Key Highlights:

- Williams-Sonoma (WSM, Financial) reports robust Q1 2025 performance with 3.4% same-store sales growth.

- Operating margin stands at a strong 16.8%, with EPS rising by 8.8% to $1.85.

- Analysts suggest a potential upside of 12.61% based on their average price target.

Williams-Sonoma's Impressive Q1 2025 Performance

Williams-Sonoma (WSM) has set a strong tone for the fiscal year with its first quarter of 2025 results. The company achieved a commendable 3.4% growth in same-store sales, showcasing effective operational strategies and market demand. This growth is coupled with an impressive operating margin of 16.8%, reflecting efficient cost management and strategic focus.

Earnings per share for the quarter climbed to $1.85, marking an 8.8% increase. This performance underscores Williams-Sonoma's commitment to enhancing shareholder value through ongoing strategic initiatives. The company remains committed to its fiscal 2025 guidance, anticipating stable revenue growth in the range of flat to 3% for the year.

Wall Street Analysts Forecast

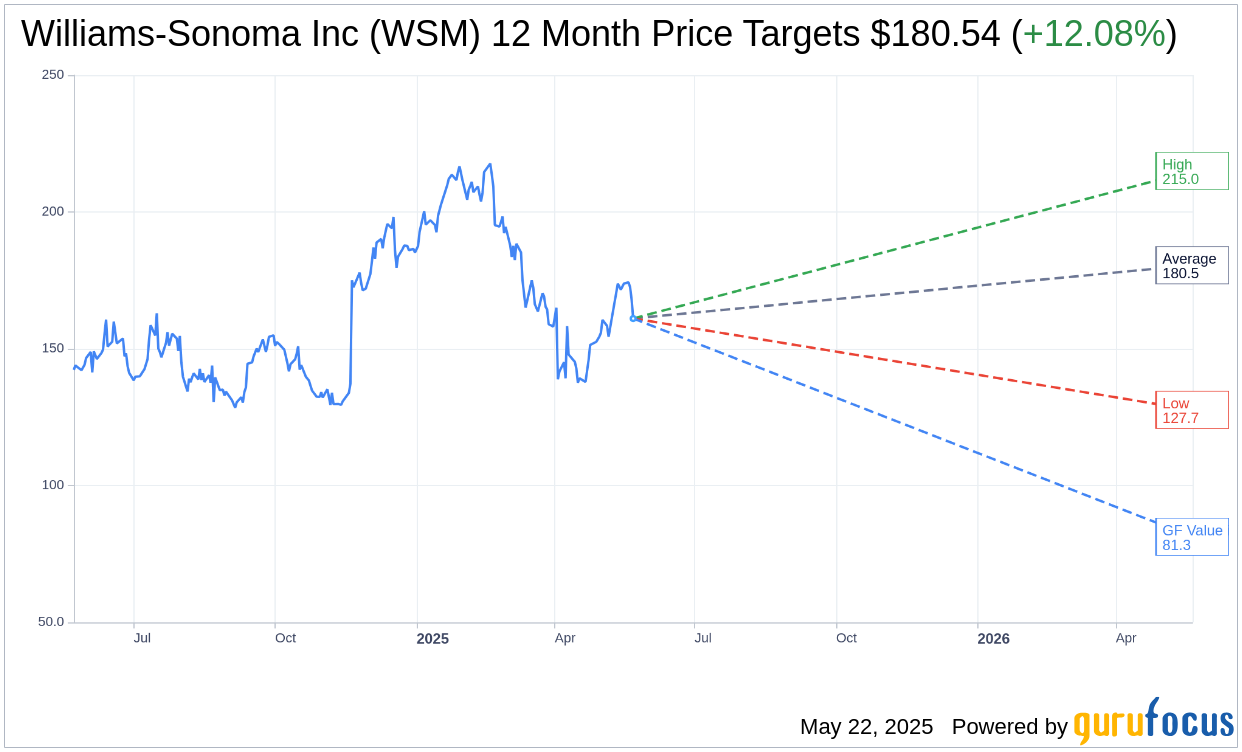

Looking forward, insights from 18 Wall Street analysts set the stage for potential growth. The one-year price targets for Williams-Sonoma Inc (WSM, Financial) average at $180.54, with projections ranging from a high of $215.00 to a low of $127.67. These estimates suggest a potential upside of 12.61% from its current trading price of $160.32. Investors can explore more detailed data on the Williams-Sonoma Inc (WSM) Forecast page.

Consensus from 24 brokerage firms currently rates Williams-Sonoma Inc (WSM, Financial) at an average recommendation of 2.6, which indicates a "Hold" status. The rating scale spans from 1, denoting Strong Buy, to 5, indicating Sell.

In terms of valuation, GuruFocus estimates the GF Value for Williams-Sonoma Inc (WSM, Financial) to be $81.29 in one year, suggesting a potential downside of 49.29% from the present price of $160.32. The GF Value metric is derived from historical trading multipliers, past business growth, and future business performance estimates. For a deeper dive, visit the Williams-Sonoma Inc (WSM) Summary page.