BofA has revised its price target for Range Resources (RRC, Financial), raising it from $45 to $47 while maintaining a Buy rating on the stock. This adjustment follows the evaluation of first-quarter results across U.S. oil and gas companies under the firm's watch. BofA highlights the potential for increasing oil demand during the summer, though it remains cautious due to uncertain geopolitical factors. Furthermore, the outlook for dry natural gas appears more stable, albeit with limited growth prospects in that segment. Investors are advised to consider these insights when making informed decisions regarding Range Resources.

Wall Street Analysts Forecast

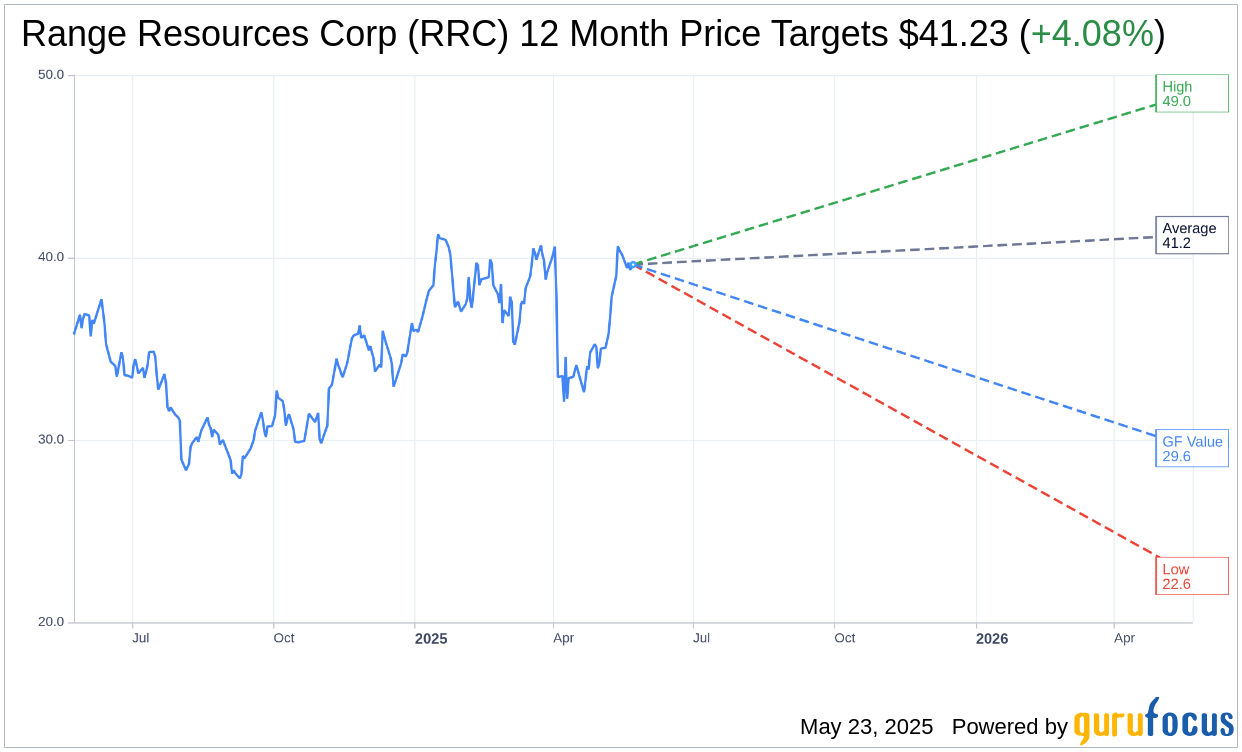

Based on the one-year price targets offered by 24 analysts, the average target price for Range Resources Corp (RRC, Financial) is $41.23 with a high estimate of $49.00 and a low estimate of $22.55. The average target implies an upside of 4.08% from the current price of $39.62. More detailed estimate data can be found on the Range Resources Corp (RRC) Forecast page.

Based on the consensus recommendation from 26 brokerage firms, Range Resources Corp's (RRC, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Range Resources Corp (RRC, Financial) in one year is $29.55, suggesting a downside of 25.41% from the current price of $39.615. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Range Resources Corp (RRC) Summary page.

RRC Key Business Developments

Release Date: April 23, 2025

- Free Cash Flow: $183 million generated in Q1 2025.

- All-in Capital: $147 million for Q1 2025.

- Production: 2.2 Bcf equivalent per day in Q1 2025.

- Lease Operating Expense: $0.13 per Mcfe for Q1 2025.

- Debt Reduction: Net debt reduced by $42 million in Q1 2025.

- Dividends Paid: $22 million in Q1 2025.

- Share Repurchases: $68 million invested in Q1 2025.

- Drilling Record: 5,961 feet per day average in Q1 2025.

- Propane Inventory Draw: Record 41 million barrel draw in Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Range Resources Corp (RRC, Financial) delivered strong free cash flow in Q1 2025, which allowed for increased returns to shareholders and debt reduction.

- The company achieved a new program drilling record, averaging 5,961 feet per day, demonstrating high operational efficiency.

- RRC's low-capital intensity and class-leading drilling and completion costs contribute to its through-cycle profitability.

- The company has secured a two-year contract extension for its electric hydraulic fracturing fleet, ensuring operational continuity.

- RRC's strategic marketing and transport portfolio enabled it to optimize sales mix and generate incremental cash flow, benefiting from strong export demand and improved storage levels.

Negative Points

- Production is expected to be slightly down in Q2 2025 due to scheduled processing maintenance.

- Completion spending will increase over the next two quarters, impacting short-term cash flow.

- There is uncertainty regarding the geopolitical impact on LPG trade and potential tariffs, which could affect pricing and demand.

- The company faces challenges in securing infrastructure for new in-basin demand projects, which could delay potential benefits.

- Volatility in natural gas pricing and financial markets presents ongoing risks to revenue and profitability.