On Wednesday, Peloton Interactive (PTON, Financial) experienced significant call activity. This rise in options trading indicates increased interest or speculation around the company's future performance. Investors and traders are closely monitoring PTON as they assess its current valuation and market resilience. The heightened call activity may reflect growing optimism or strategic positioning by market participants regarding Peloton's potential for growth or anticipated market movements.

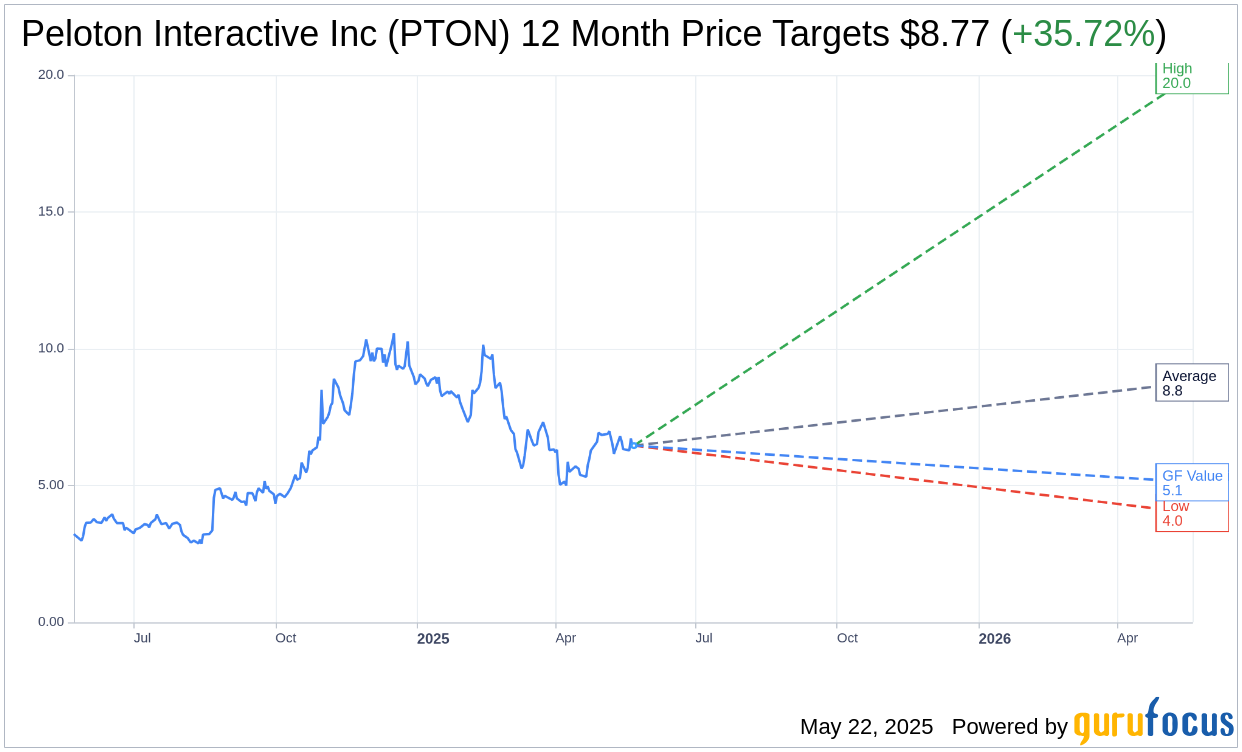

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Peloton Interactive Inc (PTON, Financial) is $8.77 with a high estimate of $20.00 and a low estimate of $4.00. The average target implies an upside of 35.72% from the current price of $6.46. More detailed estimate data can be found on the Peloton Interactive Inc (PTON) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Peloton Interactive Inc's (PTON, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Peloton Interactive Inc (PTON, Financial) in one year is $5.12, suggesting a downside of 20.74% from the current price of $6.46. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Peloton Interactive Inc (PTON) Summary page.

PTON Key Business Developments

Release Date: May 08, 2025

- Paid Connected Fitness Subscriptions: Ended the quarter with 2.88 million, a net increase of 5,000, exceeding guidance by 10,000 subscriptions.

- Revenue: Total revenue of $624 million, with $205 million from Connected Fitness products and $419 million from subscriptions.

- Gross Margin: Total gross margin was 51%, an increase of 780 basis points year-over-year.

- Connected Fitness Products Revenue: Decreased 27% year-over-year to $205 million.

- Subscription Revenue: Decreased 4% year-over-year to $419 million.

- Advertising and Marketing Spend: Decreased 46% year-over-year.

- Adjusted EBITDA: $89 million, $4 million above the high end of guidance, and an $84 million improvement year-over-year.

- Free Cash Flow: Generated $95 million in the third quarter, an increase of $86 million year-over-year.

- Unrestricted Cash and Cash Equivalents: Ended the quarter with $914 million, an increase of $85 million quarter-over-quarter.

- Net Debt: Reduced to $585 million, a 35% year-over-year decrease.

- Operating Expenses: Total operating expenses were $351 million, a 23% decrease year-over-year.

- Sales and Marketing Expense: $106 million, a decrease of 37% year-over-year.

- General and Administrative Expense: $151 million, a decrease of 1% year-over-year.

- Research and Development Expenses: $60 million, a decrease of 22% year-over-year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Peloton Interactive Inc (PTON, Financial) exceeded guidance on key metrics, including paid Connected Fitness subscriptions and adjusted EBITDA.

- The company achieved significant cost reductions, tracking ahead of a $200 million cost restructuring plan, which improved profitability.

- Peloton Interactive Inc (PTON) reported a positive free cash flow of $95 million in Q3, marking the fifth consecutive quarter of positive free cash flow.

- The company observed strong engagement with new features, such as Pace Target on the treadmill, with over 80% of Tread users utilizing it.

- Peloton Interactive Inc (PTON) successfully expanded its presence in commercial gyms through a pilot program with Precor, enhancing its reach.

Negative Points

- Connected Fitness products revenue decreased by 27% year-over-year, driven by lower sales and deliveries across all product categories.

- The company experienced a net decrease of 12,000 paid app subscriptions in the quarter.

- Peloton Interactive Inc (PTON) faces challenges in innovating hardware to complement its software and content offerings.

- The company is dealing with macroeconomic uncertainties that could impact demand for Connected Fitness hardware sales.

- Peloton Interactive Inc (PTON) has $200 million in convertible notes due in February of next year, which requires careful financial planning.