- Frontline (FRO, Financial) reported first-quarter earnings revealing significant revenue decline and ongoing industry challenges.

- Analysts predict a promising upside potential despite current price challenges.

- GuruFocus' GF Value suggests a potential downside, recommending cautious investment strategies.

Frontline (FRO) recently announced its first quarter results for 2025, highlighting a non-GAAP earnings per share (EPS) of $0.18. The company's revenue was reported at $428.09 million, representing a steep decline of 31.1% from the previous year. These figures underscore the persistent challenges that the tanker industry is currently facing.

Wall Street Analysts' Insights

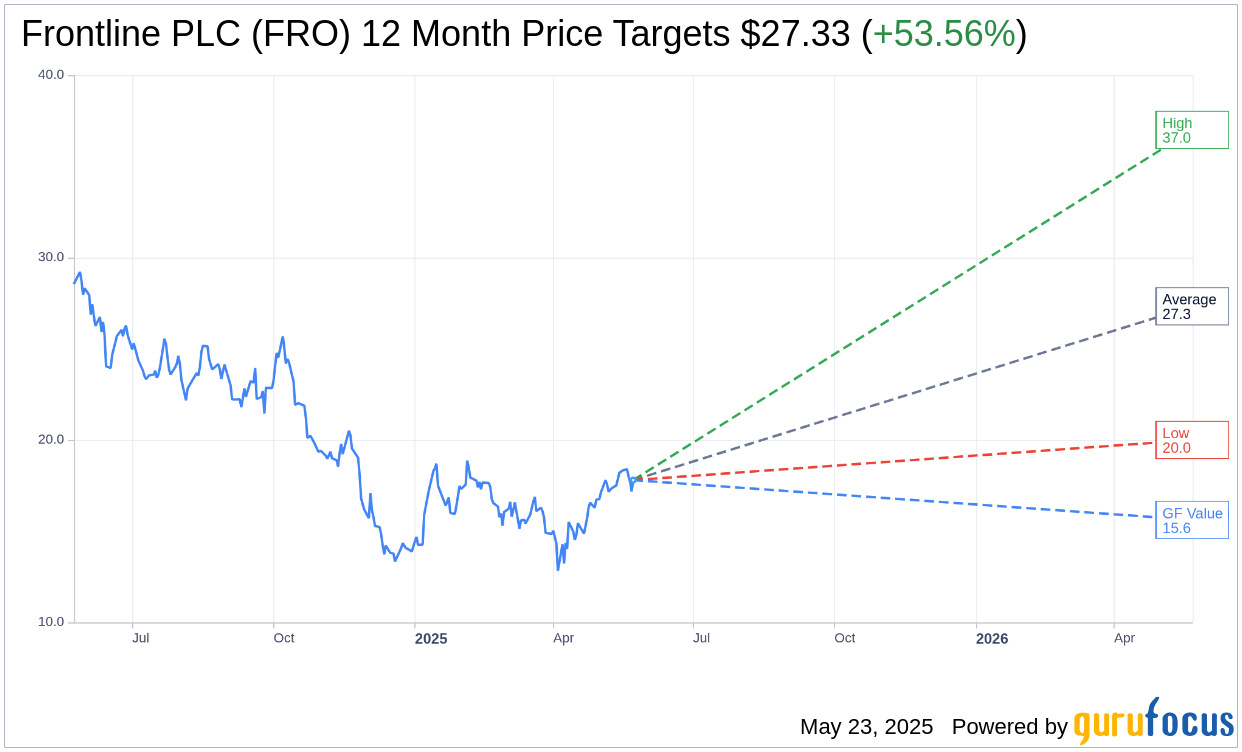

In analyzing the market sentiment, three analysts have provided one-year price targets for Frontline PLC (FRO, Financial), with an average target price of $27.33. This reflects a potential uplift of 53.56% from the current trading price of $17.80, with estimates ranging between a high of $37.00 and a low of $20.00. Investors can explore more detailed projections on the Frontline PLC (FRO) Forecast page.

Brokerage Recommendations

The consensus among three brokerage firms is a recommendation rating of 1.7 for Frontline PLC (FRO, Financial), suggesting an "Outperform" status. This rating falls on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell, indicating a generally positive outlook from the brokerage community.

Evaluating GF Value Projections

According to GuruFocus estimates, the projected GF Value for Frontline PLC (FRO, Financial) is $15.62 over one year. This estimation suggests a potential downside of 12.25% from the current price of $17.80. The GF Value is a critical metric that reflects the fair trading value of the stock, derived from historical trading multiples, past growth trajectories, and projected business performance. For further insights, investors are encouraged to visit the Frontline PLC (FRO) Summary page.

Overall, while Frontline PLC is navigating turbulent waters, the analyst forecasts and GF Value provide investors with a nuanced view of potential risks and opportunities in the stock.