- FTC halts opposition to Microsoft's $68.7 billion acquisition of Activision Blizzard, signaling a strategic triumph for Microsoft.

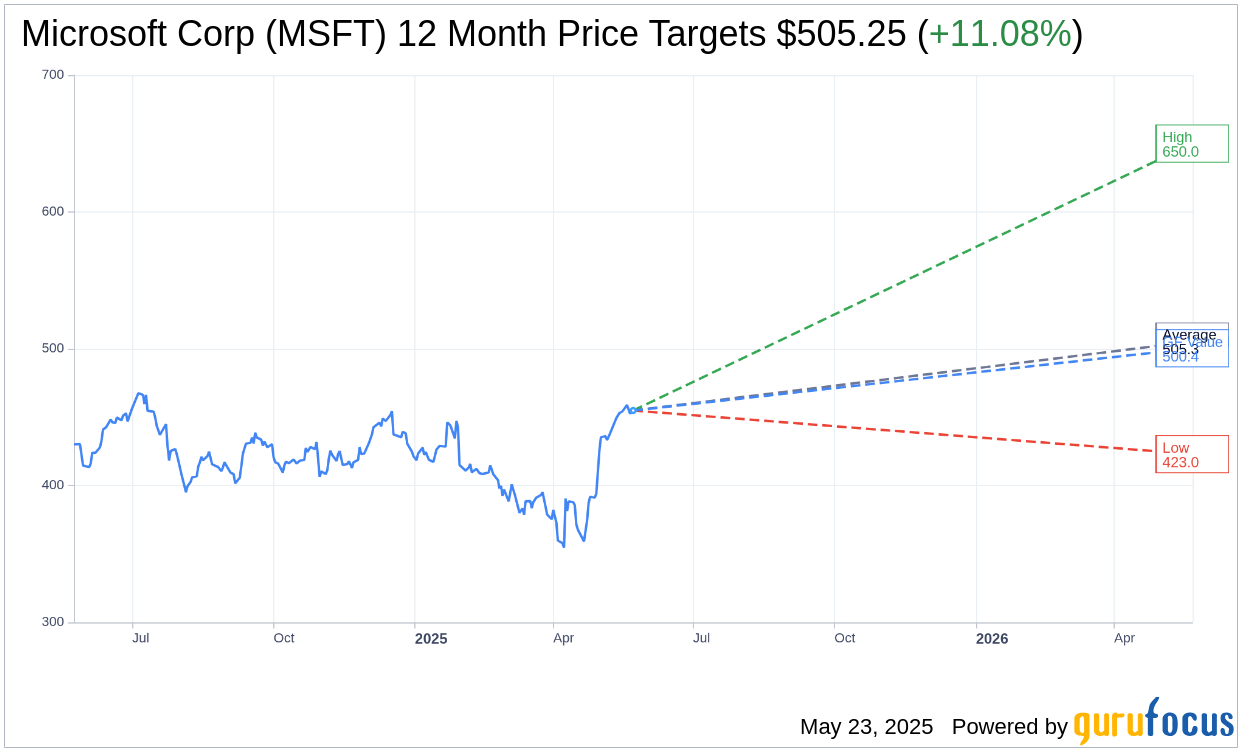

- Wall Street analysts project an average target price suggesting an 11.08% upside for Microsoft shares.

- Microsoft receives an "Outperform" average brokerage recommendation, indicating positive analyst sentiment.

The Federal Trade Commission (FTC) has officially ceased its attempts to obstruct Microsoft's (MSFT, Financial) ambitious $68.7 billion acquisition of Activision Blizzard. This pivotal development comes on the heels of a failed appeal to halt the groundbreaking deal. Microsoft's successful navigation through significant legal hurdles marks a notable strategic victory for the tech behemoth, positioning it favorably in the gaming industry.

Wall Street Analysts' Forecast

Investors are keeping a close watch on Microsoft Corp (MSFT, Financial) as Wall Street analysts have set a one-year average target price of $505.25. This forecast includes a range from a high estimate of $650.00 to a low of $423.00, suggesting a potential upside of 11.08% from the current trading price of $454.86. For further detailed estimates, visit the Microsoft Corp (MSFT) Forecast page.

Analyst Recommendations

In terms of analyst sentiment, Microsoft Corp (MSFT, Financial) garners an impressive average brokerage recommendation of 1.8, which correlates with an "Outperform" status. The recommendation scale spans from 1, representing a Strong Buy, to 5, indicating a Sell. This favorable rating underscores the optimistic outlook many brokerage firms hold for Microsoft’s future performance.

GuruFocus GF Value Estimate

According to GuruFocus estimates, Microsoft Corp’s (MSFT, Financial) projected GF Value one year from now stands at $500.36, implying a 10% upside from its current price of $454.86. The GF Value is an insightful metric, representing the fair value at which the stock should ideally trade. It is derived from historical trading multiples, previous business growth, and future performance estimates. For additional insights, explore the Microsoft Corp (MSFT) Summary page.