Craig-Hallum has initiated coverage on Life Time Group (LTH, Financial) with a positive "Buy" rating, setting their price target at $45. The investment firm expresses strong confidence in LTH despite a recent 12.5% decline in its stock value. This drop followed a robust first-quarter performance and was attributed to market overreactions to management's comments on membership trends in April and May, as well as plans for unit expansion in 2026.

Craig-Hallum anticipates that Life Time Group will benefit significantly from enduring trends in consumer wellness. They maintain a conservative stance on the company's forecasts for 2025 and 2026, suggesting potential future growth. Overall, the firm views LTH as well-positioned in the evolving market landscape.

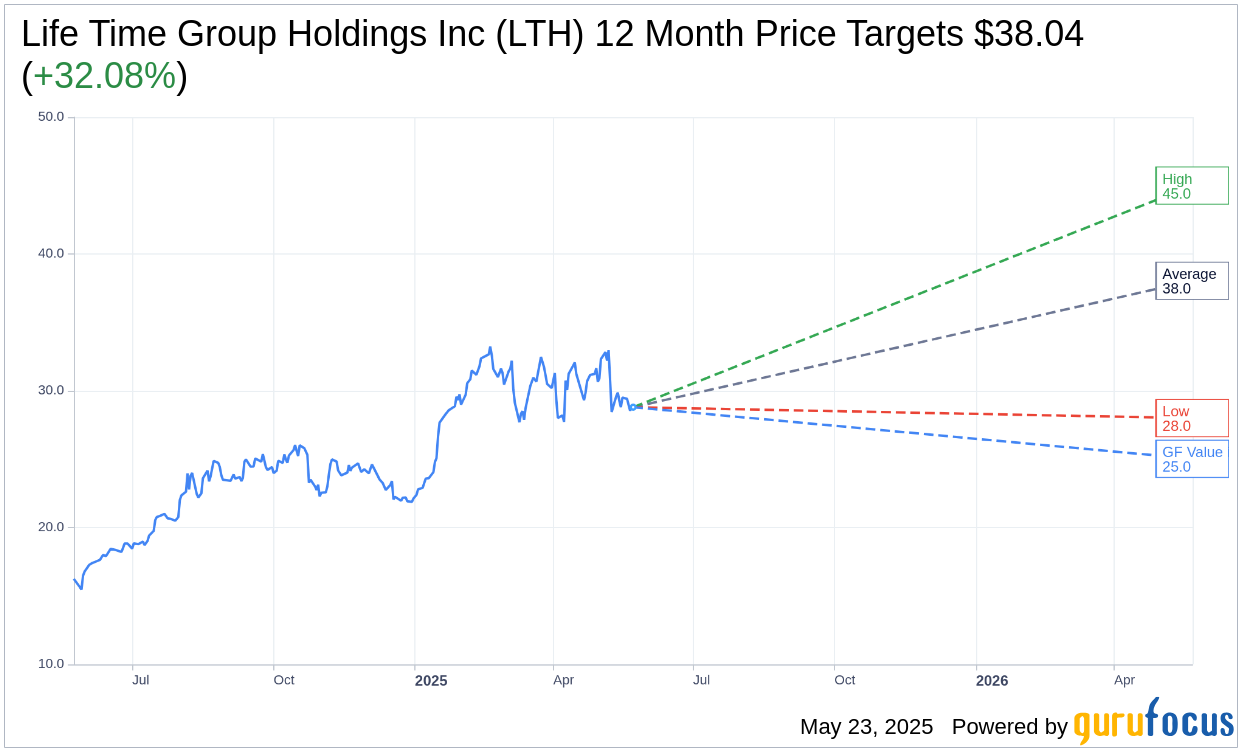

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Life Time Group Holdings Inc (LTH, Financial) is $38.04 with a high estimate of $45.00 and a low estimate of $28.00. The average target implies an upside of 32.08% from the current price of $28.80. More detailed estimate data can be found on the Life Time Group Holdings Inc (LTH) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Life Time Group Holdings Inc's (LTH, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Life Time Group Holdings Inc (LTH, Financial) in one year is $25.03, suggesting a downside of 13.09% from the current price of $28.8. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Life Time Group Holdings Inc (LTH) Summary page.

LTH Key Business Developments

Release Date: May 08, 2025

- Total Revenue: Increased 18.3% to $706 million.

- Membership Dues and Enrollment Fees: Increased 17.9%.

- Incentive Revenue: Increased 18.7%.

- Comparable Center Revenue: Increased 12.9% from the prior year period.

- Center Memberships: Increased 3.0% to over 826,000.

- Total Memberships: Approximately 880,000.

- Average Monthly Dues: Grew 11.8% year-over-year to $208.

- Average Revenue per Center Membership: Increased 13.3% to $844.

- Net Income: $76.1 million, an increase of 206%.

- Adjusted Net Income: $88.1 million, an increase of 189%.

- Adjusted EBITDA: $191.6 million, an increase of 31.2%.

- Adjusted EBITDA Margin: 27.1%, increased 260 basis points.

- Net Cash Provided by Operating Activities: Increased 103% to $184 million.

- Free Cash Flow: Approximately $41 million.

- Net Debt Leverage Ratio: 2.0 times.

- Visits in Comparable Centers: Up 4.7% versus the first quarter of last year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Total revenue increased by 18.3% to $706 million, driven by significant growth in membership dues and enrollment fees.

- Comparable center revenue rose by 12.9%, reflecting strong performance and strategic pricing adjustments.

- Net income surged by 206% to $76.1 million, with adjusted net income increasing by 189% from the prior year.

- Adjusted EBITDA grew by 31.2% to $191.6 million, with an improved margin of 27.1%.

- The company achieved positive free cash flow for the fourth consecutive quarter, amounting to approximately $41 million.

Negative Points

- The company faces uncertainty in the macroeconomic environment, which could impact future financial performance.

- There is a potential risk of tariff exposure, although currently deemed minimal, it requires ongoing monitoring.

- Membership growth is slightly softer than previous years, partly due to higher retention rates limiting new join opportunities.

- Some clubs are at capacity, necessitating waitlists, which could limit immediate membership growth.

- The company is cautious about raising legacy membership dues, which could impact revenue growth if not managed carefully.