On May 22, 2025, ePlus Inc (PLUS, Financial) released its 8-K filing detailing the financial results for the fourth quarter and fiscal year ending March 31, 2025. ePlus Inc, a holding company, provides information technology solutions through its subsidiaries, enabling organizations to optimize their IT environments and supply chain processes. The company offers consulting, professional and managed services, and lifecycle management services, including flexible financing solutions, primarily targeting medium and large enterprises in the United States and select international markets.

Fourth Quarter Highlights

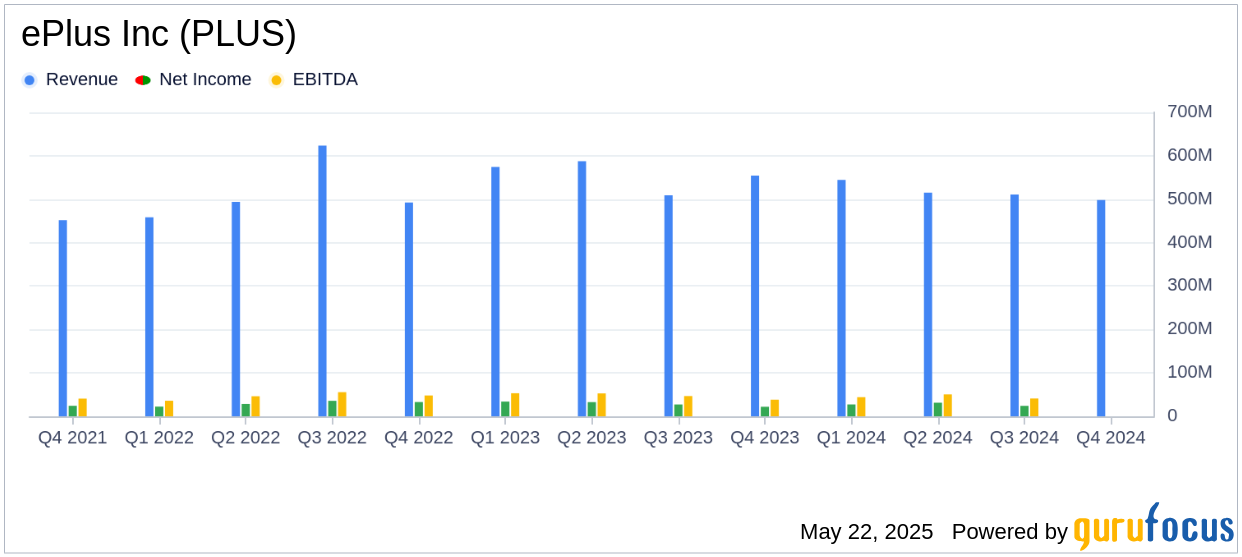

In the fourth quarter of fiscal year 2025, ePlus Inc reported a 10.2% decline in net sales to $498.1 million, compared to $554.5 million in the same quarter last year. Despite this, the company achieved a 14.6% increase in net earnings to $25.2 million. The diluted earnings per share (EPS) rose by 15.9% to $0.95, surpassing the analyst estimate of $0.68. Non-GAAP diluted EPS also increased by 19.4% to $1.11.

Consolidated gross profit improved by 11.8% to $145.8 million, with a gross margin of 29.3%, up from 23.5% in the previous year. This improvement was driven by a 33.0% increase in service revenues to $104.9 million, despite a 10.4% decline in technology business net sales to $487.2 million.

Fiscal Year 2025 Overview

For the full fiscal year 2025, ePlus Inc reported a 7.0% decrease in net sales to $2,068.8 million. Technology business net sales fell by 7.7% to $2,009.1 million, while service revenues surged by 37.1% to $400.4 million. The company's net earnings decreased by 6.7% to $108.0 million, and diluted EPS decreased by 6.5% to $4.05, exceeding the annual estimate of $3.78. Non-GAAP diluted EPS decreased by 5.1% to $4.67.

Consolidated gross profit for the year increased by 3.3% to $569.1 million, with a gross margin of 27.5%, compared to 24.8% in fiscal year 2024. The adjusted EBITDA decreased by 6.4% to $178.2 million.

Financial Achievements and Challenges

ePlus Inc's financial achievements in fiscal year 2025 include a significant increase in service revenues and gross margin expansion, which are crucial for a company in the technology solutions industry. The shift towards a services-led approach and the adoption of ratable and subscription revenue models have contributed to these improvements.

However, the company faced challenges with declining product sales, which impacted overall net sales. The acquisition of Bailiwick Services, LLC, while boosting professional service revenues, also led to a decline in gross margin due to a shift in the mix of services provided.

Balance Sheet and Cash Flow

As of March 31, 2025, ePlus Inc reported cash and cash equivalents of $389.4 million, up from $253.0 million the previous year. The increase in cash was partially offset by funds used for acquisitions and stock repurchases. Inventory levels decreased by 13.8% to $120.4 million, and accounts receivable-trade, net decreased by 19.8% to $517.1 million. Total stockholders' equity increased to $977.6 million from $901.8 million.

Management Commentary

“During the fourth quarter, we delivered double digit growth across several key metrics, including gross profit, net earnings and EPS,” commented Mark Marron, president and CEO of ePlus. “We are benefiting from evolving industry trends of increased ratable and subscription revenue models, which are driving a greater gross to net percentage and can provide long term visibility and profitability.”

Conclusion

ePlus Inc's performance in fiscal year 2025 highlights the company's ability to adapt to industry trends and capitalize on service revenue growth, despite challenges in product sales. The company's strategic focus on expanding its services portfolio and leveraging acquisitions positions it well for future growth in key areas such as AI, cybersecurity, and cloud services. As the company navigates economic uncertainties, its strong cash position and focus on strategic priorities are expected to support continued profitability and shareholder value.

Explore the complete 8-K earnings release (here) from ePlus Inc for further details.