- Ralph Lauren (RL, Financial) experiences a significant revenue boost and surpasses profit expectations in Q4.

- Analyst predictions suggest a modest downside risk relative to the current stock price.

- GuruFocus analysis indicates a potential overvaluation compared to the estimated GF Value.

Ralph Lauren Corp (NYSE: RL) recently unveiled its fiscal fourth-quarter results, showcasing a noteworthy performance that has caught the attention of investors and analysts alike. With an 8.3% rise in revenue to $1.7 billion, primarily driven by robust direct-to-consumer sales and expansion in international markets, the company has set a strong precedent. The earnings exceeded market expectations, reporting $2.27 per share, while the company also pleased its shareholders by boosting its dividend by 10% and expanding its share buyback program by a significant $1.5 billion.

Wall Street Analysts' Outlook on Ralph Lauren

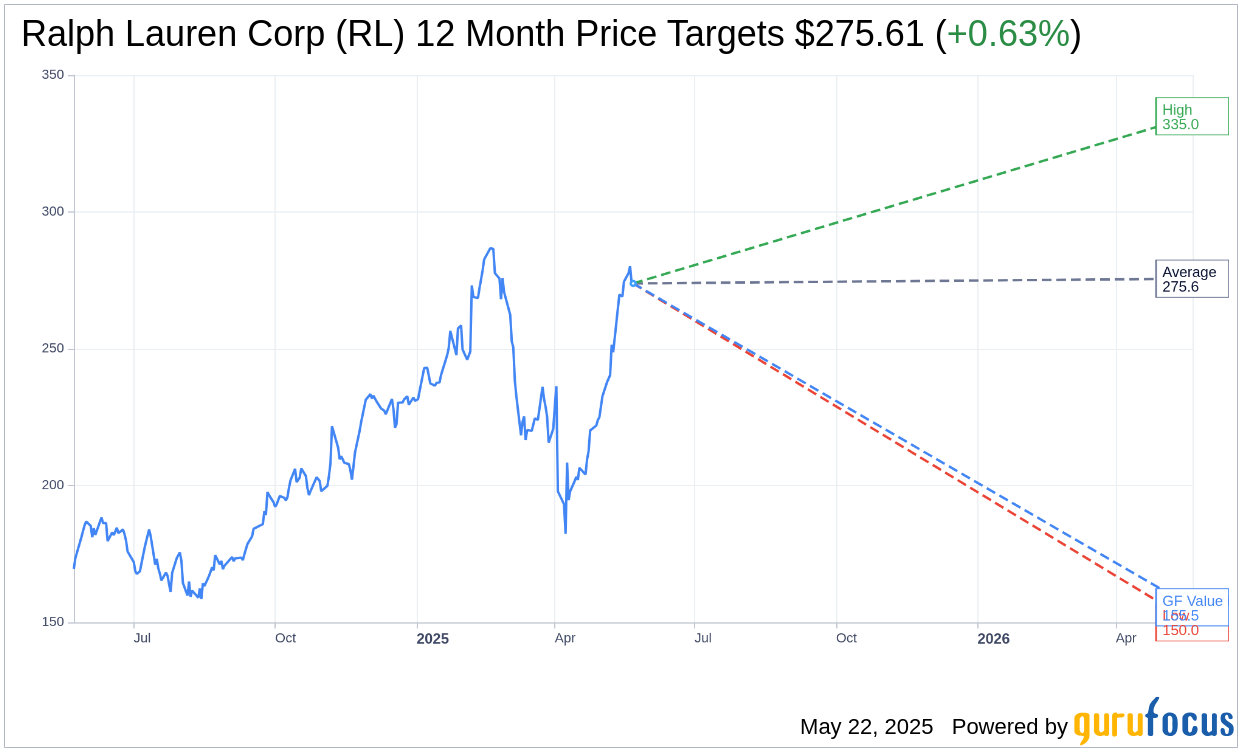

The consensus from 15 Wall Street analysts provides a clear picture of Ralph Lauren Corp's (RL, Financial) one-year price expectations. Their average target price is pegged at $275.61, with a high estimate soaring to $335.00 and a low of $150.00. This average target implies a slight 0.60% downside from the current trading price of $277.28, indicating cautious optimism. For further insights, refer to the detailed estimates on the Ralph Lauren Corp (RL) Forecast page.

In terms of market recommendations, Ralph Lauren Corp (RL, Financial) holds an "Outperform" status. This is based on a consensus recommendation score of 2.2 from 19 brokerage firms, using a scale where 1 denotes a Strong Buy and 5 indicates a Sell. This suggests a favorable view of the company's future performance.

Evaluating Ralph Lauren's GF Value

Utilizing GuruFocus's proprietary metrics, the estimated GF Value for Ralph Lauren Corp (RL, Financial) in the coming year stands at $155.51. This valuation suggests a potential downside of 43.91% from the current price level of $277.275, hinting at an overvaluation in the context of historical trading multiples and anticipated performance metrics. Investors can find comprehensive valuation details and potential implications for strategic investing on the Ralph Lauren Corp (RL) Summary page.