An analyst from DA Davidson, Brent Thielman, has increased the price target for Dycom (DY, Financial) from $220 to $265 while maintaining a Buy rating on its shares. This decision follows the company's impressive first-quarter earnings performance. Revenue for the quarter exceeded expectations, driven by robust inorganic contributions, and profits saw continued margin growth. The analyst also highlighted that new opportunities could enhance Dycom's growth prospects over the medium to long term.

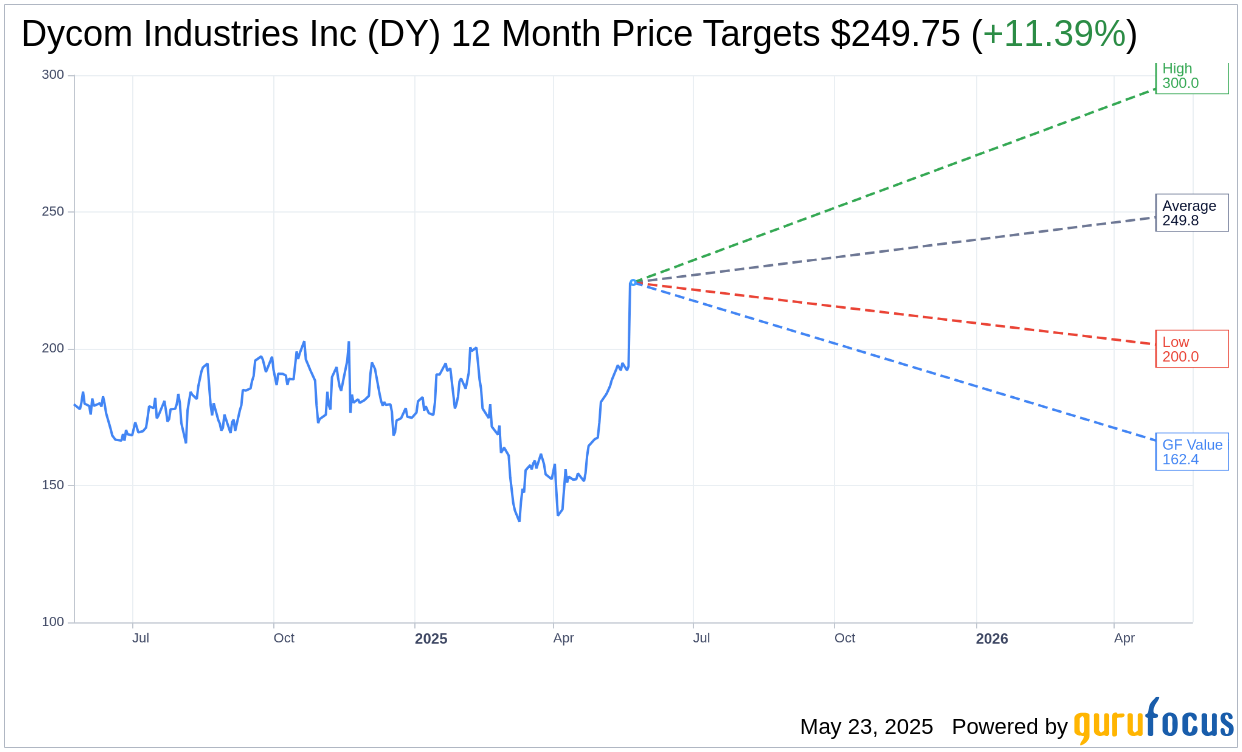

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Dycom Industries Inc (DY, Financial) is $249.75 with a high estimate of $300.00 and a low estimate of $200.00. The average target implies an upside of 11.39% from the current price of $224.21. More detailed estimate data can be found on the Dycom Industries Inc (DY) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Dycom Industries Inc's (DY, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dycom Industries Inc (DY, Financial) in one year is $162.42, suggesting a downside of 27.56% from the current price of $224.21. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dycom Industries Inc (DY) Summary page.

DY Key Business Developments

Release Date: May 21, 2025

- Revenue: $1.259 billion, a 10.2% increase over Q1 2025.

- Adjusted EBITDA: $150.4 million, representing 11.9% of revenues, a 14.9% increase over Q1 2025.

- Net Income: $61 million.

- Diluted EPS: $2.09 per share.

- Share Repurchases: 200,000 shares for $30.2 million.

- Backlog: $8.1 billion, with $4.7 billion expected in the next 12 months.

- Operating Cash Flow: Used $54 million in the quarter.

- DSOs: 111 days, a reduction of three days sequentially from Q4 2025.

- Revenue Guidance for Fiscal 2026: Increased to a range of $5.29 billion to $5.425 billion.

- Q2 Fiscal 2026 Outlook: Revenue of $1.38 billion to $1.43 billion, adjusted EBITDA of $185 million to $200 million, and diluted EPS of $2.74 to $3.05 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dycom Industries Inc (DY, Financial) exceeded the high end of their guidance for the quarter on all metrics, including revenue, adjusted EBITDA, and EPS.

- The company reported a 10.2% increase in first-quarter revenue over Q1 2025, reaching $1.259 billion.

- Dycom Industries Inc (DY) has a record backlog of $8.1 billion, including $4.7 billion expected to be completed in the next 12 months.

- The company has diversified its customer base and services within the telecommunications and digital infrastructure space, reducing dependency on any single customer.

- Dycom Industries Inc (DY) increased its revenue expectations for the year to a range of $5.29 billion to $5.425 billion, indicating confidence in future growth.

Negative Points

- Despite strong performance, Dycom Industries Inc (DY) faces macroeconomic uncertainties, including tariffs and international trade actions, which could impact future operations.

- Operating cash flows used in the quarter were $54 million, reflecting seasonal uses of cash and supporting revenue growth.

- The company is closely monitoring tariff implications, which could lead to cost increases in some equipment components sourced offshore.

- Dycom Industries Inc (DY) has not included revenue from the BEAD program in their fiscal 2026 outlook, indicating uncertainty in this area.

- The company's combined DSOs of accounts receivable and contract assets net were 111 days, suggesting room for improvement in cash flow management.