Autolus Therapeutics (AUTL, Financial) has received a significant endorsement from the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency. The committee has recommended the European Commission approve obecabtagene autoleucel, known as obe-cel, for treating adults aged 26 and over who have relapsed or refractory B-cell precursor acute lymphoblastic leukemia. This development marks another step forward for Autolus, following the U.S. FDA's approval in November 2024 and the UK's MHRA granting conditional marketing authorization in April 2025. The company aims to make this critical therapy available to patients worldwide, addressing a significant need for effective treatments in this area.

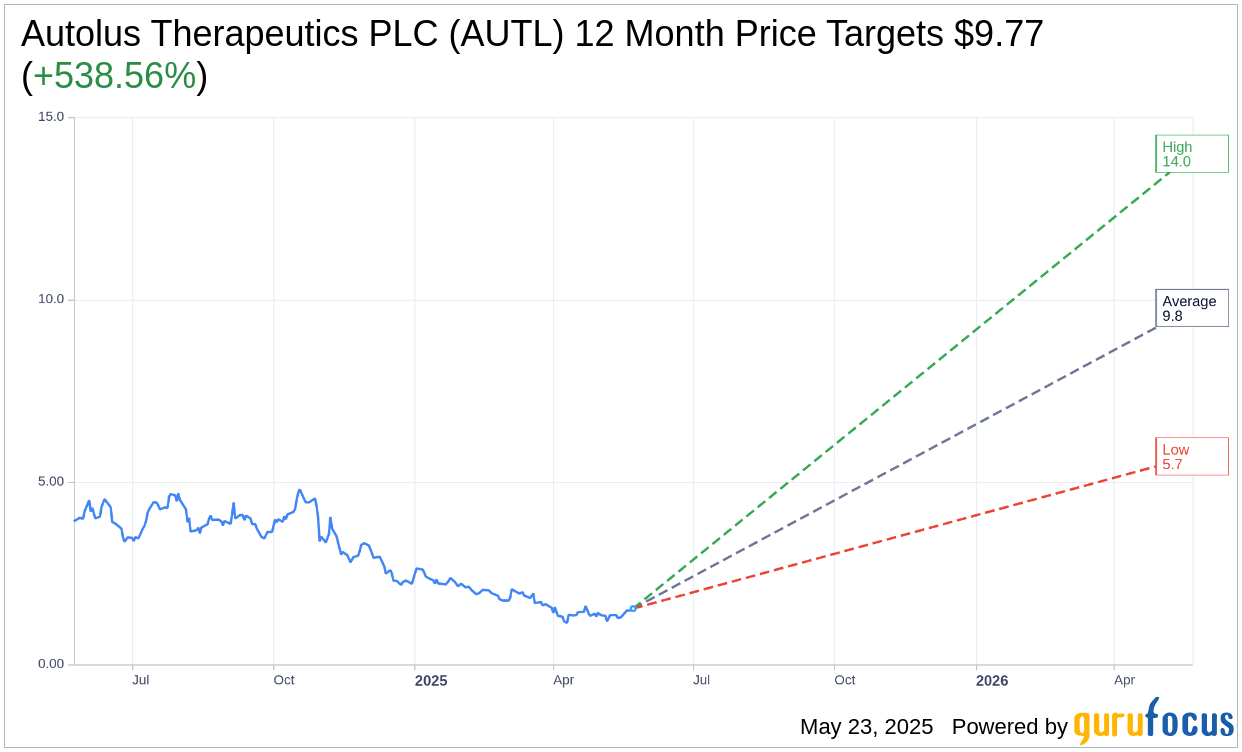

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Autolus Therapeutics PLC (AUTL, Financial) is $9.77 with a high estimate of $14.00 and a low estimate of $5.70. The average target implies an upside of 538.56% from the current price of $1.53. More detailed estimate data can be found on the Autolus Therapeutics PLC (AUTL) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Autolus Therapeutics PLC's (AUTL, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Autolus Therapeutics PLC (AUTL, Financial) in one year is $3.12, suggesting a upside of 103.92% from the current price of $1.53. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Autolus Therapeutics PLC (AUTL) Summary page.

AUTL Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Autolus Therapeutics PLC (AUTL, Financial) reported $9 million in recognized revenue for Q1 2025, indicating a strong start to the US launch of their product, Okasso.

- The company has achieved 90% coverage of total US medical lives, with 39 centers authorized to deliver Okasso, showcasing effective market access and onboarding efforts.

- Autolus Therapeutics PLC (AUTL) received conditional marketing authorization from the MHRA in the UK, with plans to engage with NICE for reimbursement and access processes.

- The company is planning to expand the number of centers delivering Okasso from 39 to approximately 60 by year-end, aiming for 90% patient access across the US.

- Autolus Therapeutics PLC (AUTL) has a strong cash position of $516.6 million at the end of Q1 2025, supporting their ongoing commercialization and clinical trial activities.

Negative Points

- The cost of sales for Q1 2025 was $18 million, exceeding the recognized revenue, indicating high initial costs associated with product delivery and manufacturing.

- The company reported a net loss of $70.2 million for Q1 2025, an increase from $52.7 million in the same period in 2024, highlighting ongoing financial challenges.

- Selling, general, and administrative expenses increased significantly to $29.5 million in Q1 2025 from $18.2 million in the same period in 2024, driven by increased headcount for US commercialization.

- There is uncertainty regarding the impact of the April 1st CMS coding update on revenue recognition, which could affect future financial reporting.

- The company faces potential challenges with tariffs and regulatory changes, which could impact their operations and market access strategies.