Compass Point has revised its rating for Radian Group (RDN, Financial), changing it from Buy to Neutral. Despite the downgrade, they have raised their price target for the company from $34 to $37. This adjustment suggests a more cautious outlook on RDN while acknowledging potential value increases from previous estimates.

Wall Street Analysts Forecast

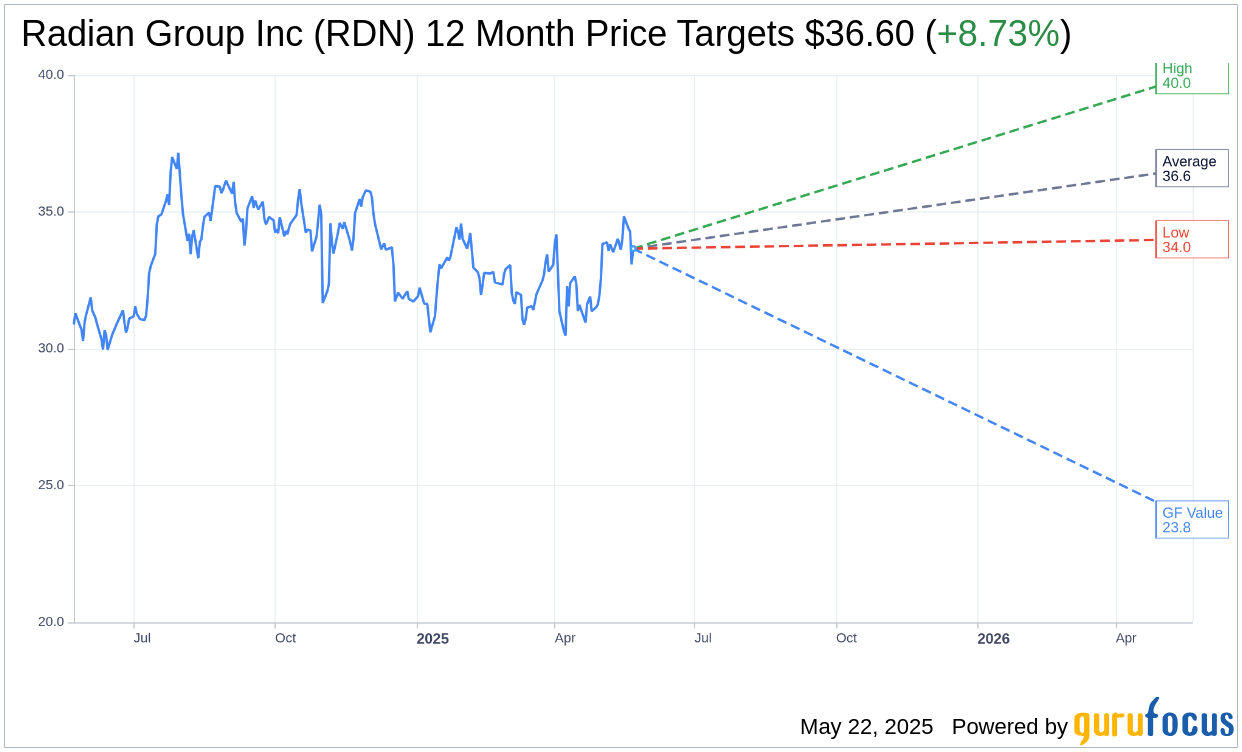

Based on the one-year price targets offered by 5 analysts, the average target price for Radian Group Inc (RDN, Financial) is $36.60 with a high estimate of $40.00 and a low estimate of $34.00. The average target implies an upside of 8.73% from the current price of $33.66. More detailed estimate data can be found on the Radian Group Inc (RDN) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Radian Group Inc's (RDN, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Radian Group Inc (RDN, Financial) in one year is $23.76, suggesting a downside of 29.41% from the current price of $33.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Radian Group Inc (RDN) Summary page.

RDN Key Business Developments

Release Date: May 01, 2025

- Net Income: $145 million in the first quarter.

- Return on Equity: 12.6% for the first quarter.

- Book Value Per Share: Increased 11% year-over-year to $32.48.

- Total Revenue: $318 million for the first quarter.

- Net Premiums Earned: $234 million in the first quarter.

- New Insurance Written: $9.5 billion in the first quarter.

- Persistency Rate: 86% in the first quarter.

- Investment Portfolio: $6.3 billion, generating $69 million in net investment income.

- Operating Expenses: $77 million, a 12% decrease from the prior quarter.

- Share Repurchases: $207 million, representing more than 4% of shares outstanding.

- Dividends Paid: $37 million during the quarter.

- Holding Company Liquidity: $834 million at the end of the first quarter.

- PMIERs Cushion: $2.1 billion for Radian Guaranty.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Radian Group Inc (RDN, Financial) reported a strong start to 2025 with a net income of $145 million and a return on equity of 12.6%.

- The company increased its book value per share by 11% year-over-year, reaching $32.48.

- Radian Group Inc (RDN) maintained a high persistency rate of 86%, benefiting from elevated interest rates.

- The company repurchased $207 million of shares, representing more than 4% of shares outstanding, demonstrating a commitment to returning capital to shareholders.

- Radian Group Inc (RDN) secured a multiyear quota share reinsurance arrangement with favorable terms, enhancing capital management and risk mitigation.

Negative Points

- The new insurance written in the first quarter of 2025 was lower compared to the fourth quarter of 2024 due to a smaller origination market.

- Net investment income declined compared to the prior quarter, primarily driven by lower mortgage loans held for sale.

- The company reported an unrealized net loss on investments of $295 million at quarter end.

- Operating expenses, while reduced, can fluctuate due to variable incentive compensation and strategic growth initiatives.

- Radian Group Inc (RDN) continues to monitor the impact of financial market volatility and global trade policy uncertainties on its business.