Regeneron (REGN, Financial) has shared preliminary outcomes from their Phase 1b LINKER-MM2 study, which investigates linvoseltamab paired with proteasome inhibitors, either carfilzomib or bortezomib, for patients with relapsed or refractory multiple myeloma. This trial targeted individuals who had undergone at least two prior therapies and were resistant to two or three drug classes. Notably, 48% of participants had soft tissue plasmacytomas at the start, and 39% were over 75 years old, indicating a high-risk group.

In patients receiving linvoseltamab with carfilzomib, 21 were assessed for effectiveness. Results indicated a 90% objective response rate, with 76% achieving complete responses over a median follow-up of 15 months. The one-year probability of maintaining response was projected at 87%, with progression-free survival expected at 83%. Plans for a Phase 3 trial comparing this combination to standard treatments are underway.

Safety evaluations involved 23 patients, revealing neutropenia, cytokine release syndrome, and thrombocytopenia as prevalent side effects. Serious adverse events occurred in 83% of participants, with 91% experiencing infections. Observations included a dose-limiting toxicity at the 100 mg level and mild neurotoxicity at 150 mg. These studies remain investigational without regulatory approval thus far.

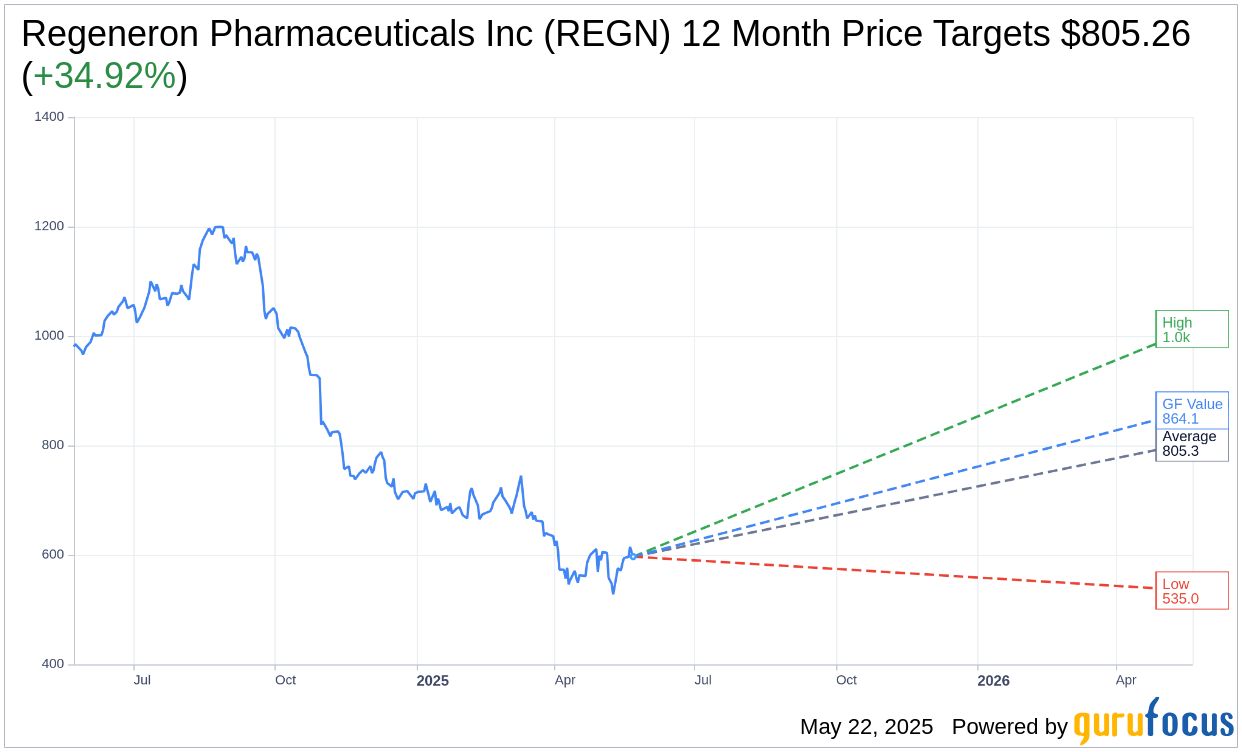

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for Regeneron Pharmaceuticals Inc (REGN, Financial) is $805.26 with a high estimate of $1,013.00 and a low estimate of $535.00. The average target implies an upside of 34.92% from the current price of $596.85. More detailed estimate data can be found on the Regeneron Pharmaceuticals Inc (REGN) Forecast page.

Based on the consensus recommendation from 28 brokerage firms, Regeneron Pharmaceuticals Inc's (REGN, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Regeneron Pharmaceuticals Inc (REGN, Financial) in one year is $864.11, suggesting a upside of 44.78% from the current price of $596.85. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Regeneron Pharmaceuticals Inc (REGN) Summary page.

REGN Key Business Developments

Release Date: April 29, 2025

- Total Revenue: $3 billion for Q1 2025.

- Net Income: $928 million for Q1 2025.

- Diluted EPS: $8.22 for Q1 2025.

- Sanofi Collaboration Revenue: Approximately $1.2 billion, with $1 billion related to collaboration profits.

- EYLEA US Net Sales: $736 million, down 39% year-over-year.

- EYLEA HD US Net Sales: $307 million, up 54% year-over-year.

- Dupixent Global Net Sales: $3.7 billion, up 20% year-over-year on a constant currency basis.

- Dupixent US Net Sales: $2.6 billion, up 19% year-over-year.

- Libtayo Global Net Sales: $285 million, up 8% year-over-year on a constant currency basis.

- Free Cash Flow: $816 million for Q1 2025.

- Cash and Marketable Securities: $17.6 billion as of the end of Q1 2025.

- Debt: Approximately $2.7 billion as of the end of Q1 2025.

- Gross Margin Guidance: Updated to 86% to 87% for 2025.

- Share Repurchases: Approximately $1.1 billion worth of shares repurchased in Q1 2025.

- Quarterly Dividend: $0.88 per share, with the next payment in June.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dupixent achieved a 20% year-over-year increase in global net sales, driven by strong demand across all approved indications.

- EYLEA HD sales grew by 54% year-over-year, maintaining its position as a leader in the anti-VEGF category.

- Regeneron Pharmaceuticals Inc (REGN, Financial) has a robust pipeline with approximately 45 product candidates in clinical development, including four regulatory approvals and nine regulatory submissions in 2025.

- Libtayo's US sales increased by 21% year-over-year, establishing it as a cornerstone therapy for advanced non-melanoma skin cancer.

- The company is making significant investments in R&D and manufacturing, with over $7 billion planned for US expansions to support growth and innovation.

Negative Points

- EYLEA US net sales declined by 39% compared to the first quarter of the previous year, impacted by increased competition and lower wholesaler inventory levels.

- The FDA issued a complete response letter for the EYLEA HD prefilled syringe, delaying its approval and impacting potential sales growth.

- Regeneron Pharmaceuticals Inc (REGN) faces challenges from increased use of low-cost off-label Avastin due to patient affordability issues.

- The company has experienced multiple complete response letters (CRLs) and regulatory delays, raising concerns about its regulatory performance.

- There is uncertainty regarding the reopening of foundation funding for patient assistance, which affects the affordability of EYLEA for some patients.