- Perpetua Resources' shares rose 4.2% after seeking substantial debt financing for their Idaho project.

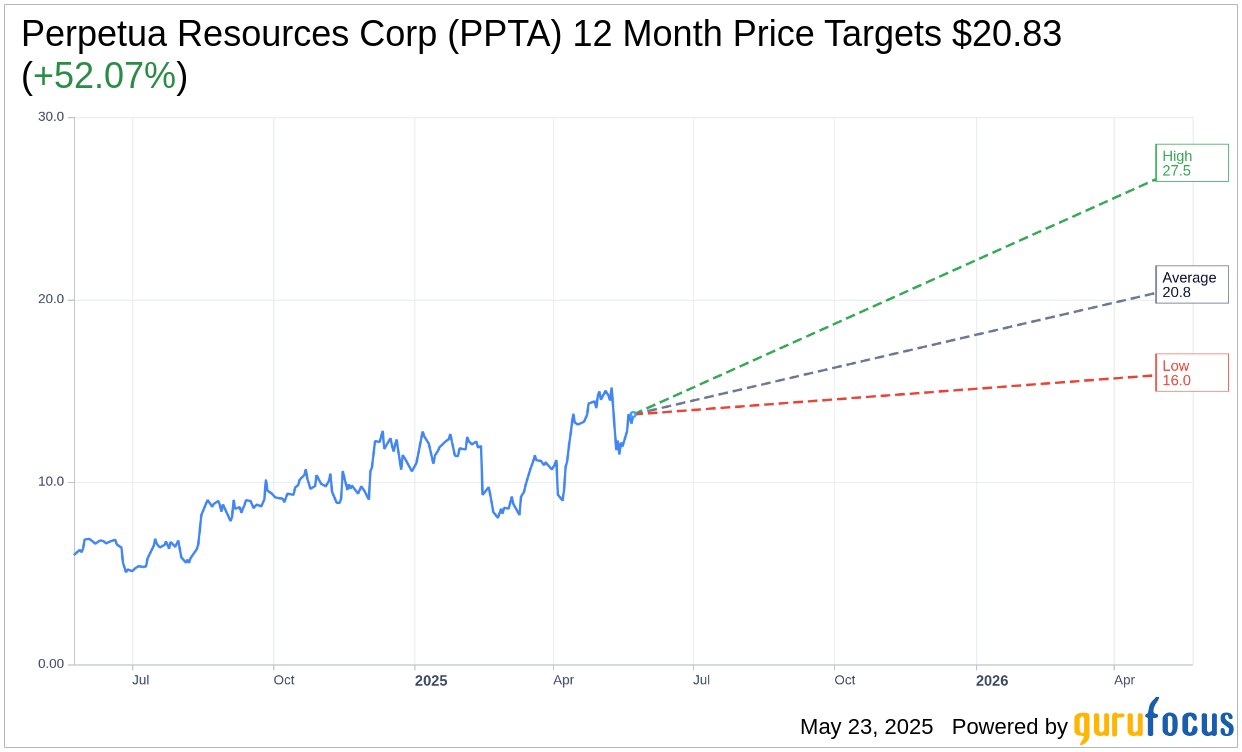

- Analyst projections suggest significant upside potential for the stock, with a one-year target price averaging $20.83.

- The company currently holds an "Outperform" rating from major brokerage firms.

Perpetua Resources Corp (PPTA) recently experienced a robust 4.2% increase in share price following its application to the U.S. Export-Import Bank for up to $2 billion in debt financing. This strategic move is intended to propel the advancement of the company's Stibnite antimony and gold project, situated in Idaho. Notably, this project represents the first U.S. initiative focused on antimony, a metal that holds considerable importance across various industries. The project recently celebrated a critical milestone by securing its final federal permit, laying the groundwork for anticipated future growth.

Wall Street Analysts Forecast

In terms of Wall Street forecasts, three analysts have provided their one-year price targets for Perpetua Resources Corp (PPTA), with an average target price set at $20.83. This figure reflects a significant potential upside of 52.07% compared to the current price of $13.70. Notably, estimates range from a high of $27.50 to a low of $16.00. For more granular details regarding these projections, please visit the Perpetua Resources Corp (PPTA, Financial) Forecast page.

Current consensus among three brokerage firms suggests an average recommendation rating of 2.0 for Perpetua Resources Corp (PPTA), categorizing the stock as "Outperform." This rating is part of a structured scale where 1 indicates a Strong Buy, and 5 implies a Sell. Investors should consider these insights as they evaluate their potential engagement with Perpetua Resources.