Key Takeaways:

- Luminar Technologies repurchased $50 million of convertible senior notes, reducing outstanding notes to $135 million.

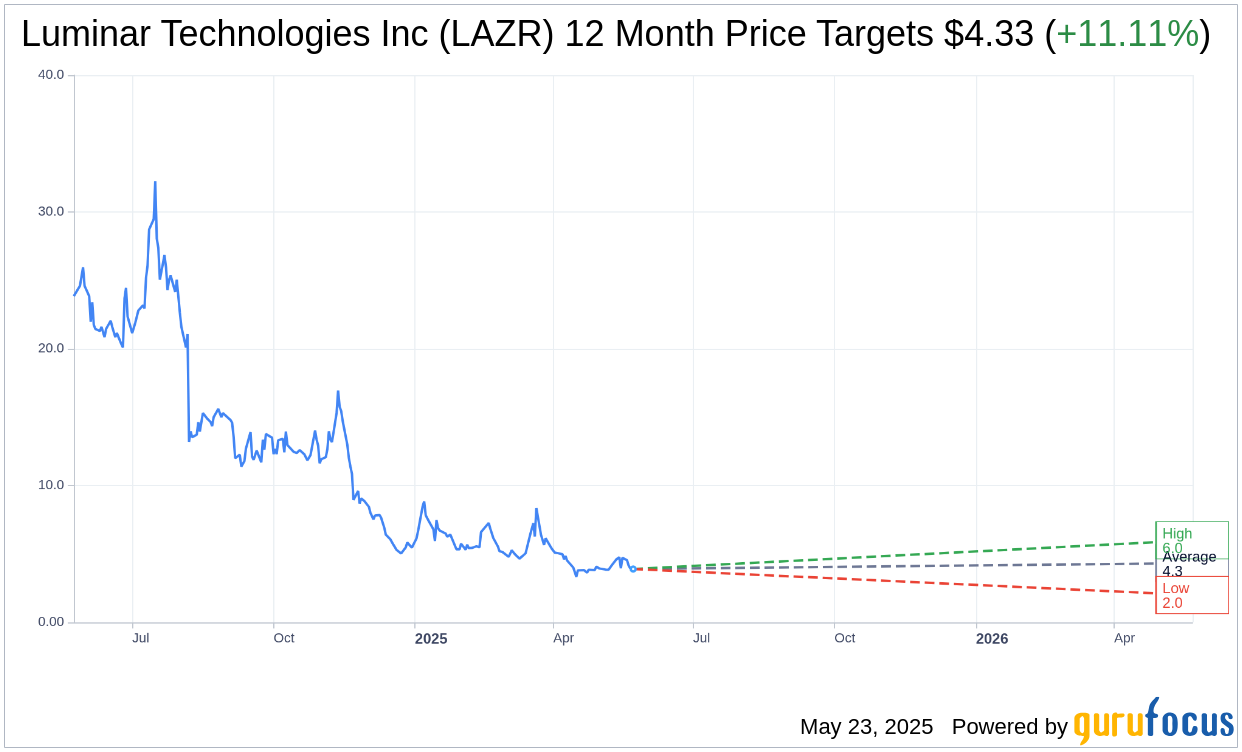

- Analyst consensus sets a moderate upside potential of 11.11% over the current stock price.

- GuruFocus estimates a significant potential upside based on the GF Value model.

Strategic Financial Moves by Luminar Technologies

Luminar Technologies (LAZR, Financial) has strategically repurchased $50 million worth of its 1.25% convertible senior notes due 2026. This recent move was financed with approximately $30 million in cash along with 1.1 million newly issued shares. Consequently, the outstanding principal balance of these notes now stands at about $135 million, reflecting a prudent approach to managing the company's debt and equity structure.

Wall Street Analysts' Forecasts

According to projections from three analysts, the average one-year target price for Luminar Technologies Inc (LAZR, Financial) is set at $4.33. This is accompanied by a high prediction of $6.00 and a low of $2.00, illustrating diverse perspectives on the stock's potential trajectory. The current market price of $3.90 positions the stock for a potential upside of 11.11%. For more in-depth analysis, visit the Luminar Technologies Inc (LAZR) Forecast page.

Brokerage Recommendations and Ratings

Among four brokerage firms, the consensus recommendation for Luminar Technologies Inc (LAZR, Financial) stands at 3.3, signifying a "Hold" position. The rating scale ranges from 1 (Strong Buy) to 5 (Sell), offering investors a snapshot of market sentiment concerning the stock.

GF Value Insights

GuruFocus projects a GF Value for Luminar Technologies Inc (LAZR, Financial) at $53.62 for the upcoming year, implying a staggering potential upside of 1274.87% from the current price of $3.90. The GF Value is calculated considering the stock's historical trading multiples, past growth metrics, and future business expectations. For a comprehensive overview, explore the Luminar Technologies Inc (LAZR) Summary page.

By staying informed on these financial developments and leveraging analyst insights, investors can better navigate Luminar Technologies' market potential within their portfolio strategies.