Cognyte Software (CGNT, Financial) remains under the investment spotlight as Needham analyst Mike Cikos reaffirmed his "Hold" rating on the company. The announcement, dated May 22, 2025, indicates that the analyst's outlook for CGNT stays consistent with previous evaluations, maintaining a cautious stance on the software firm's stock.

The reiteration of the "Hold" rating comes without any change in the price targets, as there were no adjustments made to either the current or prior price targets for (CGNT, Financial). This suggests that the analyst's perspective on the company remains stable without significant factors prompting a revision in their valuation metrics.

Cognyte Software (CGNT, Financial), known for its comprehensive intelligence analytics software solutions, continues to navigate the market landscape under the same investment guidance, reflecting a steady performance as assessed by Needham's expert, Mike Cikos.

Wall Street Analysts Forecast

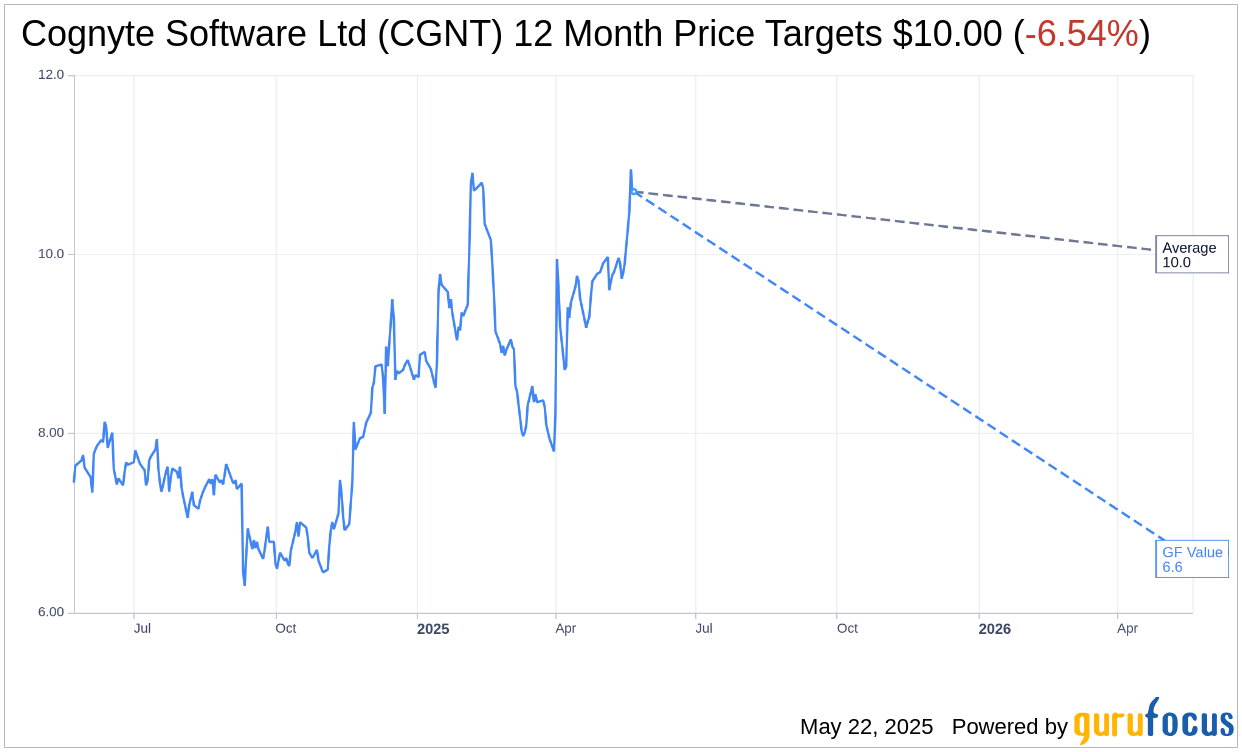

Based on the one-year price targets offered by 1 analysts, the average target price for Cognyte Software Ltd (CGNT, Financial) is $10.00 with a high estimate of $10.00 and a low estimate of $10.00. The average target implies an downside of 6.54% from the current price of $10.70. More detailed estimate data can be found on the Cognyte Software Ltd (CGNT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Cognyte Software Ltd's (CGNT, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cognyte Software Ltd (CGNT, Financial) in one year is $6.60, suggesting a downside of 38.32% from the current price of $10.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cognyte Software Ltd (CGNT) Summary page.