JPMorgan has revised its price target for Copart (CPRT, Financial) from $60 to $55 while maintaining a Neutral stance on the stock. The adjustment follows the company's fiscal third-quarter results, which did not meet expectations due to weaker volume performance. The analyst expresses concerns about potential risks to Copart's high valuation in light of these results.

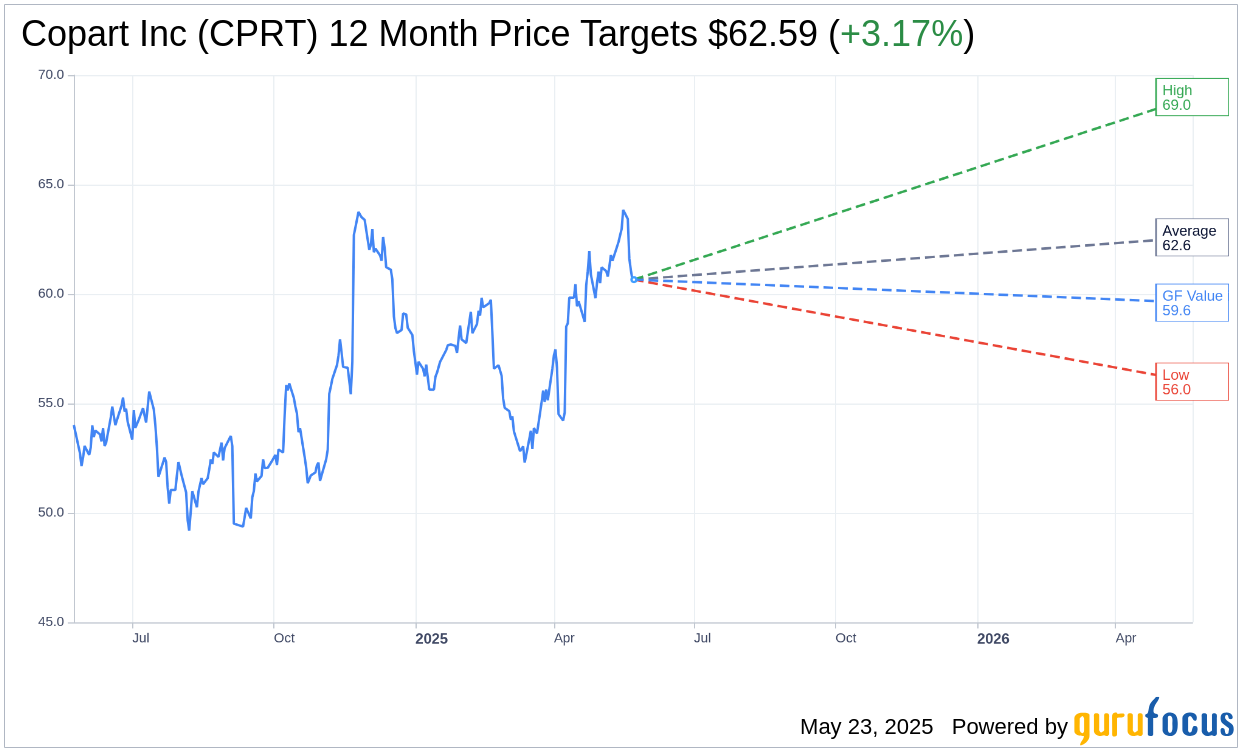

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Copart Inc (CPRT, Financial) is $62.59 with a high estimate of $69.00 and a low estimate of $56.00. The average target implies an upside of 3.17% from the current price of $60.66. More detailed estimate data can be found on the Copart Inc (CPRT) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Copart Inc's (CPRT, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Copart Inc (CPRT, Financial) in one year is $59.61, suggesting a downside of 1.73% from the current price of $60.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Copart Inc (CPRT) Summary page.

CPRT Key Business Developments

Release Date: May 22, 2025

- Global Revenue: Increased to $1.2 billion.

- Global Service Revenue: Increased by nearly $88 million or over 9% from the third quarter of '24.

- US Service Revenue Growth: 8% for the quarter, 7% excluding CAT units.

- International Service Revenue Growth: Approximately 18%.

- Global Purchased Vehicle Sales: Decreased approximately 2%.

- US Purchased Vehicle Revenue: Increased by about $20 million or 22%.

- US Purchased Vehicle Gross Profit: Decreased by $13 million or about 187%.

- International Purchased Vehicle Revenue: Decreased by over $23 million or 25%.

- International Purchased Vehicle Gross Profit: Increased by over $2 million or about 22%.

- Global Gross Profit: Approximately $552 million, an increase of $27 million or about 5%.

- Gross Margin Percentage: 46% for the quarter.

- US Gross Profit: Approximately $480 million, an increase of about 3%.

- US Gross Margin: About 48% for the quarter.

- International Gross Profit: Approximately $73 million, an increase of about 26%.

- International Gross Margin: About 35% in the quarter.

- GAAP Operating Income: Increased over 3% to approximately $452 million.

- GAAP Net Income: Increased by over 6% to $407 million or $0.42 per diluted common share.

- Liquidity: Over $5.6 billion, including nearly $4.4 billion in cash.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Copart Inc (CPRT, Financial) reported a global revenue increase to $1.2 billion, with global service revenue rising over 9% from the previous year.

- The company observed a 1% increase in global unit sales, with a more than 2% increase on a per business day basis.

- Copart Inc (CPRT) continues to invest in real estate, infrastructure, technology, and operational readiness, exemplified by the acquisition of Hall Ranch in South Florida for vehicle storage.

- The company's Blue Car service, which caters to bank, rental, and fleet partners, showed strong year-over-year growth of almost 14%.

- International segment unit sales grew by 6%, with fee units increasing by 9%, indicating strong performance outside the US market.

Negative Points

- Global insurance volume remained relatively flat year-over-year, with a nominal decline of 0.3% globally and 0.9% in the United States.

- US insurance unit volume decreased close to 1% year-over-year, reflecting challenges in the domestic insurance market.

- The company observed softness in the heavy equipment auction space due to uncertainty regarding infrastructure spending and tariffs.

- Global purchased vehicle sales for the third quarter decreased by approximately 2%, with a decrease in global purchased vehicle gross profit.

- The company faces cyclical challenges with an increasing rate of uninsured and underinsured drivers, impacting insurance volumes.