Frontline (FRO, Financial) announced its financial results for the first quarter, reporting a revenue of $247.9 million. This figure represents a decrease compared to the $252.2 million registered in the same period last year.

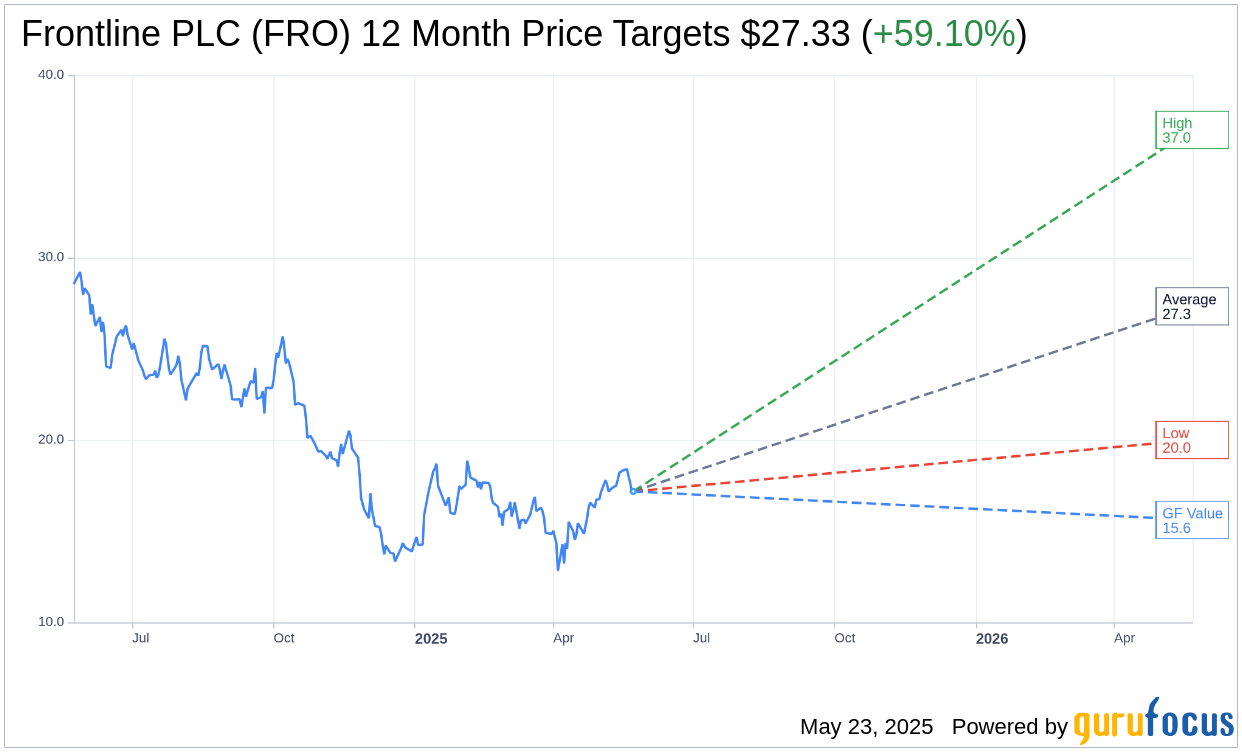

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Frontline PLC (FRO, Financial) is $27.33 with a high estimate of $37.00 and a low estimate of $20.00. The average target implies an upside of 59.10% from the current price of $17.18. More detailed estimate data can be found on the Frontline PLC (FRO) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Frontline PLC's (FRO, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Frontline PLC (FRO, Financial) in one year is $15.62, suggesting a downside of 9.08% from the current price of $17.18. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Frontline PLC (FRO) Summary page.

FRO Key Business Developments

Release Date: February 28, 2025

- VLCC TCE Rates (Q4 2024): $35,900 per day.

- Suezmax TCE Rates (Q4 2024): $33,400 per day.

- LR2/Aframax TCE Rates (Q4 2024): $26,100 per day.

- Profit (Q4 2024): $66.7 million or $0.30 per share.

- Adjusted Profit (Q4 2024): $45.1 million or $0.20 per share.

- Cash and Cash Equivalents: $693 million.

- Fleet Composition: 41 VLCCs, 22 Suezmax tankers, 18 LR2 tankers.

- Average Fleet Age: 6.6 years.

- OpEx (Q4 2024): $7,600 per day for VLCCs, $9,100 per day for Suezmax, $7,600 per day for LR2.

- Cash Generation Potential: $447 million or $2.01 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Frontline PLC (FRO, Financial) achieved strong TCE rates in Q4 2024, with $35,900 per day for VLCCs, $33,400 per day for Suezmax, and $26,100 per day for LR2/Aframax fleets.

- The company reported a solid profit of $66.7 million for the quarter, translating to $0.30 per share.

- Frontline PLC (FRO) maintains a strong liquidity position with $693 million in cash and cash equivalents.

- The fleet is modern, with an average age of 6.6 years, and 99% of vessels are ECO-friendly, with 56% scrubber-fitted.

- The tanker fleet growth is expected to remain muted, which could support higher rates in the future due to limited supply.

Negative Points

- Adjusted profit decreased by $30 million compared to the previous quarter, primarily due to lower TCE earnings.

- Global oil exports were down 700,000 barrels per day in Q4 2024 compared to the previous year, impacting tanker rates.

- The geopolitical landscape, including sanctions and tariffs, creates uncertainty and complicates market dynamics.

- The average fleet age for tankers is at its highest since 2001, indicating potential future replacement needs.

- Frontline PLC (FRO) faces challenges in ordering new vessels due to high newbuilding prices and geopolitical uncertainties affecting shipyard operations.