Bridger Aerospace (BAER, Financial) has been awarded two significant 120-day contracts by the US Forest Service, which involve deploying two of its CL-415EAF “Super Scooper” aircraft. These contracts are noteworthy, as they have been granted early in the wildfire season and extend for a record duration of 120 days each.

The agreement highlights the increasing recognition of the Super Scoopers as vital tools in combating wildfires and reflects the Forest Service's proactive approach to disaster management. By pre-positioning these resources, they aim to respond more swiftly, minimizing damage and enhancing the protection of life and property against the escalating threat of wildfires.

This development also underscores Bridger Aerospace's strategic focus on maintaining fleet readiness throughout the year, thus improving both the predictability and visibility of their revenue streams.

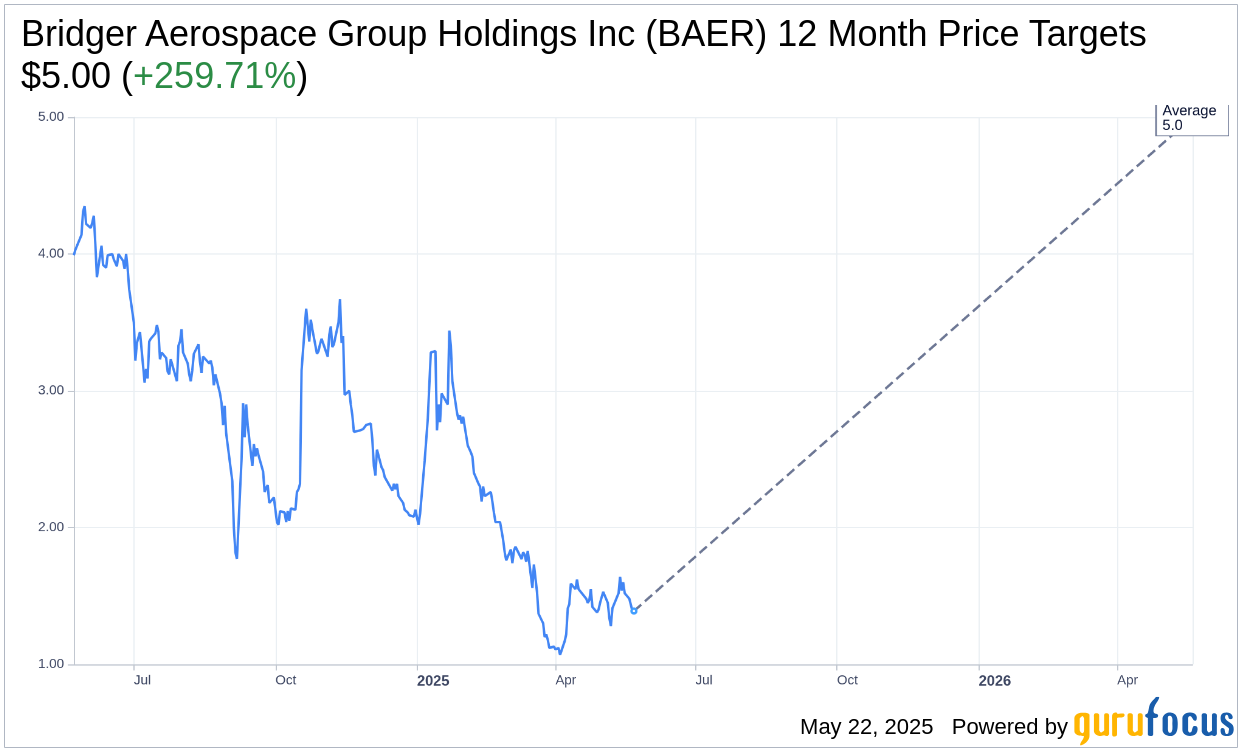

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Bridger Aerospace Group Holdings Inc (BAER, Financial) is $5.00 with a high estimate of $5.00 and a low estimate of $5.00. The average target implies an upside of 259.71% from the current price of $1.39. More detailed estimate data can be found on the Bridger Aerospace Group Holdings Inc (BAER) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Bridger Aerospace Group Holdings Inc's (BAER, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

BAER Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Record first quarter revenue of $15.6 million, an increase of 184% over the previous year.

- Early deployment of aircraft and new contracts contributed to significant revenue growth.

- Successful signing of a 5-year $20.1 million contract with the US Department of the Interior.

- Introduction of new technologies and partnerships, such as the FF 72 aircraft, to enhance fleet capabilities.

- Positive legislative developments in Congress to improve wildfire response efficiency.

Negative Points

- Net loss of $15.5 million reported for the first quarter of 2025.

- High maintenance expenses, totaling $11 million, contributed to increased costs.

- Adjusted EBITDA was negative $5.1 million, indicating ongoing financial challenges.

- Dependence on seasonal wildfire activity leads to revenue volatility.

- Significant cash decline from $39.3 million at the end of 2024 to $22.3 million in the first quarter of 2025.