BTIG has adjusted its price target for Chefs’ Warehouse (CHEF, Financial), elevating it from $68 to $74, while maintaining a Buy rating on the stock. This decision follows a meeting with the company's management, where confidence was expressed in the continuation of strong Q1 sales into Q2. The firm regards the fiscal year 2025 outlook as not only achievable but potentially conservative, considering the ongoing robust sales trends.

Chefs’ Warehouse is expected to reap benefits from its post-pandemic investments, which are projected to fuel several years of sales growth and improve profit margins without requiring any acquisitions.

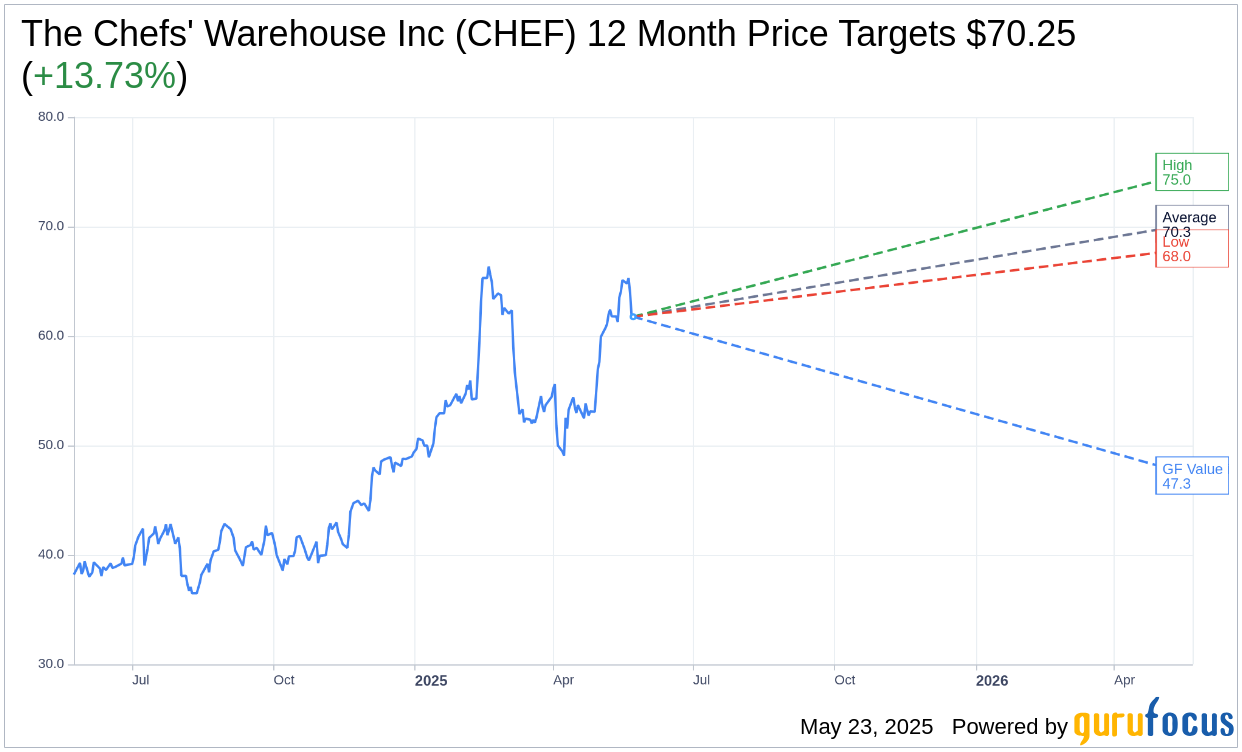

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for The Chefs' Warehouse Inc (CHEF, Financial) is $70.25 with a high estimate of $75.00 and a low estimate of $68.00. The average target implies an upside of 13.73% from the current price of $61.77. More detailed estimate data can be found on the The Chefs' Warehouse Inc (CHEF) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, The Chefs' Warehouse Inc's (CHEF, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Chefs' Warehouse Inc (CHEF, Financial) in one year is $47.26, suggesting a downside of 23.49% from the current price of $61.77. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Chefs' Warehouse Inc (CHEF) Summary page.

CHEF Key Business Developments

Release Date: April 30, 2025

- Net Sales: Increased 8.7% to $950.7 million from $874.5 million in Q1 2024.

- Specialty Sales Growth: Up 10.7% year-over-year.

- Gross Profit: Increased 7.9% to $226 million from $209.4 million in Q1 2024.

- Gross Profit Margin: Decreased by 18 basis points to 23.8%.

- Operating Income: Increased to $22.7 million from $16 million in Q1 2024.

- Net Income: $10.3 million or $0.25 per diluted share, up from $1.9 million or $0.05 per diluted share in Q1 2024.

- Adjusted EBITDA: $47.5 million, up from $40.2 million in Q1 2024.

- Total Liquidity: $278.9 million, including $116.5 million in cash.

- Net Debt: Approximately $535.2 million with a net debt to adjusted EBITDA ratio of 2.4 times.

- Full Year 2025 Guidance: Net sales estimated between $3.96 billion and $4.04 billion; gross profit between $954 million and $976 million; adjusted EBITDA between $234 million and $246 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Chefs' Warehouse Inc (CHEF, Financial) reported an 8.7% increase in net sales for the first quarter of 2025, reaching $950.7 million.

- Specialty sales grew by 10.7% over the prior year, driven by unique customer growth and increased placement and specialty case growth.

- The company achieved a 7.9% increase in gross profit to $226 million compared to the first quarter of 2024.

- Digital platform adoption is improving, with 58% of customers ordering online through domestic specialty locations, up from 56% at the end of 2024.

- The Chefs' Warehouse Inc (CHEF) maintained strong liquidity with $278.9 million, including $116.5 million in cash and $162.4 million available under its ABL facility.

Negative Points

- Gross profit margins decreased by approximately 18 basis points to 23.8% compared to the previous year.

- The company experienced a 0.7% reduction in year-over-year sales due to the attrition of certain low-margin noncore customer business.

- Center-of-the-plate category gross margins decreased by approximately 83 basis points year-over-year.

- Selling, general, and administrative expenses increased by 6.5% to $202.8 million, driven by higher costs associated with compensation, benefits, and facility investments.

- The company faces ongoing risks and uncertainties related to tariffs and input costs, which could impact future financial performance.