Granite Construction (GVA, Financial) has secured a significant contract valued at around $26 million from San Francisco International Airport (SFO). The project involves upgrading Taxiway Z and part of Taxiway S at the airport in San Francisco, California. This upgrade, funded by SFO, will be incorporated into Granite's second-quarter Capital Allocation Plan (CAP).

The primary objective of this project is to enhance the taxiways to maintain the safety and operational efficiency of aircraft. Taxiway Z is crucial for aircraft movement, connecting terminals with maintenance and cargo areas. These improvements are expected to support the seamless operation of airport traffic, ensuring continued safety and efficiency for aircraft at one of the busiest airports in the region.

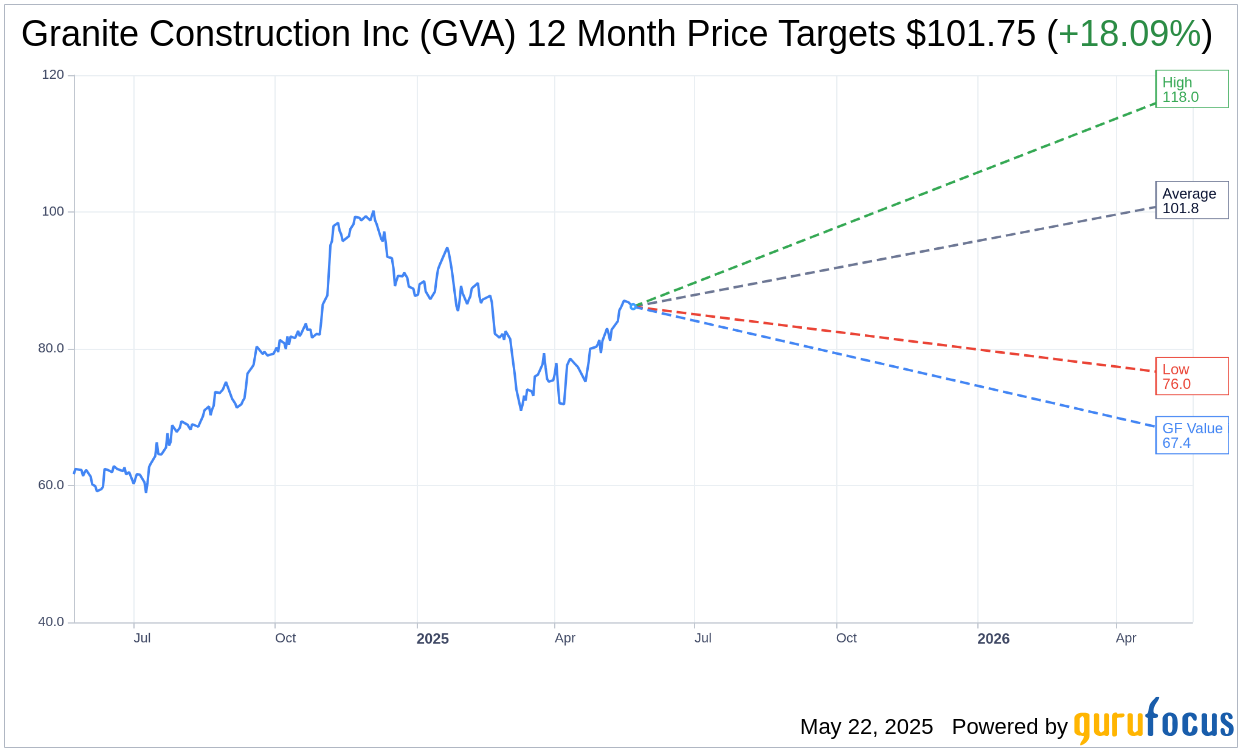

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Granite Construction Inc (GVA, Financial) is $101.75 with a high estimate of $118.00 and a low estimate of $76.00. The average target implies an upside of 18.09% from the current price of $86.16. More detailed estimate data can be found on the Granite Construction Inc (GVA) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Granite Construction Inc's (GVA, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Granite Construction Inc (GVA, Financial) in one year is $67.37, suggesting a downside of 21.81% from the current price of $86.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Granite Construction Inc (GVA) Summary page.

GVA Key Business Developments

Release Date: May 01, 2025

- Revenue Increase: $28 million or 4% increase in the first quarter.

- Gross Profit Increase: $30 million or 54% increase.

- Adjusted Net Income Improvement: $9 million improvement.

- Adjusted EBITDA Improvement: $14 million improvement.

- Operating Cash Flow: Positive $4 million.

- Construction Segment Revenue: $615 million, a $19 million or 3% increase year-over-year.

- Construction Segment Gross Profit: $85 million with a gross profit margin of 14%.

- Materials Segment Revenue: $85 million, an $8 million increase year-over-year.

- Materials Segment Gross Loss: Decreased by $1 million to a loss of $2 million.

- 2025 Revenue Guidance: $4.2 billion to $4.4 billion.

- Adjusted EBITDA Margin Guidance: 11% to 12%.

- Cash and Marketable Securities: $513 million as of the end of Q1.

- Debt: Largely unchanged at $740 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Granite Construction Inc (GVA, Financial) reported a strong start to 2025 with revenue increasing by $28 million or 4% and gross profit increasing by $30 million or 54%.

- The company confirmed its 2025 guidance and 2027 financial targets, indicating confidence in its future performance.

- Granite Construction Inc (GVA) has seen a record increase in its Committed and Awarded Projects (CAP) to $5.7 billion, reflecting a strong bidding environment.

- The Materials segment showed significant improvement with increased reserves and new plants, leading to margin improvements in aggregates and asphalt.

- The company is actively pursuing mergers and acquisitions to strengthen its market position, with a target of completing two to three deals in 2025.

Negative Points

- Granite Construction Inc (GVA) faces uncertainty in the macroeconomic environment, particularly concerning tariffs which could impact costs.

- Despite a strong start, the company experienced some project delays due to wet weather in March, affecting revenue recognition.

- The Materials segment reported a gross loss of $2 million, although this was an improvement from the previous year.

- The company is exposed to risks related to inflation and price increases in commodities like natural gas, diesel, and liquid asphalt.

- There is a potential risk of project disruptions due to changes in federal administration policies, although none have been experienced yet.