Interactive Strength (TRNR, Financial) has released a shareholder update, featuring a comprehensive Q&A session with its Founder and CEO, Trent Ward, alongside Wattbike CEO Stephen Loftus. The discussion, which is accessible on the company's investor website, sheds light on the integration advancements between TRNR and Wattbike. It also elaborates on strategies for collaborative market entry in both the UK and US markets.

The dialogue highlights the synergistic benefits in technology and data that these partnerships bring to TRNR. Additionally, there is a focus on multi-channel sales strategies, including operations on platforms like Amazon. According to Mr. Ward, with the formalization of recent strategic acquisitions, investors should remain assured of TRNR's growth trajectory and potential success. The update underscores several initiatives across the partnered companies aimed at enhancing shareholder value.

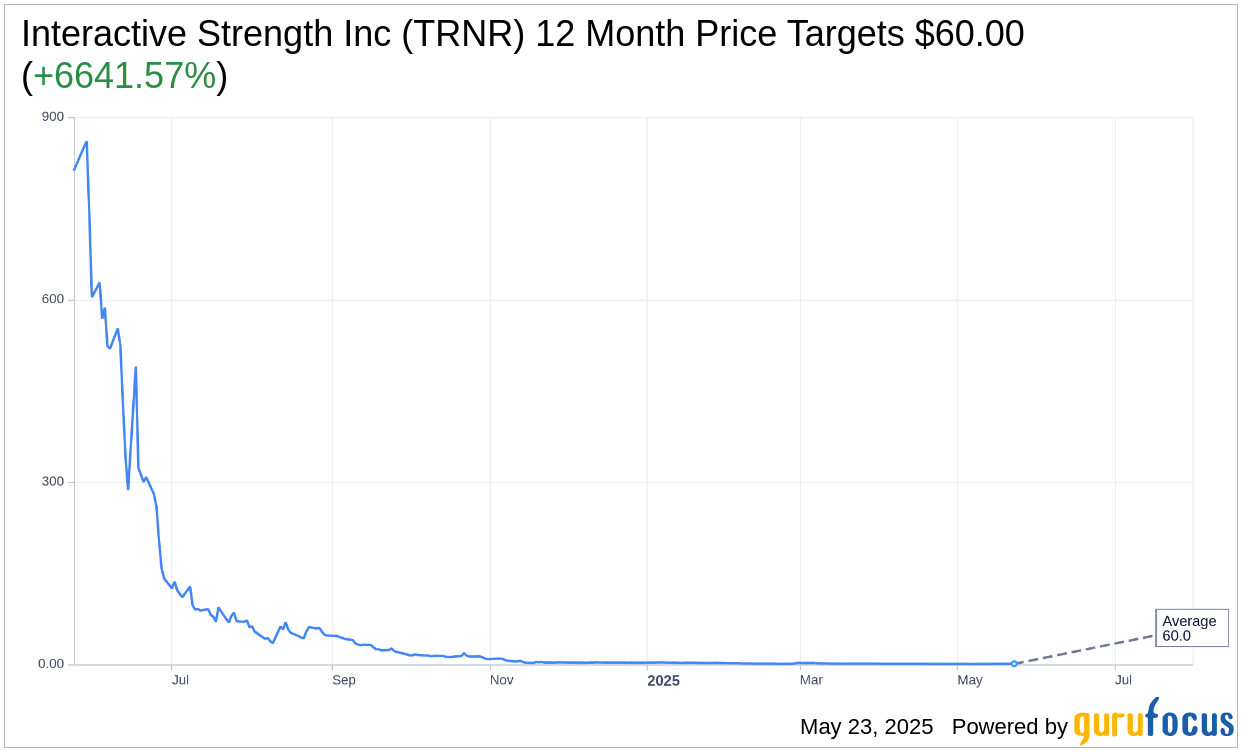

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Interactive Strength Inc (TRNR, Financial) is $60.00 with a high estimate of $60.00 and a low estimate of $60.00. The average target implies an upside of 6,641.57% from the current price of $0.89. More detailed estimate data can be found on the Interactive Strength Inc (TRNR) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Interactive Strength Inc's (TRNR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.