Key Highlights:

- Freight Technologies (FRGT, Financial) initiates a one-for-four reverse stock split.

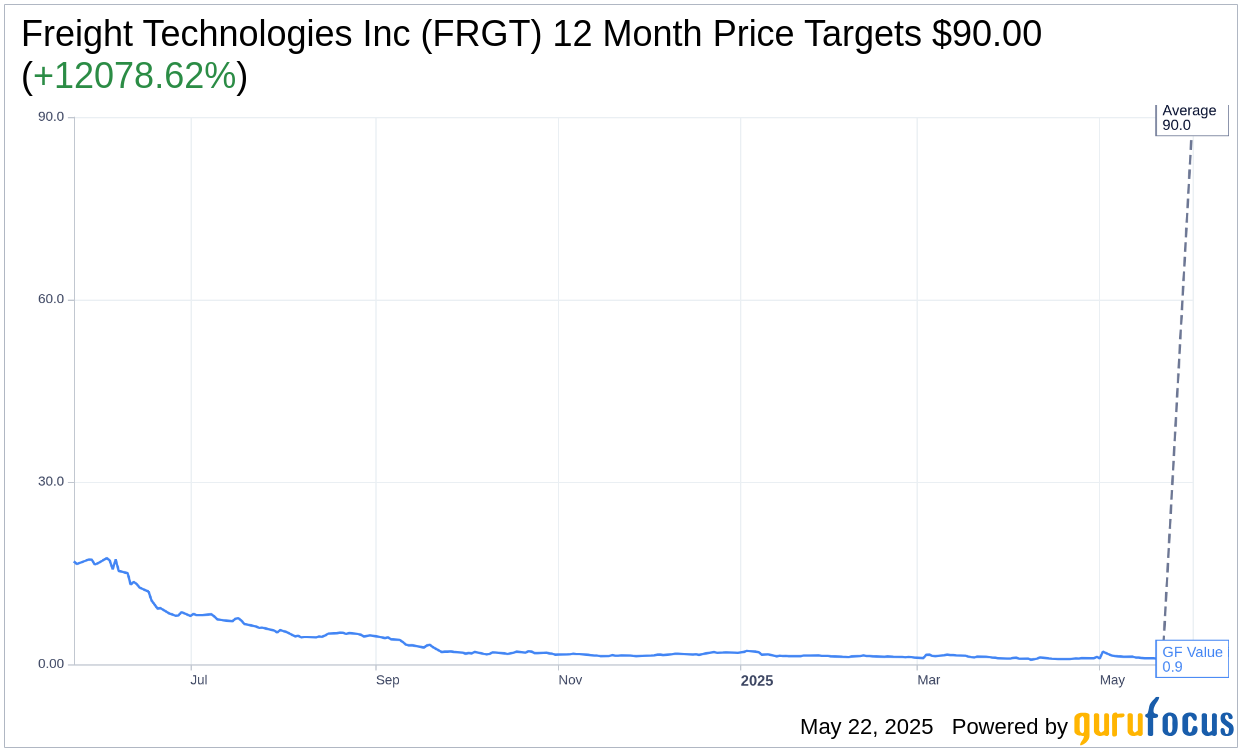

- Wall Street analysts project a substantial price target increase for FRGT.

- Freight Technologies' stock shows a significant potential upside according to GuruFocus metrics.

Freight Technologies' Strategic Move

Freight Technologies Inc. (FRGT) has announced a strategic financial adjustment through a one-for-four reverse stock split, effective May 27, 2025. This maneuver will effectively reduce the number of outstanding shares from 9.15 million to 2.29 million, while maintaining the current total of authorized shares. In response to this announcement, FRGT shares saw a significant drop of over 12% in premarket trading on Thursday, reflecting immediate market reactions.

Wall Street's Perspective

Wall Street analysts have provided a one-year price target for Freight Technologies Inc. (FRGT, Financial) with an average estimate of $90.00, a high estimate of $90.00, and a low estimate of $90.00. This average target price indicates a remarkable potential upside of 13,204.75% from the current trading price of $0.68. For more in-depth analysis and estimation data, investors can visit the Freight Technologies Inc (FRGT) Forecast page.

Moreover, according to the consensus recommendation from one brokerage firm, Freight Technologies Inc. currently holds an average brokerage recommendation of 2.0, corresponding to an "Outperform" status. This recommendation reflects a favorable outlook on the company's performance, considering a rating scale from 1 (Strong Buy) to 5 (Sell).

Evaluating GF Value and Potential Returns

GuruFocus provides a distinct metric called the GF Value, which estimates the fair value at which a stock should ideally trade. For Freight Technologies Inc. (FRGT, Financial), the estimated GF Value in one year is projected at $0.92. This estimation suggests a potential upside of 36% from the current price of $0.67645. The GF Value calculation considers historical trading multiples, past business growth, and future performance estimates. Investors interested in comprehensive data and insights can explore the Freight Technologies Inc (FRGT) Summary page.

This strategic initiative and optimistic projections offer a noteworthy consideration for investors evaluating their positions in Freight Technologies Inc., especially given the significant upsides indicated by both Wall Street and GuruFocus metrics.