- Lennox International (LII, Financial) increases its stock repurchase program by $1 billion.

- Analysts predict a minor downside potential from the current stock price.

- Company announces a 13% hike in its quarterly dividend, now at $1.30 per share.

Lennox International (LII) has strategically decided to augment its stock repurchase program by an impressive $1 billion, which adds to the $290 million that remains from previous authorizations. The company aims to execute these buybacks using various dynamic approaches. Moreover, Lennox International has declared a quarterly dividend of $1.30 per share, representing a notable 13% increase.

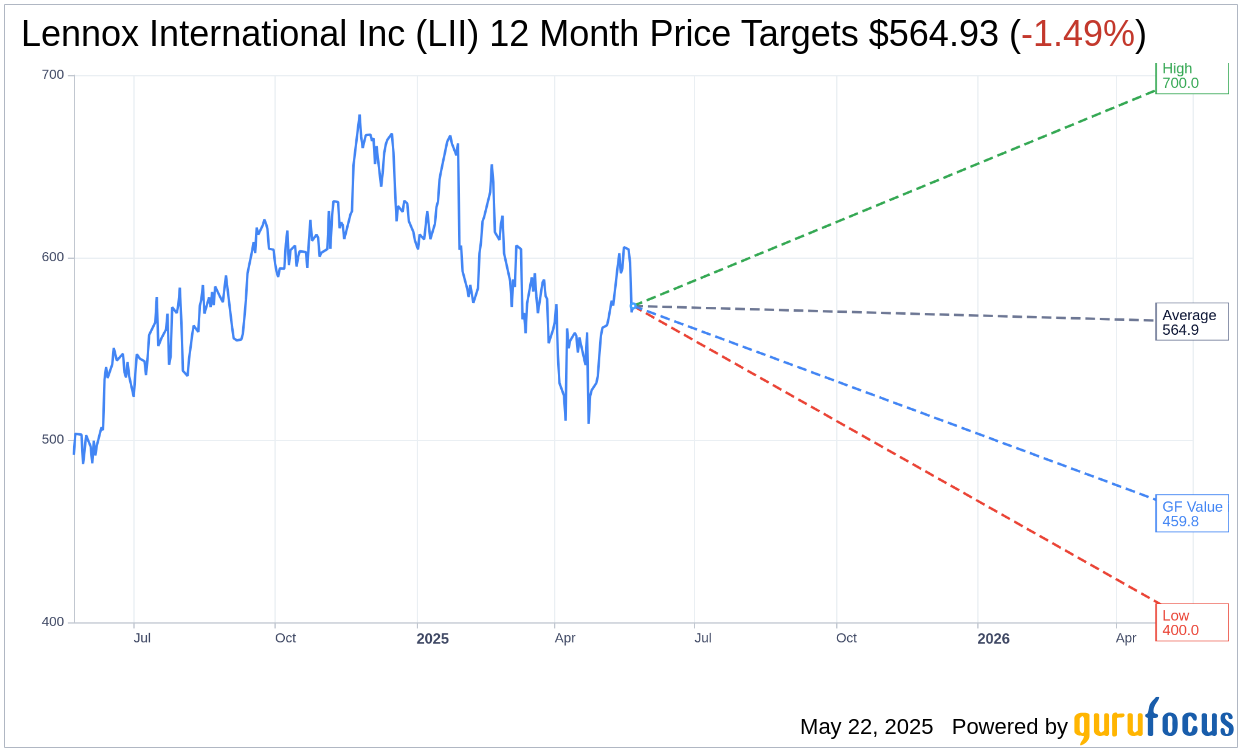

Wall Street Analysts Forecast

The projections from 17 financial analysts suggest an average target price for Lennox International Inc (LII, Financial) of $564.93. These targets show a high estimate of $700.00 and a low of $400.00. This averages out to imply a slight downside of 1.26% from the current market price of $572.15. For more comprehensive estimated data, visit the Lennox International Inc (LII) Forecast page.

Investor Ratings and Insights

The collective insights from 21 brokerage firms have resulted in an average brokerage recommendation of 3.0 for Lennox International Inc (LII, Financial), signifying a "Hold" status. This rating is based on a scale where 1 indicates a Strong Buy and 5 a Sell.

According to GuruFocus estimates, the anticipated GF Value for Lennox International Inc (LII, Financial) in one year stands at $459.80. This suggests a potential downside of 19.64% from the current price of $572.15. The GF Value represents GuruFocus' evaluation of the fair market value of the stock, derived from historical trading multiples, past business growth, and future performance forecasts. More extensive data can be accessed on the Lennox International Inc (LII) Summary page.