Synchronoss Technologies, under the ticker SNCR, has unveiled version 25.5 of its Synchronoss Personal Cloud, incorporating advanced AI-driven features to enhance user interaction. This upgrade includes improved photo editing options, offering new styles and transformations, alongside AI-curated personalized memories that automatically stylize photos.

The update also introduces timeline comparisons with custom "Then and Now" photos and a GPS-integrated photo viewing experience. According to Jeff Miller, President and CEO of Synchronoss, these enhancements aim to tackle the issue of digital content overload, facilitating easier access and enjoyment of significant photos often buried in vast libraries. By leveraging intelligent indexing and categorization, complemented by AI-powered creative tools, Synchronoss helps users rediscover and appreciate valuable moments stored in their digital collections.

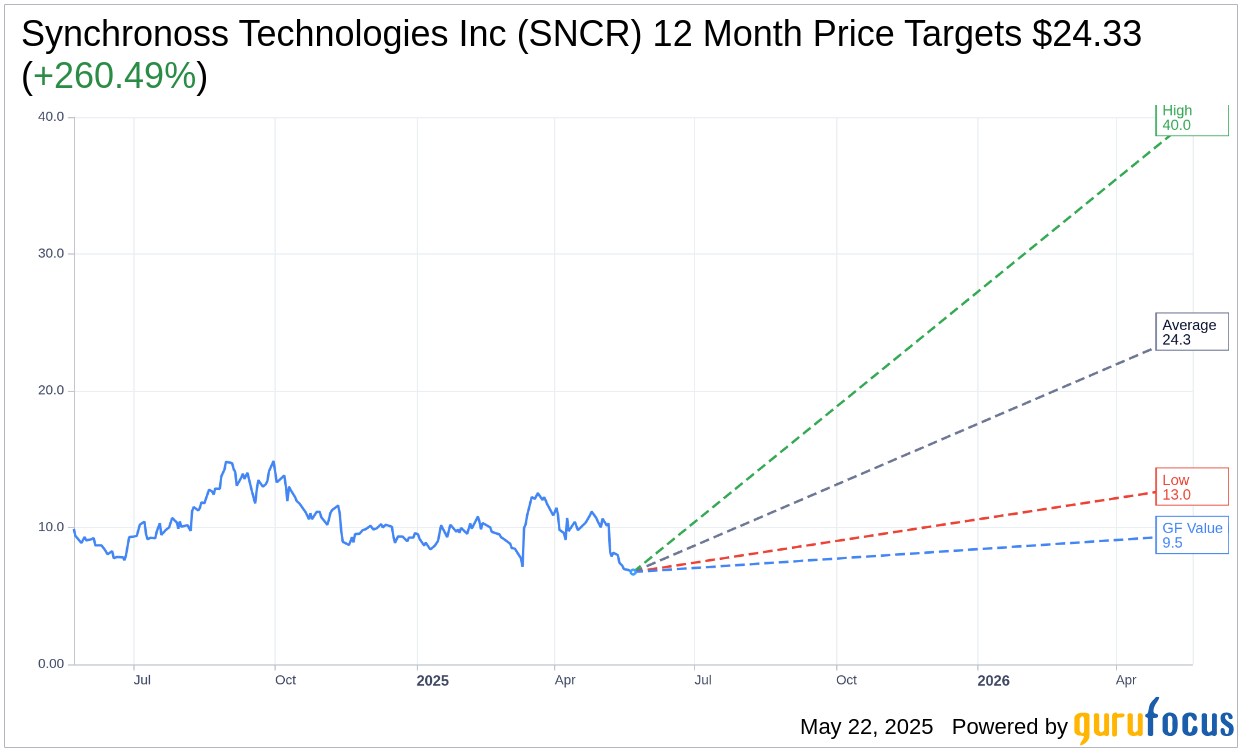

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Synchronoss Technologies Inc (SNCR, Financial) is $24.33 with a high estimate of $40.00 and a low estimate of $13.00. The average target implies an upside of 260.49% from the current price of $6.75. More detailed estimate data can be found on the Synchronoss Technologies Inc (SNCR) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Synchronoss Technologies Inc's (SNCR, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Synchronoss Technologies Inc (SNCR, Financial) in one year is $9.46, suggesting a upside of 40.15% from the current price of $6.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Synchronoss Technologies Inc (SNCR) Summary page.

SNCR Key Business Developments

Release Date: May 06, 2025

- Revenue: $42.2 million, down from $43 million in the prior year period.

- Cloud Subscriber Growth: 3.3% increase.

- Recurring Revenue: 93.1% of total revenue.

- Adjusted EBITDA: $12.7 million, representing a 30.2% margin.

- Adjusted Gross Profit: $33.4 million or 79% of total revenue.

- Income from Operations: $8.2 million, up 79.8% year-over-year.

- Operating Expenses: Decreased 11.5% from $38.4 million to $34 million.

- Net Loss: $3.8 million or a negative $0.37 per share.

- Cash and Cash Equivalents: $29.1 million as of March 31, 2025.

- Free Cash Flow: Negative $3 million.

- Adjusted Free Cash Flow: Negative $3.3 million.

- New Term Loan: $200 million, four-year term loan.

- Guidance for 2025: Revenue between $170 million and $180 million; Adjusted Gross Margin between 78% and 80%; Adjusted EBITDA between $52 million and $56 million; Free Cash Flow between $11 million and $16 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Revenue for the quarter was $42.4 million, with a 3.3% increase in subscriber growth across the global customer base.

- Adjusted EBITDA increased by 17% year-over-year to $12.7 million, representing a margin of 30.2%.

- Over 90% of revenue is classified as recurring, with long-term contracts with major carriers like AT&T, Verizon, and SoftBank.

- The company successfully refinanced its debt with a $200 million, four-year term loan, strengthening its capital structure.

- Operational expenses were reduced by 11.5% year-over-year, demonstrating effective cost control measures.

Negative Points

- Total revenue decreased slightly from $43 million in the prior year period due to the expiration of a customer contract.

- Net loss was reported at $3.8 million, primarily due to $5.6 million in non-cash foreign exchange losses.

- Free cash flow was negative $3 million, reflecting a cash spend-heavy period in the first quarter.

- The macroeconomic landscape, including tariffs and global trade uncertainties, poses challenges.

- Potential impact of tariffs could slow phone upgrade cycles, affecting short-term subscriber growth.