- SpringWorks Therapeutics receives positive EMA panel recommendation for Mirdametinib.

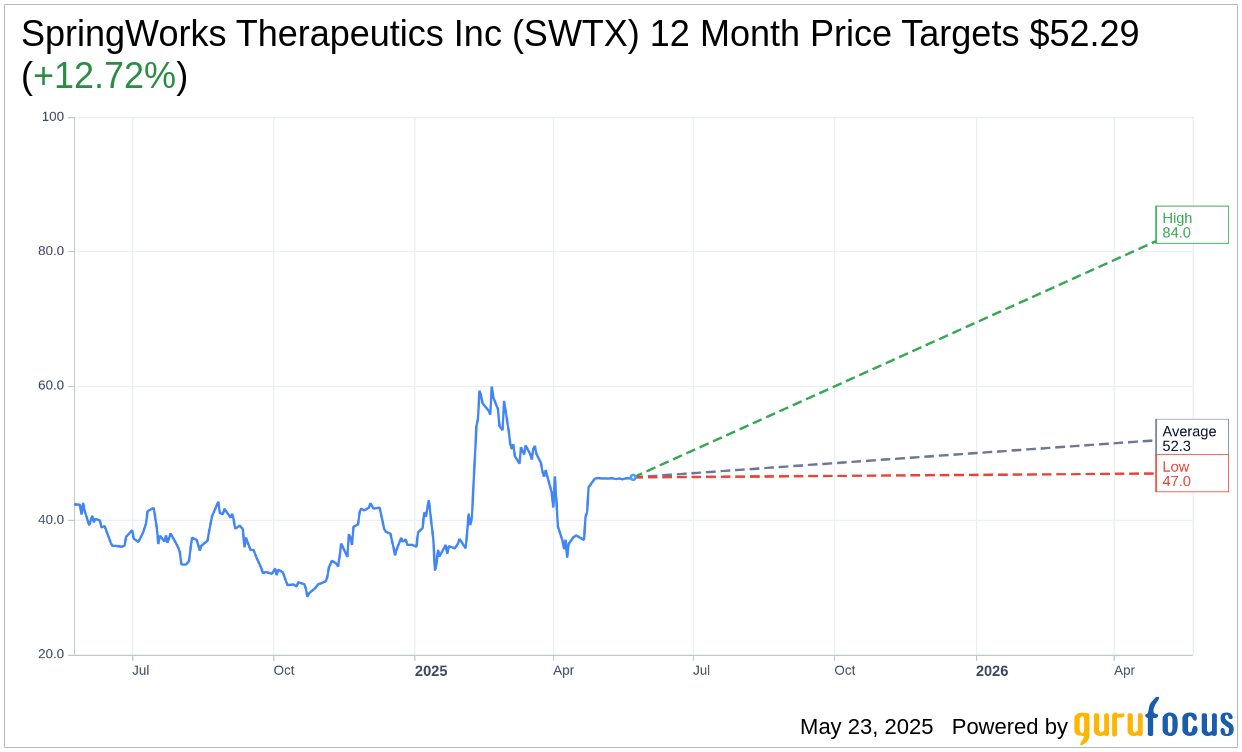

- Analysts forecast a potential 12.72% upside based on a current price of $46.39.

- Average brokerage recommendation indicates a "Hold" status for SWTX.

SpringWorks Therapeutics (NASDAQ: SWTX) is advancing in the European market with its promising MEK inhibitor, Mirdametinib. The development comes as the European Medicines Agency's advisory panel has given a favorable opinion on the drug, specifically for treating inoperable plexiform neurofibromas in neurofibromatosis type 1 (NF1) patients aged two and older. The decision now awaits final approval by the European Commission, projected for Q3 2025.

Market Expectations and Analyst Insights

Investment analysts have provided insights into SpringWorks Therapeutics' potential market performance. With seven experts projecting a one-year price target, the mean estimate stands at $52.29. This includes a high forecast of $84.00 and a low of $47.00, suggesting a promising average upside of 12.72% from the current share price of $46.39. For more comprehensive forecast data, visit the SpringWorks Therapeutics Inc (SWTX, Financial) Forecast page.

Brokerage Recommendations

The current consensus among six brokerage firms provides an average recommendation of 3.0 for SpringWorks Therapeutics, placing the stock in a "Hold" category. This rating uses a scale from 1 to 5, where 1 indicates a Strong Buy and 5 suggests a Sell. This neutral stance reflects a balanced view, weighing potential growth prospects against inherent market risks.

Overall, SpringWorks Therapeutics appears to be navigating the regulatory landscape successfully while garnering cautious optimism from the analyst community. Investors should consider these factors when evaluating SWTX as part of their portfolio strategy.