its silicon nitride material in agriculture, specifically for plant protection and antimicrobial treatment. This new patent complements the previously issued U.S. Patent No. 11,591,217, collectively forming a patent portfolio aimed at the antimicrobial agribiotech market.

Although SINTX remains committed to advancing silicon nitride for medical uses, its versatility enables strategic diversification into high-impact areas, such as agriculture. To support this initiative, SINTX has established a wholly-owned subsidiary focused on the development and commercialization of agricultural and environmental technologies. This new entity, SINTX Agribiotech, will function independently from the company's medical device operations, allowing for targeted resource allocation and strategic development in its sector.

The subsidiary will have a dedicated management team to drive its operations, facilitating technology validation in real-world settings and fostering potential partnerships or licensing agreements with agricultural firms. This strategic move signals SINTX's intent to leverage its expertise in silicon nitride beyond traditional medical applications.

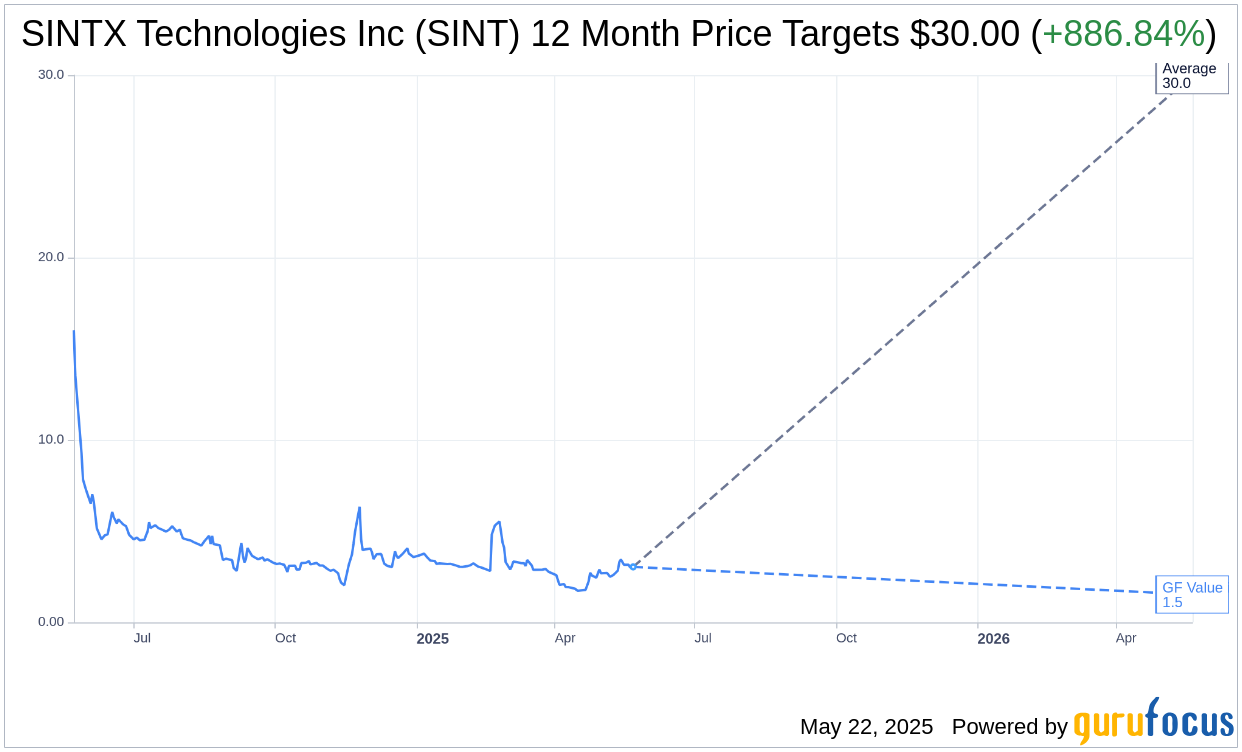

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for SINTX Technologies Inc (SINT, Financial) is $30.00 with a high estimate of $30.00 and a low estimate of $30.00. The average target implies an upside of 886.84% from the current price of $3.04. More detailed estimate data can be found on the SINTX Technologies Inc (SINT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, SINTX Technologies Inc's (SINT, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for SINTX Technologies Inc (SINT, Financial) in one year is $1.53, suggesting a downside of 49.67% from the current price of $3.04. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the SINTX Technologies Inc (SINT) Summary page.