Morgan Stanley has adjusted its price target for PSEG (PEG, Financial) from $102 to $101 while maintaining an Overweight rating on the shares. This adjustment is part of the firm's broader review of its price objectives within the Regulated & Diversified Utilities/IPPs sector in North America. The firm highlights ongoing robust demand from data centers and major load customers for utility services. Additionally, according to the firm, utility companies are generally well-positioned to manage any potential adjustments related to the IRA, with many companies having secured safe harbor provisions in advance.

Wall Street Analysts Forecast

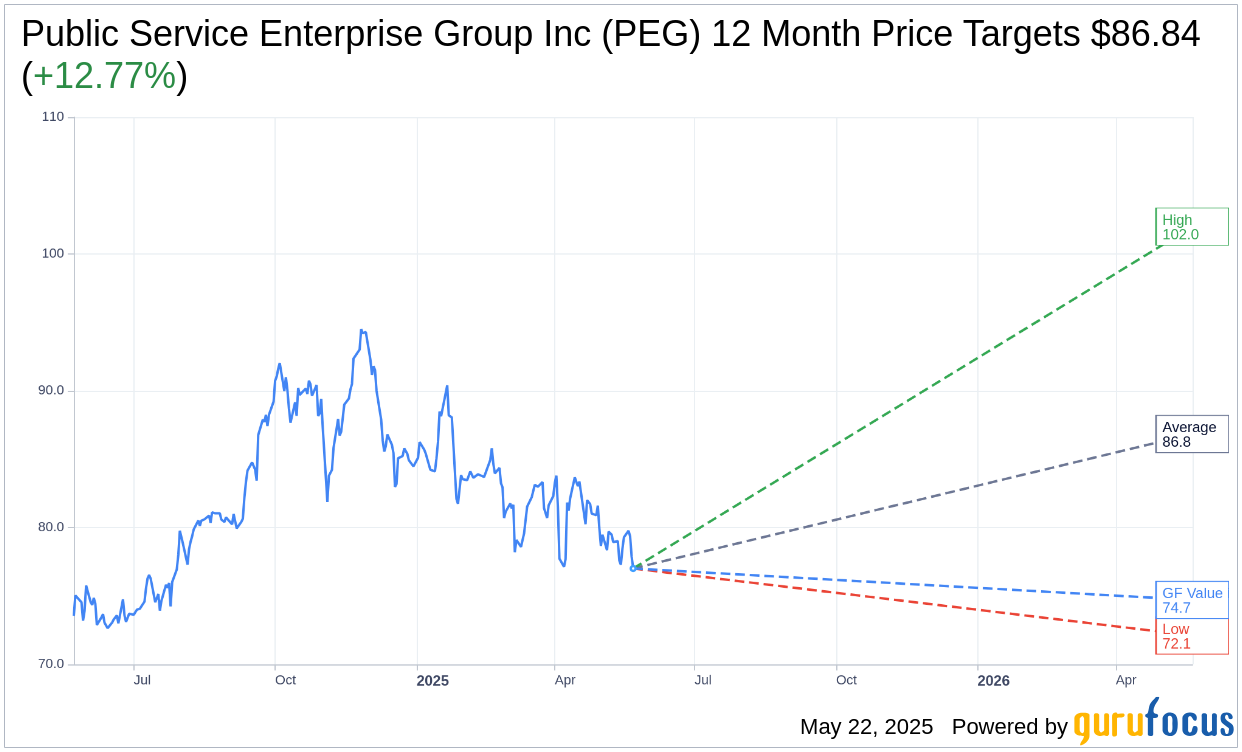

Based on the one-year price targets offered by 15 analysts, the average target price for Public Service Enterprise Group Inc (PEG, Financial) is $86.84 with a high estimate of $102.00 and a low estimate of $72.11. The average target implies an upside of 12.77% from the current price of $77.01. More detailed estimate data can be found on the Public Service Enterprise Group Inc (PEG) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Public Service Enterprise Group Inc's (PEG, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Public Service Enterprise Group Inc (PEG, Financial) in one year is $74.71, suggesting a downside of 2.99% from the current price of $77.01. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Public Service Enterprise Group Inc (PEG) Summary page.

PEG Key Business Developments

Release Date: April 30, 2025

- Net Income: $1.18 per share for Q1 2025, up from $1.06 per share in Q1 2024.

- Non-GAAP Operating Earnings: $1.43 per share for Q1 2025, compared to $1.31 per share in Q1 2024.

- PSE&G Net Income and Non-GAAP Operating Earnings: $546 million for Q1 2025, up from $488 million in Q1 2024.

- Capital Investments: $800 million invested in Q1 2025, with a full-year plan of $3.8 billion.

- Liquidity: Total available liquidity of $4.6 billion as of March 2025, including $900 million in cash.

- Long-term Debt Issuance: $1.9 billion issued in Q1 2025.

- Full Year Non-GAAP Operating Earnings Guidance: Reiterated at $3.94 to $4.06 per share for 2025.

- Five-Year Capital Spending Program: $21 billion to $24 billion through 2029.

- Rate Base CAGR: Expected 6% to 7.5% through 2029.

- Non-GAAP Operating Earnings CAGR: 5% to 7% through 2029.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Public Service Enterprise Group Inc (PEG, Financial) delivered solid operating and financial performance in the first quarter of 2025, benefiting from regulatory recovery and seasonality of gas revenues.

- The company maintained high levels of reliability and efficient customer response times during challenging winter conditions.

- PSEG's nuclear operations achieved a fleet capacity factor of 99.9%, supplying the grid with approximately 8.4 terawatt hours of clean and reliable baseload power.

- The company is focused on infrastructure replacement and modernization, with a five-year capital spending program of $21 billion to $24 billion, supporting a rate base CAGR of 6% to 7.5% through 2029.

- PSEG's liquidity position improved significantly, with total available liquidity of $4.6 billion as of the end of March 2025.

Negative Points

- The Basic Generation Service (BGS) default rate is scheduled to increase residential electric bills by 17% starting June 1, largely due to capacity auction results.

- There are ongoing discussions with New Jersey policymakers to mitigate the customer bill impacts of the BGS increase, indicating potential regulatory challenges.

- PSEG faces uncertainties related to the FERC 206 process and the settlement process for behind-the-meter data centers.

- The company is dealing with affordability concerns in New Jersey, with upward pressure on energy prices expected to persist until new generating supply is added to the grid.

- PSEG's commercial discussions related to nuclear capacity are contingent on resolving uncertainties around FERC processes and market rules.