Douglas Elliman (DOUG, Financial) has reportedly caught the attention of a competing firm with a merger proposition, according to recent information. This development suggests potential consolidation in the real estate sector, which could impact both companies' market positions. The offer has sparked discussions about future strategic alignments and the evolving competitive landscape. Stakeholders and investors will be watching closely as this story unfolds, considering the broader implications for the market and for Douglas Elliman's operations.

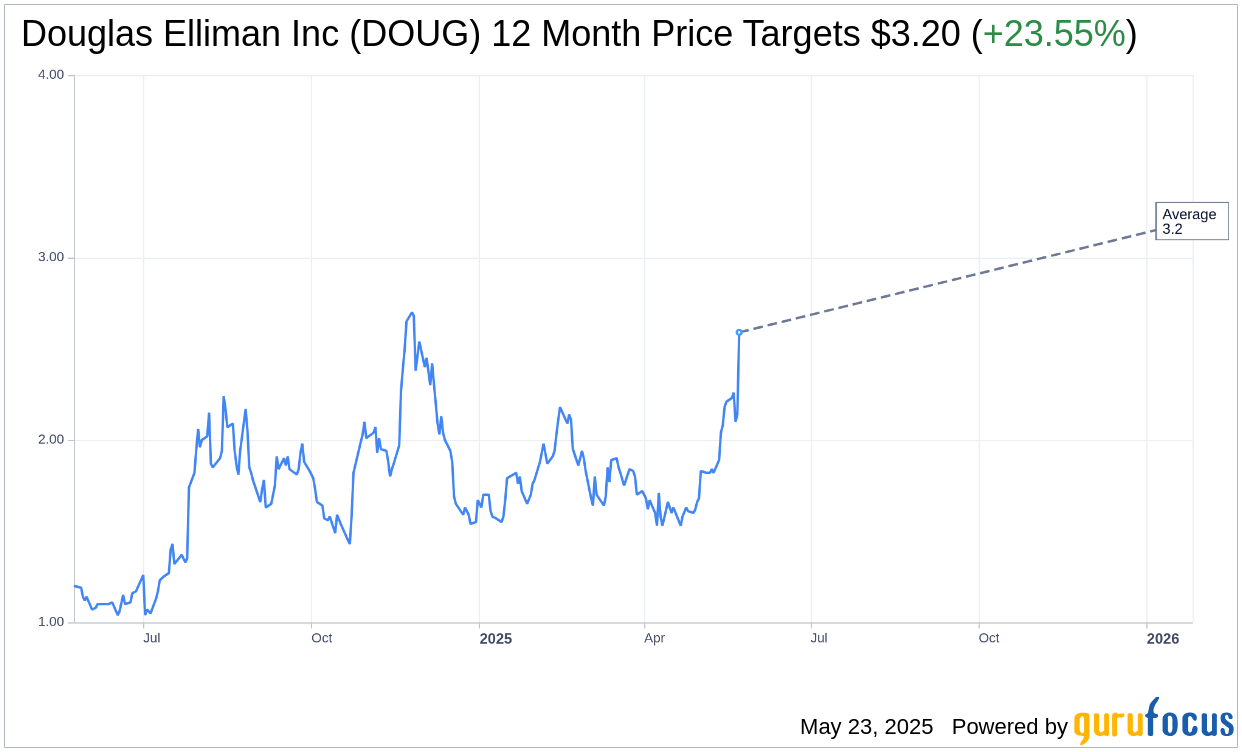

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Douglas Elliman Inc (DOUG, Financial) is $3.20 with a high estimate of $3.20 and a low estimate of $3.20. The average target implies an upside of 23.55% from the current price of $2.59. More detailed estimate data can be found on the Douglas Elliman Inc (DOUG) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Douglas Elliman Inc's (DOUG, Financial) average brokerage recommendation is currently 1.0, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

DOUG Key Business Developments

Release Date: May 02, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Douglas Elliman Inc (DOUG, Financial) reported a significant revenue increase of 2027% year over year, reaching $253.4 million, marking their strongest first quarter performance since 2022.

- The company made substantial progress in reducing operating losses compared to the first quarter of 2024, indicating improved profitability.

- The development marketing division saw a remarkable revenue increase of 222% from the first quarter of 2024, highlighting its role as a cornerstone of long-term growth strategy.

- Douglas Elliman Inc (DOUG) experienced a 73% increase in home sales of $5 million or more, and a 76% increase in home sales of $10 million or more, showcasing strength in the luxury market.

- The company reduced its operating expenses by $3 million from the first quarter of 2024, demonstrating effective cost management and expense discipline.

Negative Points

- Douglas Elliman Inc (DOUG) reported a net loss of $6 million or $0.07 per diluted share for the first quarter, although this was an improvement from the previous year.

- The company continues to face challenges such as elevated US mortgage rates, low housing inventory, and soft transaction volume, which could impact future performance.

- Despite improvements, the adjusted net loss for the first quarter was $2.4 million or $0.03 per share, indicating ongoing financial challenges.

- Broader economic trends, tariffs, and geopolitical uncertainties remain potential risks that could affect the company's operations and growth.

- The seasonality of the business and timing of annual cash bonuses resulted in a cash flow drain, although it was less severe than in the previous year.