Key Highlights:

- Meta Platforms faces legal challenges in Germany regarding AI training data.

- Analysts predict a potential upside of over 12% for Meta's stock.

- Current market analysis shows a varied consensus on Meta's valuation.

Meta Platforms (META, Financial) is currently in the spotlight due to legal challenges in Germany, where a consumer rights group sought to prevent the company from utilizing Facebook and Instagram user posts for artificial intelligence training. Despite these legal hurdles, Meta continues its efforts to develop AI models, with training based on European Union interactions resuming after regulatory guidelines were clarified.

Wall Street Analysts Offer Insights

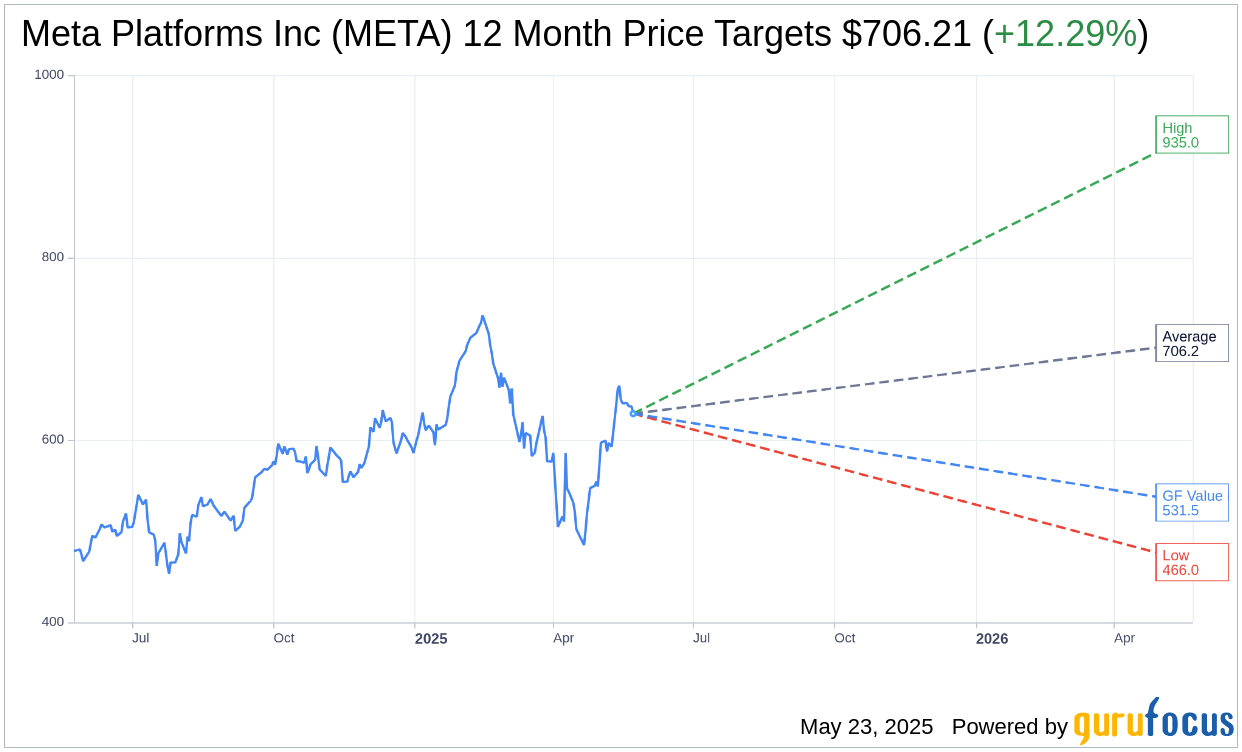

Wall Street analysts present a range of price targets for Meta Platforms Inc (META, Financial), based on evaluations by 60 analysts over the next year. The average projected target price is $706.21. Analysts' predictions show a high estimate of $935.00 and a low of $466.00, reflecting diverse expectations. This average suggests a potential upside of 12.29% from the current trading price of $628.90. For a more comprehensive analysis of these projections, please visit the Meta Platforms Inc (META) Forecast page.

Furthermore, a consensus recommendation from 72 brokerage firms gives Meta Platforms Inc (META, Financial) an average rating of 1.8. This rating implies an "Outperform" status on a scale where 1 represents a Strong Buy and 5 stands for Sell, indicating generally positive expectations from analysts.

Understanding Meta's GF Value

According to GuruFocus estimates, the GF Value for Meta Platforms Inc (META, Financial) is assessed to be $531.47 in one year, indicating a potential downside of 15.49% from its current price of $628.8999. The GF Value is GuruFocus' proprietary calculation of what the stock should ideally be valued based on historical multiples, previous business growth, and anticipated future performance. For additional insights and detailed analysis, visit the Meta Platforms Inc (META) Summary page.

This mixed outlook on Meta Platforms Inc presents investors with a complex decision landscape, weighing potential regulatory impacts against optimistic analyst forecasts.