Jefferies has increased its price target for Ralph Lauren (RL, Financial) to $328, up from the previous target of $250, while maintaining a Buy rating on the stock. The decision follows Ralph Lauren's impressive fourth-quarter results, which demonstrated sustained brand strength. Despite these positive developments, the analyst notes that the company's fiscal year outlook appears conservative, taking into account potential challenges such as tariffs, price sensitivity, and consumer spending slowdowns. The analyst also believes that the stock's higher price-to-earnings ratio is warranted given these factors.

Wall Street Analysts Forecast

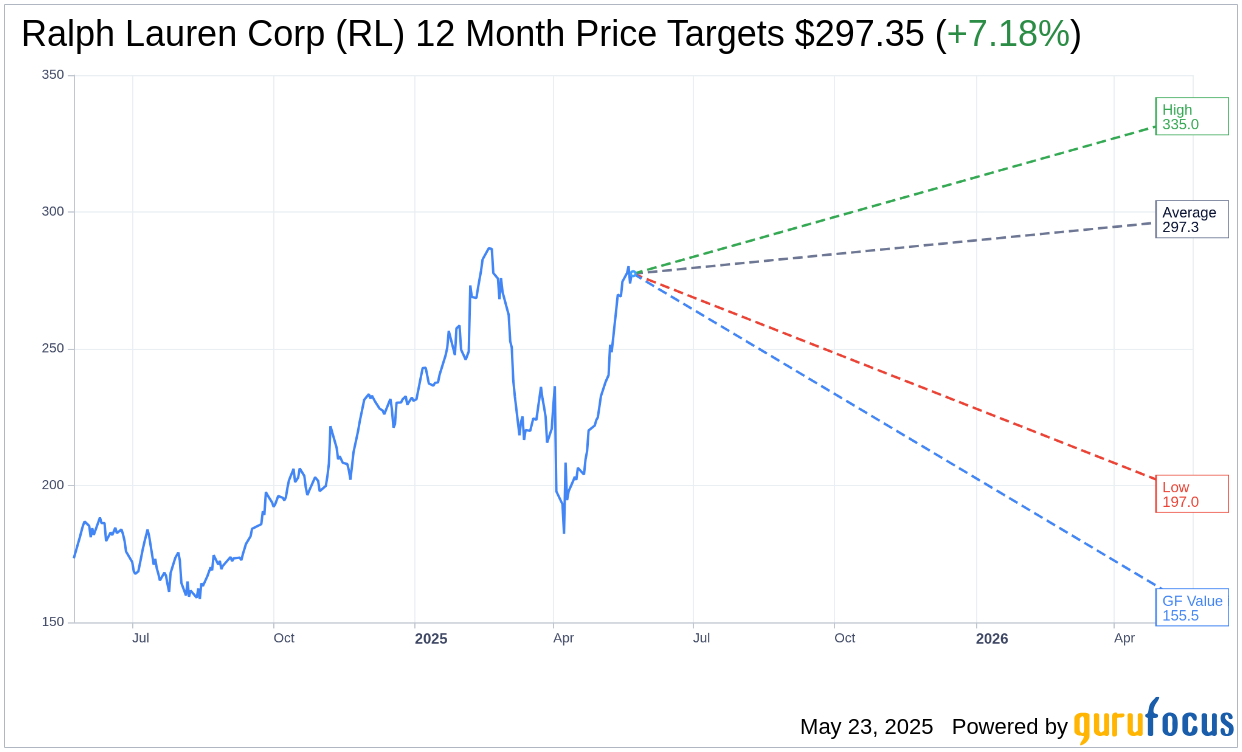

Based on the one-year price targets offered by 15 analysts, the average target price for Ralph Lauren Corp (RL, Financial) is $297.35 with a high estimate of $335.00 and a low estimate of $197.00. The average target implies an upside of 7.18% from the current price of $277.42. More detailed estimate data can be found on the Ralph Lauren Corp (RL) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Ralph Lauren Corp's (RL, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ralph Lauren Corp (RL, Financial) in one year is $155.51, suggesting a downside of 43.94% from the current price of $277.42. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ralph Lauren Corp (RL) Summary page.

RL Key Business Developments

Release Date: May 22, 2025

- Revenue Growth: 10% increase in Q4, exceeding the 6% to 7% outlook.

- Full Year Revenue Growth: 8% increase, with record revenues in Europe and Asia.

- Adjusted Operating Profit Growth: 24% increase for the full year.

- Free Cash Flow: $1 billion generated, with $625 million returned to shareholders.

- Adjusted Gross Margin: Expanded 260 basis points to 69.2% in Q4.

- Adjusted Operating Margin: Expanded 240 basis points to 11.1% in Q4.

- Comp Sales Growth: 13% increase in Q4, with strong growth in digital and brick-and-mortar stores.

- North America Revenue Growth: 6% increase in Q4.

- Europe Revenue Growth: 16% increase in Q4.

- Asia Revenue Growth: 13% increase in Q4.

- Net Inventory: Up 5% year-over-year.

- Store Openings: 83 new own and partner stores opened, focused largely in Asia.

- Annual Dividend Increase: 10% increase authorized by the Board of Directors.

- Share Repurchase Authorization: Additional $1.5 billion authorized for share repurchases.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ralph Lauren Corp (RL, Financial) reported fourth-quarter results that exceeded expectations on both the top and bottom line, with 10% revenue growth driven by strong performance across all geographies and channels.

- The company achieved 8% top-line growth for the full year, including record revenues for its international businesses in Europe and Asia, which now comprise the majority of total company revenues.

- Adjusted operating profits grew 24%, surpassing expectations, even as the company invested in long-term strategic priorities and shareholder returns.

- Ralph Lauren Corp (RL) added a record 5.9 million new consumers to its direct-to-consumer businesses, with a high single-digit increase from the previous year, led by younger, female, and less price-sensitive cohorts.

- The company increased its social media followers by low double digits, surpassing 65 million, driven by platforms like Li, threads, WeChat, Doyin, and TikTok.

Negative Points

- The global operating environment has become more challenging with uncertainty around tariffs and broader consumer behavior, impacting future growth projections.

- Despite strong performance, Ralph Lauren Corp (RL) remains cautious about the second half of fiscal '26 due to potential macroeconomic challenges, particularly in North America.

- The company plans to exit about 90 department store doors in fiscal '26, which could impact its wholesale revenue growth.

- Tariffs and inflationary pressures are expected to be headwinds, particularly affecting gross margins in the second half of the year.

- Ralph Lauren Corp (RL) anticipates a more uncertain global operating environment, with potential impacts from tariffs, weakening consumer confidence in the US, and increased risk of a broader consumer pullback.