Morgan Stanley's analyst David Arcaro has adjusted the price target for Dominion (D, Financial), bringing it down slightly from $63 to $62, while maintaining an Equal Weight rating on the stock. This revision is part of Morgan Stanley's broader update across the Regulated & Diversified Utilities and Independent Power Producer sectors in North America.

The utilities sector continues to attract significant interest from data centers and large-scale energy consumers, indicating robust demand. Furthermore, management teams within the sector express confidence that any potential changes to the Inflation Reduction Act (IRA) are manageable due to existing safe harbor provisions.

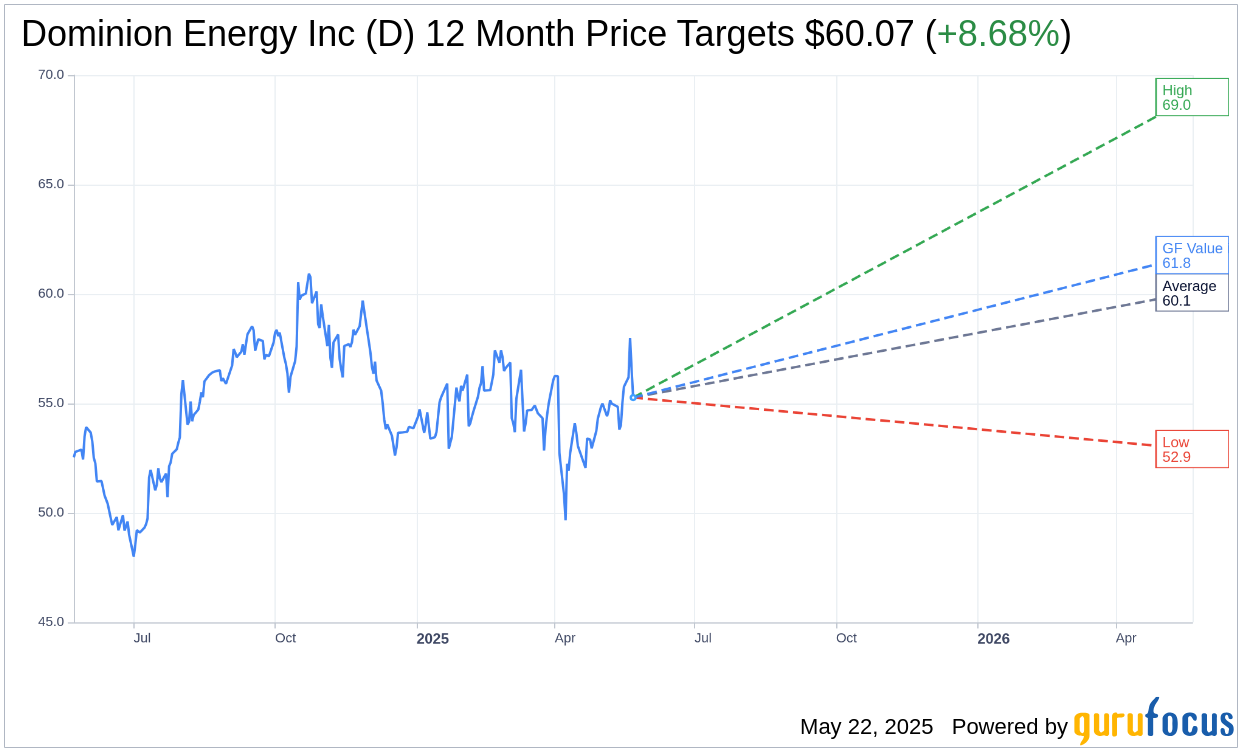

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Dominion Energy Inc (D, Financial) is $60.07 with a high estimate of $69.00 and a low estimate of $52.92. The average target implies an upside of 8.68% from the current price of $55.27. More detailed estimate data can be found on the Dominion Energy Inc (D) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Dominion Energy Inc's (D, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dominion Energy Inc (D, Financial) in one year is $61.78, suggesting a upside of 11.78% from the current price of $55.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dominion Energy Inc (D) Summary page.

D Key Business Developments

Release Date: May 01, 2025

- Forward Settled Common Equity: Approximately $1 billion sold under the existing ATM program at an average price of $57.

- DRIP Related Equity Issuance: Expected to complete $200 million by year-end.

- Data Center Capacity: Approximately 40 gigawatts in various stages of contracting, with 10 gigawatts under electric service agreements.

- Offshore Wind Project Cost: Updated project cost of $10.8 billion.

- Tariff Costs: Actual incurred tariff costs of $4 million through Q1; potential cumulative impact of $500 million by 2026.

- Residential Customer Bill Impact: Expected to increase by an average of $0.04 per month over the project's life.

- Project LCOE: $62 per megawatt hour, inclusive of REX.

- Chesterfield Energy Reliability Center: Expected cost of approximately $1.5 billion, with service commencement in 2029.

- Millstone Facility Output: Over 90% of Connecticut's carbon-free electricity, with 55% under a fixed price contract through late 2029.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dominion Energy Inc (D, Financial) has successfully sold approximately $1 billion of forward settled common equity under its existing ATM program, aligning with its 2025 common equity guidance.

- The Coastal Virginia Offshore Wind project is progressing well, with 55% completion and on track for full completion by the end of next year, creating approximately 2,000 jobs and generating $2 billion in economic activity.

- Dominion Energy Inc (D) has maintained strong demand from data center customers, with no evidence of slowing demand across its service area.

- The company has achieved constructive outcomes in all of its regulated service areas, contributing to the success of South Carolina's economy and maintaining reliable service in Virginia.

- Dominion Energy Inc (D) reported a strong first quarter performance, with earnings modestly above expectations, driven by better-than-expected sales and favorable weather conditions.

Negative Points

- The Coastal Virginia Offshore Wind project faces potential tariff exposure, with cumulative tariff impacts potentially reaching $500 million if current policies continue through 2026.

- Dominion Energy Inc (D) recorded a modest charge this quarter for costs not expected to be recovered from customers, related to the offshore wind project.

- Residential sales showed slight weakness in the first quarter, although the company does not expect this trend to continue.

- The company faces uncertainty regarding the impact of tariffs on its solar and storage projects, although it considers these impacts manageable.

- There is ongoing uncertainty around the final cost of PJM network upgrades, with final numbers expected in July.