Teck Resources (TECK, Financial) has received notice of a "mini-tender" offer from TRC Capital Corporation, aiming to acquire up to 2 million of Teck's Class B subordinate voting shares. This volume represents about 0.41% of the company's outstanding Class B shares as of May 23, 2025. The proposed purchase price is set at $47.80 per share, which is a 4.46% reduction from the closing price on the Toronto Stock Exchange on May 20, 2025, one day before the offer was made.

Teck has advised its shareholders against accepting TRC’s offer, highlighting that the price offered is below the market value. Stakeholders are encouraged to assess this below-market tender with caution.

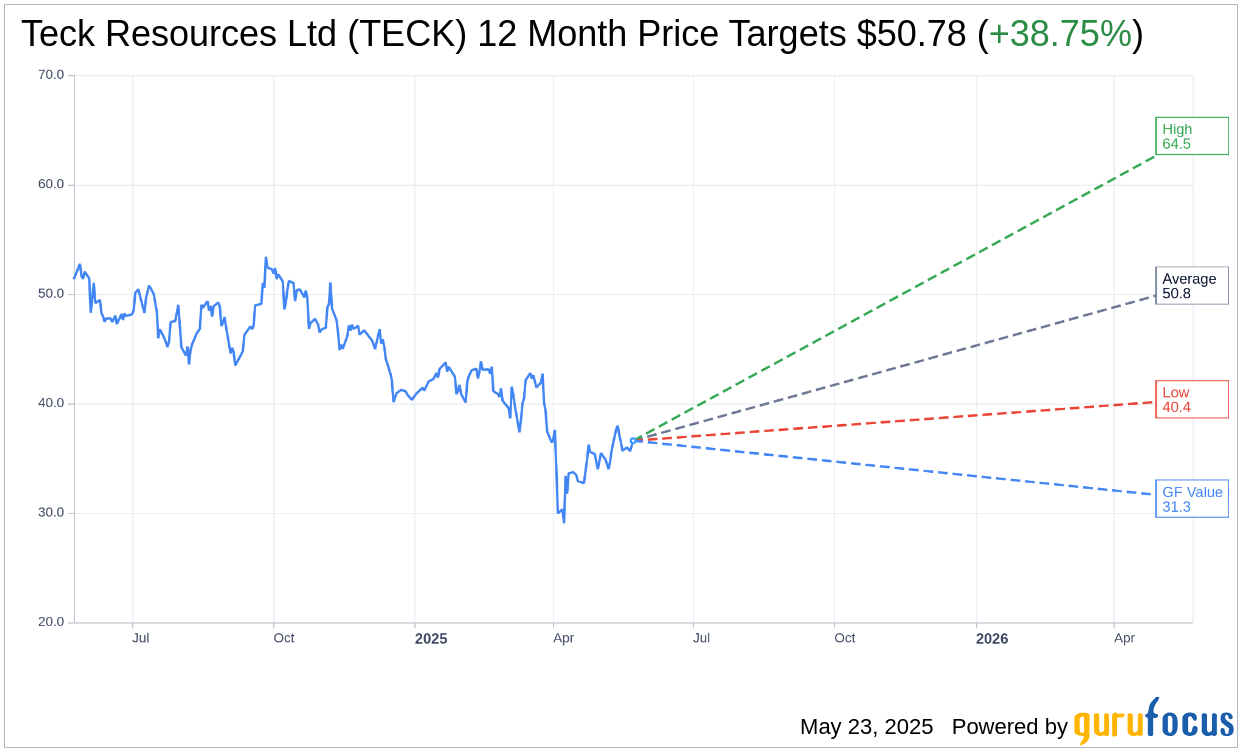

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Teck Resources Ltd (TECK, Financial) is $50.78 with a high estimate of $64.45 and a low estimate of $40.38. The average target implies an upside of 38.75% from the current price of $36.60. More detailed estimate data can be found on the Teck Resources Ltd (TECK) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Teck Resources Ltd's (TECK, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teck Resources Ltd (TECK, Financial) in one year is $31.31, suggesting a downside of 14.45% from the current price of $36.6. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teck Resources Ltd (TECK) Summary page.